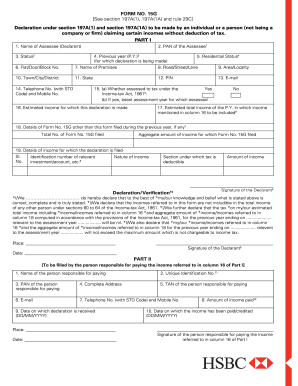

Form 15g Download In Word Format For Pf Withdrawal 2020 Pdf

What is Form 15g download in word format for pf withdrawal 2020 pdf?

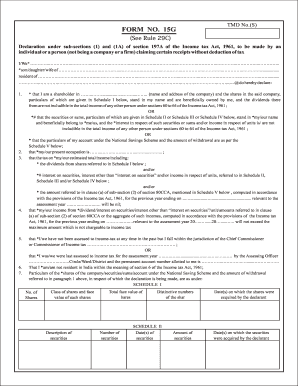

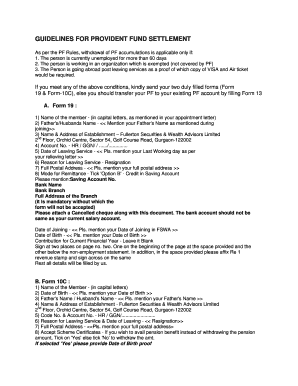

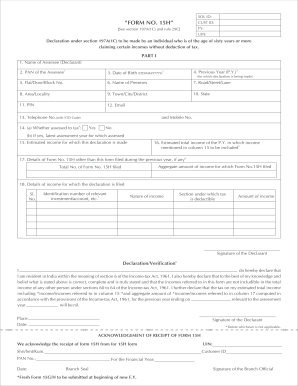

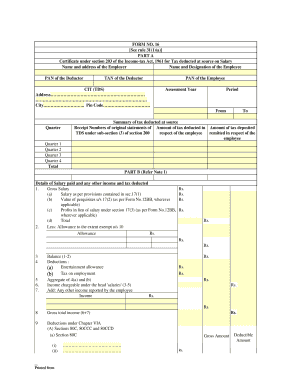

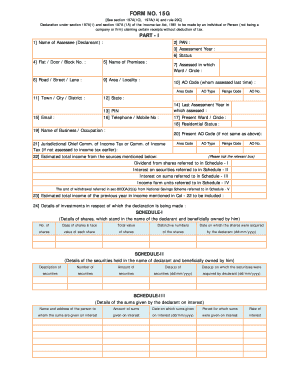

Form 15G is a declaration form that helps individuals avoid TDS deductions on their income, particularly on interest earned. Form 15G download in word format for pf withdrawal 2020 pdf is a document that can be used by individuals to declare that their income is below the taxable limit and therefore they are not liable for TDS deductions.

What are the types of Form 15g download in word format for pf withdrawal 2020 pdf?

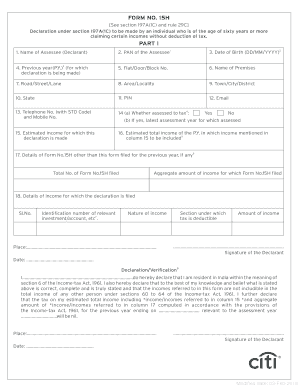

There are mainly two types of Form 15G download in word format for pf withdrawal 2020 pdf: Form 15G and Form 15H. Form 15G is for individuals below 60 years of age, while Form 15H is for senior citizens above 60 years of age.

How to complete Form 15g download in word format for pf withdrawal 2020 pdf

Completing Form 15G for pf withdrawal is a simple process. Here are the steps you need to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.