Income Verification Letter Sample

What is income verification letter necessary for?

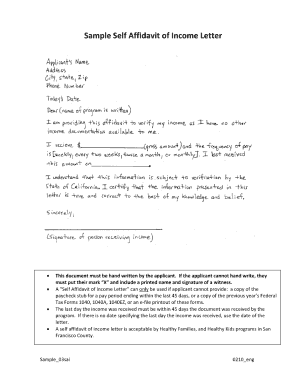

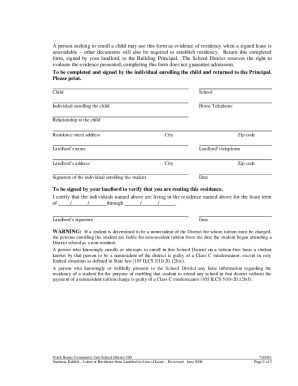

The income verification letter is used by individuals when they have no other proofs of their salary. The document should be verified by the real witness who knows the amount of the wages.

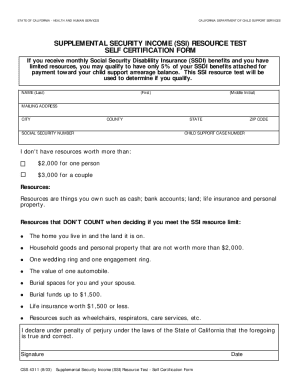

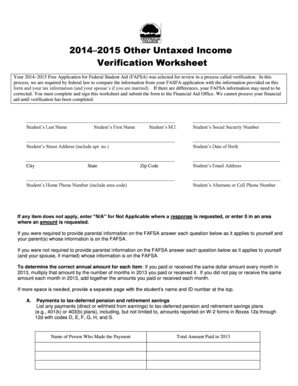

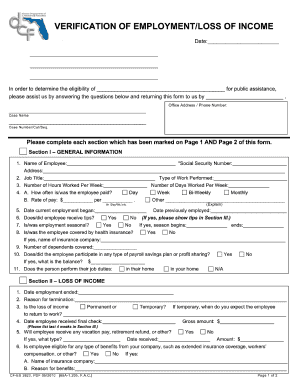

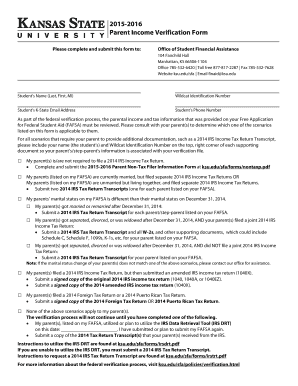

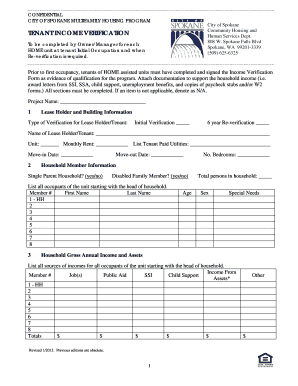

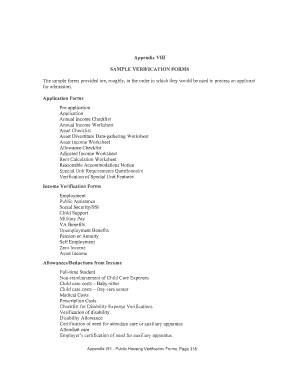

The letter may be provided by an employer to an employee. The income verification includes the initials and social security number as well as postal address and contact details of the person. The main part of the document specifies the number of earnings, their type, the frequency of the payments (monthly, weekly) and the name of the employer or company a person works with. If applicants completes the sample by themselves, they need to enumerate reasons why such a template has not been provided from their work.

The sample may be required when a person wants to get a credit, loan an apartment or buy a house. The bank or lender usually requires a letter to be sure that individuals have enough earnings to pay. That is the normal practice that helps to secure such a bargain.

How to submit the income verification sample electronically?

Start with the blank you should complete. Find the necessary documentation on the Internet or select it out from the PDFfiller library. If you already have the file, upload it from the internal storage of your personal computer or laptop to the personal PDFfiller account.

Submit the form in a few minutes by using a few simple steps: