What is irs payment online?

To simplify the process of paying taxes, the IRS provides individuals and businesses with the option to make payments online. This convenient method allows taxpayers to securely submit their payments electronically, eliminating the need for paper checks or money orders. By utilizing the IRS payment online system, users can save time, avoid potential delays, and have peace of mind knowing their payments are processed efficiently.

What are the types of irs payment online?

The IRS offers several types of online payment options to cater to different taxpayer needs. They include:

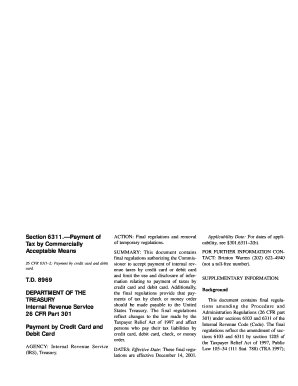

Credit or Debit Card Payment: Taxpayers can pay their taxes using a credit or debit card. This method allows for immediate payment and can be done online through the IRS payment portal or by phone.

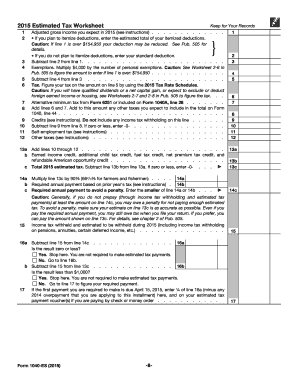

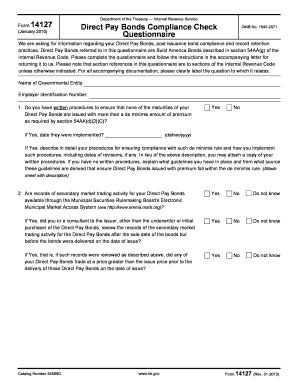

Electronic Funds Withdrawal: Taxpayers can authorize the IRS to withdraw the payment directly from their bank account. This can be set up during the e-file process or by using the IRS Direct Pay service.

IRS Direct Pay: Taxpayers can make payments directly from their bank account using the IRS Direct Pay service. This option is free and secure, allowing users to schedule payments in advance or make same-day payments.

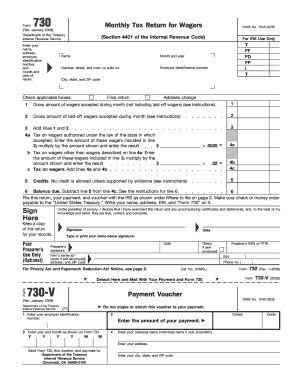

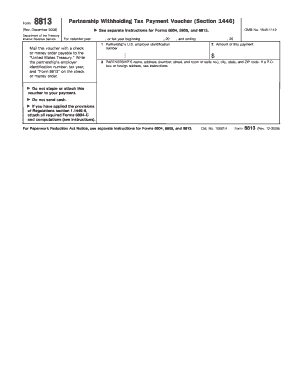

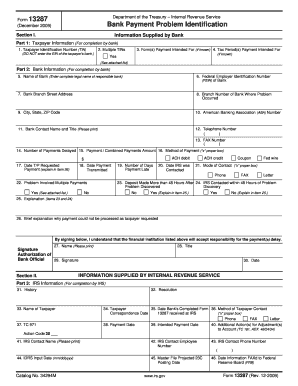

Electronic Federal Tax Payment System (EFTPS): This system is for businesses and individuals who regularly make federal tax payments. Users must enroll in EFTPS beforehand to make payments.

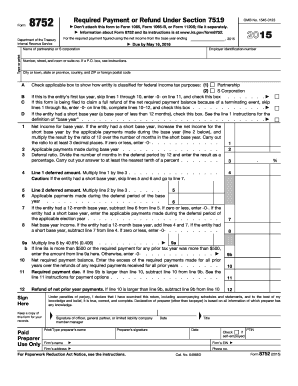

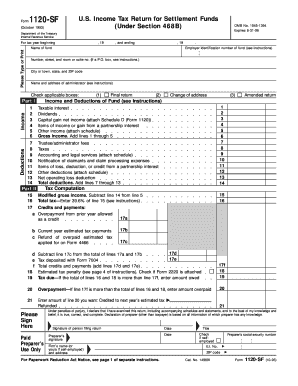

Online Payment Agreement: Taxpayers who owe a large amount may qualify for an online payment agreement. This allows them to pay their debt in installments over time.

Payroll Deduction: Employees can arrange for their employers to deduct taxes directly from their wages and send the payment to the IRS.

How to complete irs payment online

Completing an IRS payment online is a straightforward process. Follow these steps to make your payment:

01

Visit the official IRS website at www.irs.gov

02

Click on the 'Pay' tab to access the online payment options

03

Select the payment method that suits your needs (credit/debit card, direct bank withdrawal, etc.)

04

Enter the required payment information, such as your tax identification number, payment amount, and other relevant details

05

Review the payment details for accuracy

06

Submit the payment information and wait for confirmation

07

Keep a copy of the confirmation for your records

Empowering users to create, edit, and share documents online, pdfFiller offers unlimited fillable templates and powerful editing tools. With pdfFiller as your go-to PDF editor, you can efficiently manage your documents and streamline your workflows.