What is proof of income form?

A proof of income form is a document that provides evidence of an individual's or organization's income. It is commonly used to verify income for various purposes, such as applying for loans, renting a property, or qualifying for government assistance programs. This form typically includes information about the source and amount of income, as well as relevant personal details.

What are the types of proof of income form?

There are several types of proof of income forms that may be required depending on the specific purpose. Some common types of proof of income forms include:

Pay stubs: These are documents provided by employers that show details of an individual's wages or salary, including deductions and other withholdings.

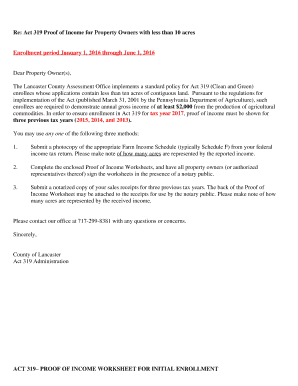

Tax returns: These documents provide a comprehensive overview of an individual's income and tax obligations for a specific year.

Bank statements: These statements show the inflow and outflow of funds in an individual's bank account, giving an overview of their income and expenses.

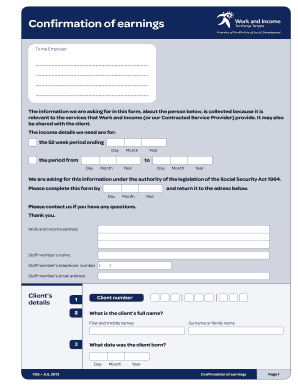

Employment verification letter: This is a letter issued by an employer confirming an individual's employment status, position, and income.

Social Security statements: These statements provide details of an individual's earnings and contributions to the Social Security program.

Benefit letters: These letters are issued by government agencies or organizations to confirm an individual's eligibility for benefits and the amount they receive.

How to complete proof of income form

Completing a proof of income form may vary depending on the specific form and requirements. However, here are some general steps to follow:

01

Gather all necessary documents: Collect all the relevant documents that provide evidence of your income, such as pay stubs, tax returns, bank statements, and employment verification letter.

02

Carefully review the form: Read the form thoroughly to understand the information required and any instructions provided.

03

Provide accurate and up-to-date information: Fill in all the required fields with accurate and current details about your income, ensuring consistency with the supporting documents.

04

Attach supporting documents: If required, attach copies of the supporting documents to the form. Make sure to keep the originals for your records.

05

Double-check for errors: Before submitting the form, review all the information entered for any errors or discrepancies.

06

Submit the form: Follow the submission instructions provided and submit the completed form along with any required supporting documents.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.