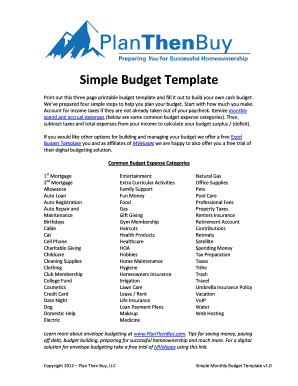

What is simple budget template?

A simple budget template is a tool used to help individuals or businesses track and manage their finances. It provides a basic format for recording income and expenses, allowing users to easily see where their money is going and make adjustments as needed. With a simple budget template, users can effectively plan and monitor their financial goals.

What are the types of simple budget template?

There are several types of simple budget templates available, each designed to cater to different needs and preferences. Some common types include:

Blank budget template - A flexible template that allows users to customize categories and input their own income and expenses.

Weekly budget template - Helps users track their finances on a weekly basis, taking into account variable expenses and income.

Monthly budget template - Provides a comprehensive overview of monthly finances, enabling users to plan and allocate funds accordingly.

Family budget template - Specifically designed to help households manage their overall expenses and savings as a family unit.

Business budget template - Tailored for businesses, this template includes specific categories for sales, expenses, and profit calculations.

How to complete simple budget template

Completing a simple budget template is a straightforward process that can be broken down into the following steps:

01

Enter your income sources - Start by listing all sources of income, such as salary, investments, or side hustles.

02

Track your expenses - Categorize your expenses into different categories, such as housing, transportation, groceries, and entertainment.

03

Input the amounts - Specify the amounts for each income source and expense category.

04

Calculate totals - Let the template automatically calculate the total income, total expenses, and the difference between them.

05

Analyze and adjust - Review the results to identify areas where you can cut back or allocate more funds.

By following these steps, you can effectively use a simple budget template to gain control over your finances and work towards your financial goals. Empower yourself with pdfFiller, the leading online document management platform that allows you to create, edit, and share documents hassle-free. With unlimited fillable templates and powerful editing tools, pdfFiller is the ultimate PDF editor that can help you get your documents done efficiently.