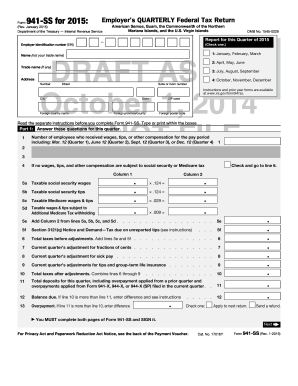

Irs Form 941 2015

What is irs form 941 2015?

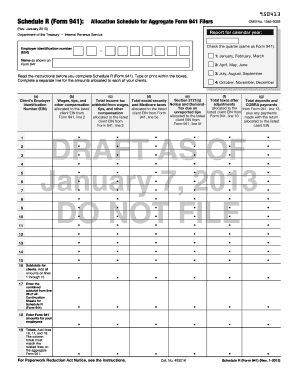

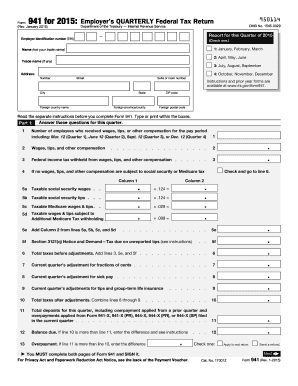

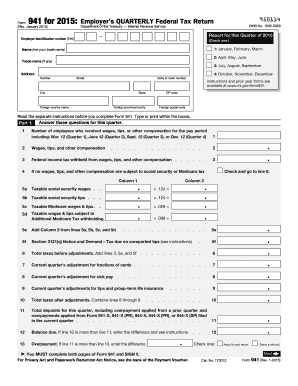

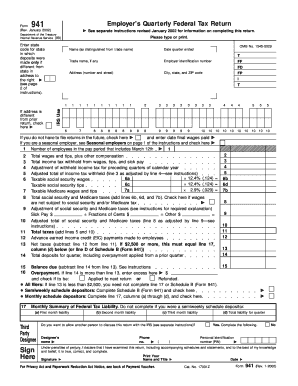

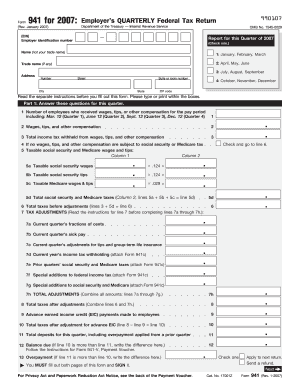

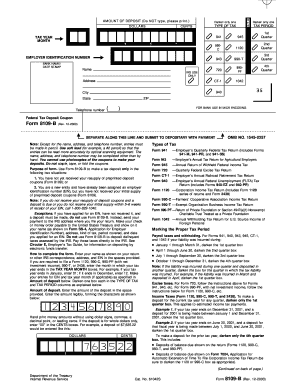

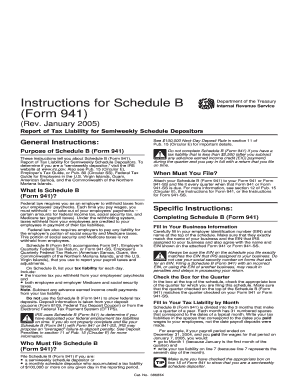

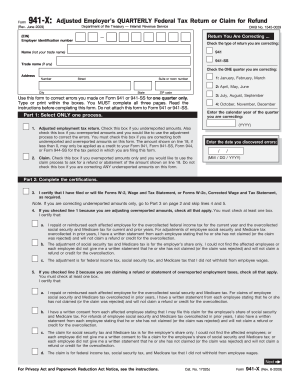

The IRS Form 941 for the year 2015 is a quarterly tax return form specifically designed for employers to report information regarding their employees' wages, tips, and withheld taxes. This form is used to calculate the employer's portion of Social Security and Medicare taxes, as well as any additional Medicare tax and the credit for COBRA premium assistance payments.

What are the types of irs form 941 2015?

The types of IRS Form 941 for the year 2015 include:

Quarter 1 (January - March)

Quarter 2 (April - June)

Quarter 3 (July - September)

Quarter 4 (October - December)

How to complete irs form 941 2015

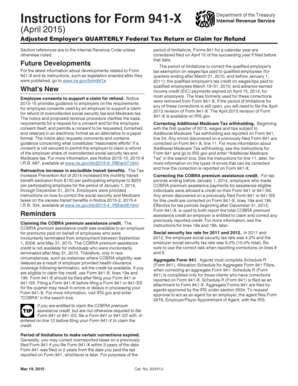

To complete IRS Form 941 for the year 2015, follow the steps below:

01

Provide your business and employer identification details.

02

Enter the total number of employees and their wages for each quarter.

03

Calculate the applicable taxes and report the withheld amounts.

04

Include any adjustments or credits, such as COBRA premium assistance payments.

05

Sign and date the form.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out irs form 941 2015

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I file a 941 for a previous year?

How to file a 941 from a previous year Click the Reports menu. Go to Employees & Payroll, click More Payroll Reports in Excel, then choose Tax Form Worksheets. Turn on the Macros. Under Which worksheet do you want to create?, choose Quarterly 941. Enter the dates, then click Create Report.

How do I file last year 941?

How to file a 941 from a previous year Click the Reports menu. Go to Employees & Payroll, click More Payroll Reports in Excel, then choose Tax Form Worksheets. Turn on the Macros. Under Which worksheet do you want to create?, choose Quarterly 941. Enter the dates, then click Create Report.

What happens if you forget to file 941?

If you fail to File your Form 941 or Form 944 by the deadline: Your business will incur a penalty of 5% of the total tax amount due. You will continue to be charged an additional 5% each month the return is not submitted to the IRS up to 5 months.

Can you file form 941 late?

Late Filing Deposits made between six and 15 days late have a five percent penalty and a ten percent penalty for deposits more than 16 days late, plus interest. If you file Form 941 late, the IRS imposes a penalty of five percent per month or partial month you are late, up to a maximum of 25 percent.

How do I get my IRS tax history?

Once your transcript is available, you may use Get Transcript Online. You may order a tax return transcript and/or a tax account transcript using Get Transcript by Mail or call 800-908-9946. Please allow 5 to 10 calendar days for delivery. You may also submit Form 4506-T, Request for Transcript of Tax Return.

Can I see my 941 online?

You can access your federal tax account through a secure login at IRS.gov/account.

Related templates