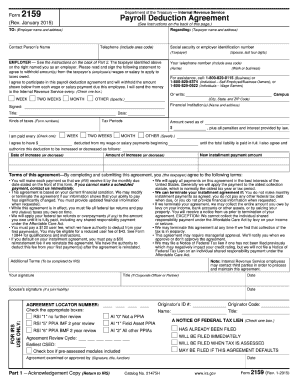

What is 2159 Form?

The 2159 Form is a document used for ___________. [Insert brief explanation here]

What are the types of 2159 Form?

There are several types of 2159 Forms, including:

Type _______

Type _______

Type _______

How to complete 2159 Form

Completing the 2159 Form is a straightforward process. Simply follow these steps:

01

_______

02

_______

03

_______

pdfFiller empowers users to create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done.

Video Tutorial How to Fill Out 2159 Form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is a form 2159?

Payroll Deduction Agreement (Form 2159) – Internal Revenue Service (IRS) Government Form in United States of America – Formalu.

What is a payroll deduction form?

A payroll deduction authorization form is a written agreement an employee must sign if they want certain voluntary deductions taken from their paycheck. These forms should be as clear and specific as possible so employees know how much money voluntary deductions will take out of their paycheck.

Where do I send 433d Form?

Mail 433-D form to: Internal Revenue Service. ACS Support. PO Box 8208. Philadelphia, PA 19101-8208.

What is a 433-D form?

The Form 433-D is used to finalize an approved installment agreement and authorize payments by direct debit. The Form 9465 can be filed with a tax return.

Related templates