Financial Statements Analysis

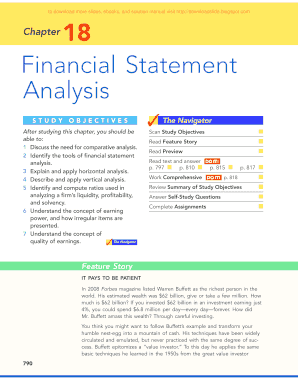

What is financial statement analysis?

Financial statement analysis is the process of examining and evaluating a company's financial statements to gain insights into its financial health and performance. It involves analyzing key financial ratios and metrics, such as liquidity, profitability, and solvency, to assess the company's ability to meet its financial obligations and generate profits.

What are the types of financial statement analysis?

There are three main types of financial statement analysis: horizontal analysis, vertical analysis, and ratio analysis. 1. Horizontal analysis compares financial data over multiple periods to identify trends and changes in performance. It helps to assess the company's growth or decline over time. 2. Vertical analysis involves comparing items within a single financial statement to determine their proportionate contribution to the whole. It helps understand the relative importance of different items and their impact on the overall financial position. 3. Ratio analysis calculates various financial ratios using data from the financial statements. These ratios provide valuable insights into the company's liquidity, profitability, efficiency, and financial stability.

How to complete financial statement analysis

To complete financial statement analysis, follow these steps: 1. Gather the necessary financial statements, including the balance sheet, income statement, and cash flow statement. 2. Conduct horizontal analysis by comparing financial data over multiple periods to identify trends and changes. 3. Perform vertical analysis by comparing items within a single financial statement to understand their relative importance. 4. Calculate various financial ratios using the data from the financial statements to assess the company's financial health and performance. 5. Interpret the financial ratios and other analysis findings to draw conclusions about the company's strengths, weaknesses, opportunities, and threats. 6. Use the insights gained from the analysis to make informed decisions and recommendations regarding the company's financial strategies and operations.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.