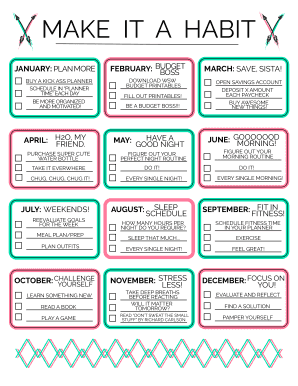

Paycheck Budget Printable

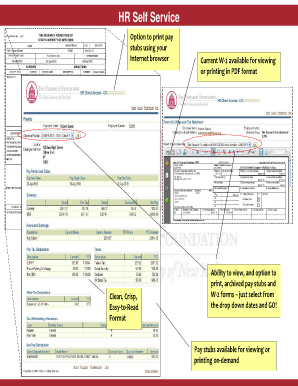

What is paycheck budget printable?

A paycheck budget printable is a document that helps individuals track and manage their income and expenses. It is a convenient and easy-to-use tool that allows you to create a budget plan based on your paychecks.

What are the types of paycheck budget printable?

There are several types of paycheck budget printables available to suit different needs and preferences. Some popular types include:

Basic paycheck budget printable: This type provides a simple layout to track income and expenses.

Detailed paycheck budget printable: This type includes additional sections to record specific categories of expenses, such as groceries, rent, utilities, etc.

Interactive paycheck budget printable: This type allows you to input your income and expenses digitally and perform calculations automatically.

How to complete paycheck budget printable

Completing a paycheck budget printable is easy and straightforward. Follow these steps:

01

Start by gathering information about your income, including your regular paycheck amount and any additional sources of income.

02

Next, list all your necessary expenses, such as rent/mortgage, utilities, groceries, transportation, etc.

03

Subtract your expenses from your income to determine how much disposable income you have left.

04

Allocate a portion of your disposable income towards savings or debt repayments.

05

Regularly update your paycheck budget printable to stay on track and make adjustments as needed.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out paycheck budget printable

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I create a budget using Word?

0:00 1:02 How to Create a Budget in Microsoft Word 2010 - YouTube YouTube Start of suggested clip End of suggested clip And then you're going to select new on the right side of the screen you'll notice that there areMoreAnd then you're going to select new on the right side of the screen you'll notice that there are budgets. In terms of templates under office comm. So you click on budgets.

How do you create a simple budget for beginners?

The following steps can help you create a budget. Step 1: Calculate your net income. The foundation of an effective budget is your net income. Step 2: Track your spending. Step 3: Set realistic goals. Step 4: Make a plan. Step 5: Adjust your spending to stay on budget. Step 6: Review your budget regularly.

Does Google have a budgeting tool?

This free add-on allows you to use Google Sheets as a budgeting application. Setup categories/subcategories for income and expenses, then enter your transactions. A Expenses tab will allow you to analyze your expenses by category for every month and compare that to your budget.

Does Microsoft have a budgeting tool?

My Monthly Budget provides a simple, visual way to help you manage your expenses and bills.

How do you create a budget layout?

The following steps can help you create a budget. Step 1: Calculate your net income. The foundation of an effective budget is your net income. Step 2: Track your spending. Step 3: Set realistic goals. Step 4: Make a plan. Step 5: Adjust your spending to stay on budget. Step 6: Review your budget regularly.

How do you create a budget for a paycheck?

Poorman suggests the popular 50/30/20 rule of thumb for paycheck allocation: 50% of gross pay for essentials like bills and regular expenses (groceries, rent, or mortgage) 30% for spending on dining/ordering out and entertainment. 20% for personal saving and investment goals.

Related templates