Past Due Invoice Letter

What is past due invoice letter?

A past due invoice letter is a formal communication sent to a client or customer to remind them that their payment for a specific invoice is overdue. It serves as a reminder and a request for prompt payment.

What are the types of past due invoice letter?

There are several types of past due invoice letters that can be used depending on the circumstances and the relationship with the client or customer. These include:

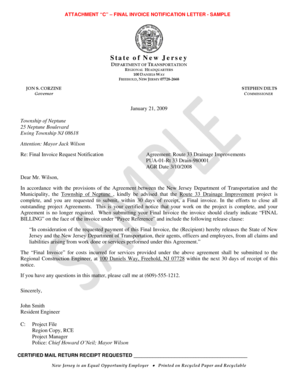

First Reminder: Sent when the invoice is slightly overdue, usually within a few days of the due date.

Second Reminder: Sent when the invoice is significantly overdue, usually after a week or two from the due date.

Final Notice: Sent as a last attempt to collect payment before taking further action, such as legal action or involving a debt collection agency.

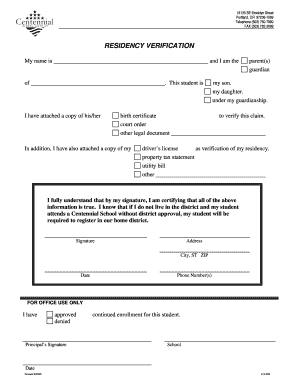

How to complete past due invoice letter

To effectively complete a past due invoice letter, follow these steps:

01

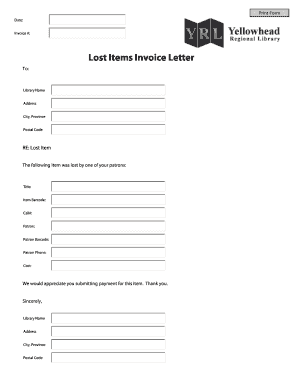

Header: Start with a professional and concise header that includes your company name, address, and contact information, as well as the date.

02

Salutation: Address the recipient in a friendly and respectful manner, using their name if possible.

03

Introductory Paragraph: Clearly state the purpose of the letter, which is to remind the recipient about the overdue invoice.

04

Invoice Details: Provide clear and specific information about the invoice, including the invoice number, amount due, and original due date.

05

Reminder of Consequences: Clearly communicate the potential consequences of non-payment, such as additional fees, legal action, or damage to the business relationship.

06

Request for Payment: Clearly state the preferred method of payment, provide instructions if necessary, and include a specific deadline for payment.

07

Closing: End the letter with a polite closing remark and your contact information in case the recipient has any questions or concerns.

Remember, pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What to say to collect on past due invoices?

I have not yet received your payment on the attached invoice #XXXXX for the amount of [amount], which was due on [due date]. Please be aware that, as per my payment terms, you may be charged additional [late fees or interest] on payments received more than [number of days] past the due date.

How do I request payment for past due invoices?

A polite email reminder is the first step of how to ask for payment professionally. The first step is a call or reminder sent via email or snail mail reminding them of the past due status of invoices. That gives your customers the chance to explain their situation for the overdue invoice.

What to say when calling about past due invoices?

Customer: I've not yet paid as the invoice is incorrect. You: I'm very sorry to hear that, could you please explain what the problem is? You: Apologies and thanks for explaining, I'll have that looked into right away. I'll issue an updated invoice as soon as this has been resolved.

How do you get customers to pay overdue invoices?

How to get customers to pay overdue bills Send a gentle reminder. Send an updated invoice. Ask why the client isn't paying. Demand payment more firmly. Escalate the situation. Hire a factoring service. Hire a debt collection service. Discuss all costs and payment terms before you begin a project.

Related templates