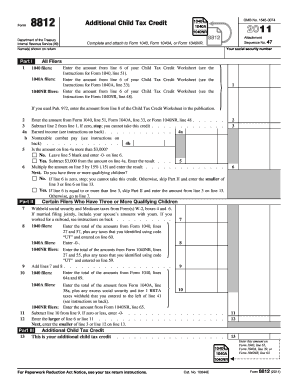

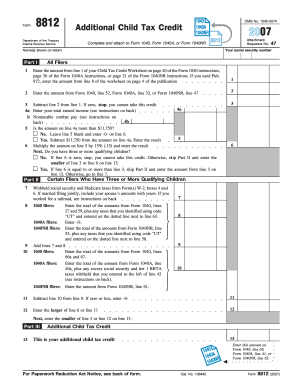

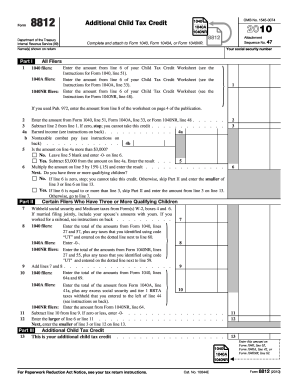

What is 8812 Form?

The 8812 Form, also known as the Additional Child Tax Credit, is a tax form used by taxpayers to claim a refundable credit for the excess amount of the Child Tax Credit. It is an important form for taxpayers who have eligible children and want to avail additional tax benefits.

What are the types of 8812 Form?

There is only one type of 8812 Form, which is the form for claiming the Additional Child Tax Credit. However, it is important to note that the form may vary slightly depending on the tax year for which it is being filed.

How to complete 8812 Form

Completing the 8812 Form is a relatively simple process. Here are the steps to follow:

01

Obtain the necessary tax forms - Form 8812 and your income tax return form.

02

Gather all the required information - Collect all the necessary information such as the names and Social Security numbers of your eligible children.

03

Fill in the basic information - Start by entering your personal details, including your name, address, and Social Security number.

04

Provide details about your eligible children - Fill in the information about your eligible children, including their names, Social Security numbers, and relationship to you.

05

Calculate the Additional Child Tax Credit - Use the instructions provided with the form to calculate the amount of the credit you are eligible for.

06

Complete the remaining sections - Fill in any additional required sections of the form, ensuring that all information is accurate.

07

Review and submit - Double-check all the information you entered on the form and make any necessary amendments. Once you are satisfied with the accuracy of the form, sign and submit it along with your income tax return.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.