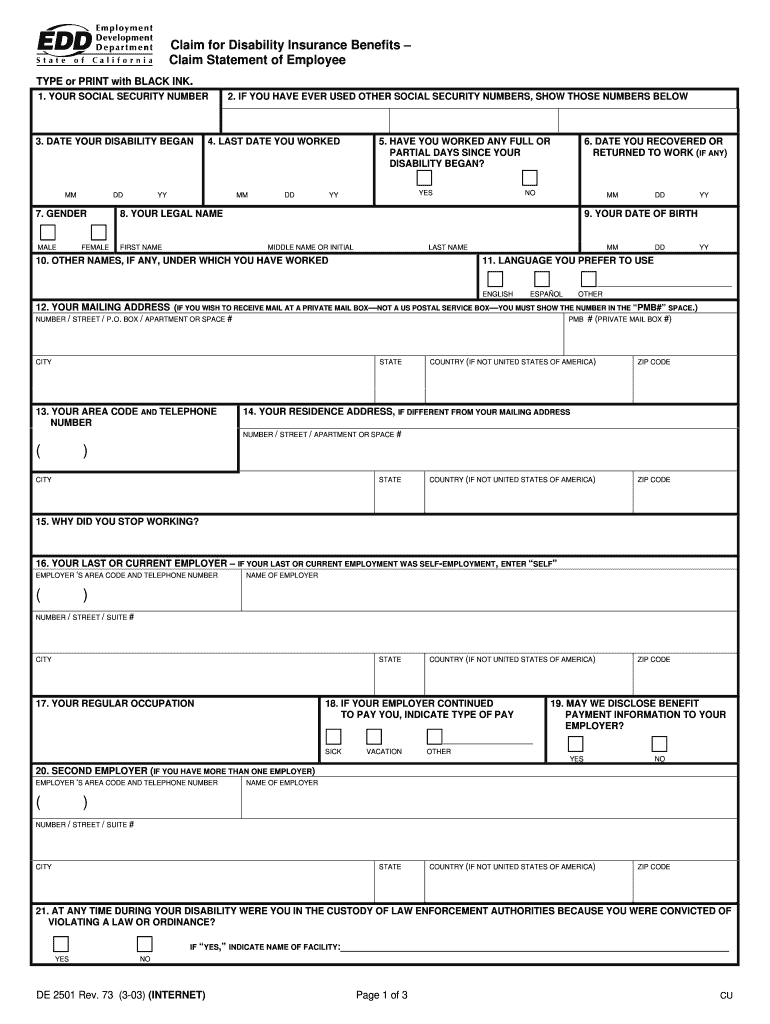

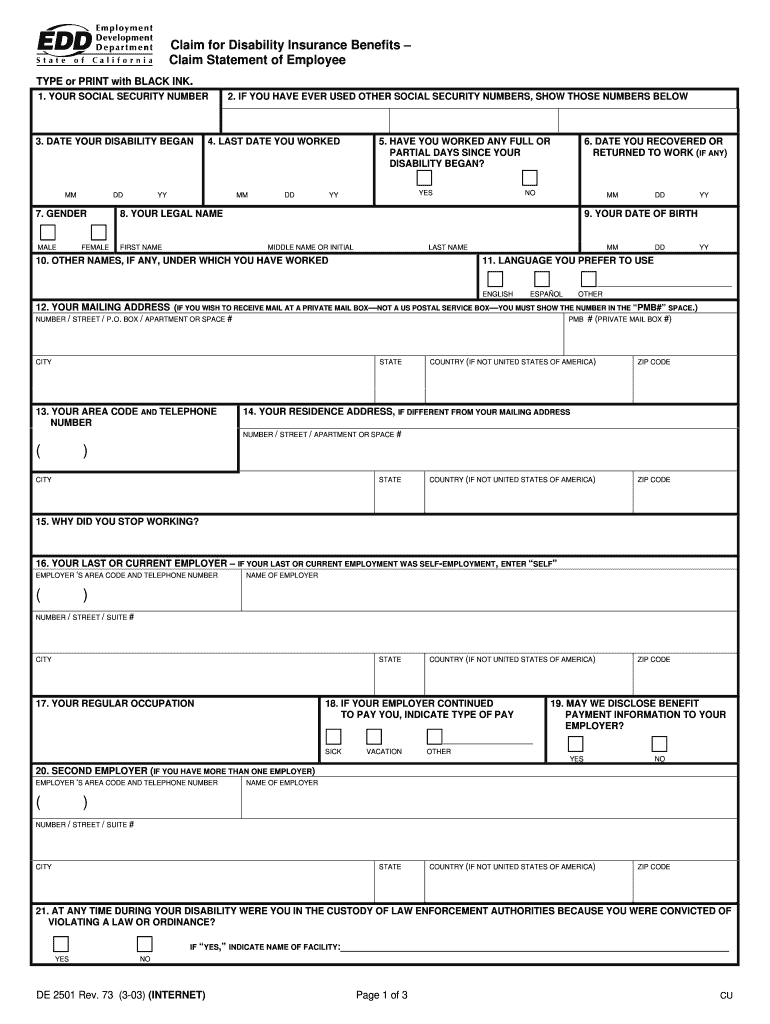

CA DE 2501 2003 free printable template

Get, Create, Make and Sign

How to edit disability insurance for podiatrists online

CA DE 2501 Form Versions

How to fill out disability insurance for podiatrists

How to fill out disability insurance for podiatrists:

Who needs disability insurance for podiatrists?

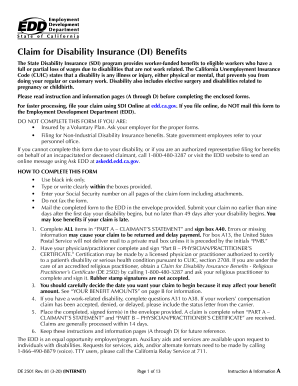

Instructions and Help about disability insurance for podiatrists

Either this is Jonathan Ginsberg IN#39;like to talk to you about SocialSecurity disability and long-termdisability claims and if you#39’ve got along-term disability claim typically ITIS an employee sponsored a long-termdisability claim in which a company such as UNM or Prudential has agreed to pay you a monthly benefit if you cannot perform typically at your own occupation or equivalent occupation if you show some form of disability and almost everylong-term disability policy has provision that says that long if you'reap proved for long term disability you have also got to apply for SocialSecurity and the reason for that is that under these contracts Social Security will offset long term disability and San aside one of the issues that means is that if you get approved for SocialSecurity and you get a lump sum the long term disability carrier is going to expect you to repay the lump sum to them lot of people are very unhappy about this they go through the two or three year process of getting SocialSecurity they get an award of $50,000and then as soon as the long term disability carrier finds out about it, they say IN#39’ll take that money thank you very much so just be aware going in but if you've got long-term disability especially company-sponsoredthere'’s a good chance you won't be able to keep your long term your lump sum rather I didn't want to also bring you some information about the people who assist you and pursuing Social Security what we#39’re seeing now is that many of the long-term disability carriers have entered into contracts with non attorney reps and these are companies that handle social security matters they're not attorneys though and basically these nonattorney reps will assist you in applying for and obtaining SocialSecurity that typically would not apparent hearings, although sometimes they debut usually they try to get you approve dearly on and that's fine the only issue with these non attorney reps is that they have a contract with the insurance company not and that#39’re first their first loyalty is going to be with the insurance company that's providing this contract and all going business not with you, you have the right to say no I want an attorney like Jonathan Ginsberg or anybody else to represent me and typically when you Dothan the non attorney rep will back off, so my advice would be if you have anon-attorney rep working with you in along-term disability case where SocialSecurity has been implicated I would think very long and hard about whether you want this non-attorney rep again Nolan attorney whose first loyalties with the insurance company to assist you want to because again their goal ingoing to be to try to get you on as fasts possible not necessary to look forbore back benefits not to say to be as concerned about the Medicare aspect of things and to really focus on what#39;best for you, so that would encourage you that if you have been contacted by anon-attorney rep and their#39’s a long term...

Fill form : Try Risk Free

People Also Ask about disability insurance for podiatrists

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your disability insurance for podiatrists online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.