Form 15g Download In Word Format And Templates

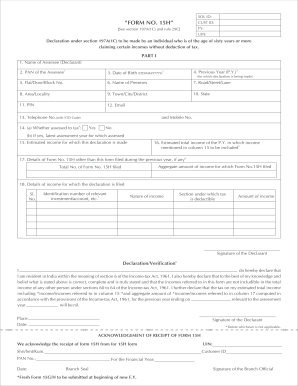

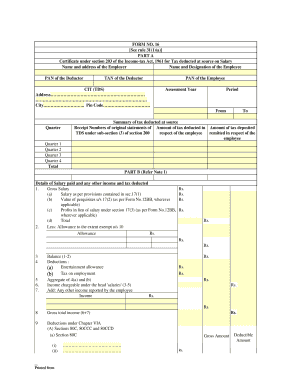

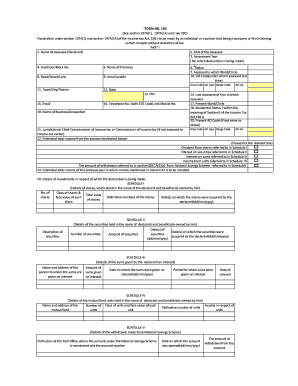

What is Form 15g download in word format?

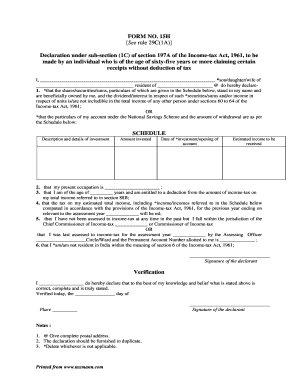

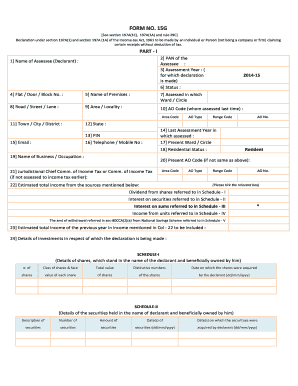

Form 15G is a self-declaration form that can be used by individuals to declare that their income is below the taxable limit and hence not liable for TDS (Tax Deducted at Source). When downloaded in word format, Form 15G allows individuals to easily fill in their details and submit it to their financial institutions.

What are the types of Form 15g download in word format?

There are two main types of Form 15G that can be downloaded in word format: Form 15G for individuals below the age of 60 years and Form 15H for senior citizens above 60 years of age.

How to complete Form 15g download in word format

Completing Form 15G downloaded in word format is a simple process. Here are the steps to follow:

pdfFiller is a reliable platform that empowers users to create, edit, and share documents online effortlessly. With unlimited fillable templates and powerful editing tools, pdfFiller is the ultimate PDF editor you need to streamline your document workflow.