MI DoT 3683 2009-2024 free printable template

Show details

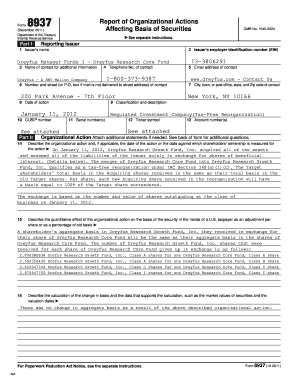

Michigan Department of Treasury 3683 Rev. 8-09 Reset Form Payroll Service Provider Combined Power of Attorney Authorization and Corporate Officer Liability COL Certificate for Businesses Issued under authority of the Revenue Act P. A. 122 of 1941 as amended* Filing is voluntary. Complete this form if you wish to appoint someone to represent your business to the State of Michigan for withholding tax matters. Taxpayer Name Account No*/Federal Employer ID No* FEIN Address Street or RR City State...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your entity michigan form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your entity michigan form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing entity michigan online

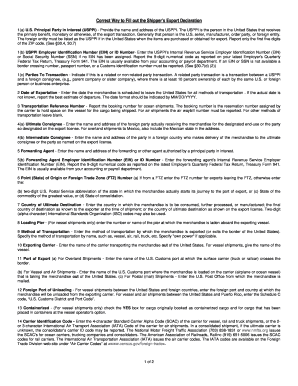

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit michigan representative form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

How to fill out entity michigan form

How to fill out state of Michigan tax:

01

Gather all necessary forms and documents, such as W-2 forms, 1099 forms, and any other income-related documents.

02

Determine your filing status, whether it's single, married filing jointly, married filing separately, or head of household.

03

Calculate your total income by adding up all sources of income, including wages, self-employment income, rental income, etc.

04

Determine your deductions and credits, such as the standard deduction or itemized deductions, and various tax credits you may be eligible for.

05

Complete the state of Michigan tax return form, which can be obtained online or through mail by contacting the Michigan Department of Treasury.

06

Double-check your work and ensure that all information is accurate and complete.

07

Sign and date the tax return form before mailing it to the Michigan Department of Treasury.

Who needs the state of Michigan tax:

01

Any individual who resides in the state of Michigan for all or part of the tax year and meets the income threshold set by the state.

02

Individuals who have earned income or other sources of income from within the state of Michigan.

03

Businesses that generate income from within the state of Michigan and meet the tax obligations set by the state.

Video instructions and help with filling out and completing entity michigan

Instructions and Help about form 3683 michigan

Fill ids michigan : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is state of michigan tax?

The state of Michigan imposes a variety of taxes on its residents and businesses. Some of the main taxes include:

1. Income Tax: Michigan has a flat rate income tax of 4.25% on both individual and corporate incomes.

2. Sales Tax: The state sales tax rate in Michigan is 6%, which is applied to most goods and services. However, some items such as groceries and prescription drugs are exempt from sales tax.

3. Property Tax: Property owners in Michigan are subject to property taxes, which are levied by the local government. The property tax rate varies depending on the locality and is typically based on the assessed value of the property.

4. Use Tax: Michigan has a use tax, which is imposed on items purchased outside the state but used within Michigan. It is typically levied at the same rate as the sales tax.

5. Business Taxes: Michigan imposes various taxes on businesses, including the Corporate Income Tax, Business Income Tax, and the Michigan Business Tax for certain entities.

It's important to note that this information is a general overview, and there may be additional taxes or exemptions based on specific circumstances. It is always recommended to consult with a tax professional or the Michigan Department of Treasury for comprehensive and up-to-date tax information.

Who is required to file state of michigan tax?

Any individual or business that earns income in the state of Michigan is generally required to file a Michigan state tax return. However, specific filing requirements may vary depending on factors such as income level, filing status, and eligibility for certain exemptions or credits. It is advisable to consult the Michigan Department of Treasury or a tax professional for more accurate and personalized information based on specific circumstances.

How to fill out state of michigan tax?

To fill out the State of Michigan tax form, follow these steps:

1. Gather necessary documents: Collect all the required documents, such as W-2 forms, 1099 forms, and any other income statements or financial records.

2. Download the form: Visit the official website of the Michigan Department of Treasury (https://www.michigan.gov/treasury), navigate to the "Tax Forms" section, and download the relevant form. Most individuals will need to fill out form MI-1040.

3. Fill out personal information: Include your name, address, Social Security number, and filing status at the top of the form.

4. Report income: Enter your income information from all sources in the relevant sections of the form. Be sure to report accurate amounts and include all necessary supporting documents.

5. Deductions: If eligible, subtract any deductions from your income to arrive at your adjusted gross income (AGI). Common deductions include student loan interest, mortgage interest, and contributions to retirement accounts.

6. Tax credits: If applicable, claim any tax credits for which you qualify. Check the instructions for the specific form to determine which credits you might be eligible for.

7. Calculate tax and payments: Use the tax tables or tax calculation software to determine your total tax liability. Then, subtract any tax payments you have already made throughout the year, such as withholding taxes or estimated tax payments.

8. Refund or balance due: Compare your tax liability with the total payments made. If your payments are greater than your tax liability, you may be eligible for a refund. If your tax liability is higher, you will need to pay the balance.

9. Sign and submit: Sign and date the completed form. Make a copy for your records, and mail the original form to the address provided on the form or file electronically if applicable.

It is highly recommended to consult with a tax professional or use tax preparation software to ensure accuracy and maximize deductions or credits based on your specific circumstances.

What is the purpose of state of michigan tax?

The purpose of the state of Michigan tax is to generate revenue that is used to fund various public services and government programs within the state of Michigan. These taxes help finance education, infrastructure development, public safety, healthcare, social welfare programs, and other essential services provided by the state government. The taxes are collected from individuals, businesses, and other entities residing or operating within the state, and the revenue generated is allocated towards providing and improving these services for the benefit of the residents of Michigan.

What information must be reported on state of michigan tax?

The information that must be reported on the State of Michigan tax return includes:

1. Personal Information: Such as name, address, social security number, and filing status.

2. Federal AGI (Adjusted Gross Income): This is the total income earned from all sources minus specific deductions, such as student loan interest, alimony payments, etc.

3. Michigan AGI: This is calculated by starting with the federal AGI and making specific adjustments required by Michigan tax laws.

4. Total Michigan Income: Includes income earned from all sources within the state, including wages, self-employment income, rental income, pension income, etc.

5. Deductions and Exemptions: Michigan allows for various deductions and exemptions which can reduce the taxable income. Examples include deductions for home mortgage interest, property taxes, medical expenses, personal exemptions, etc.

6. Credits: State of Michigan offers various tax credits that can reduce the amount of tax owed. Common credits include the Homestead Property Tax Credit, Earned Income Tax Credit, College Tuition Credit, and various business-related credits.

7. Withholding and Estimated Payments: If applicable, taxpayers need to report any Michigan income tax withheld by employers or estimated tax payments made throughout the year.

8. Calculation of Tax Liability: Using the provided information, taxpayers must calculate their Michigan tax liability using the appropriate tax rate schedule or tax tables.

9. Payment or Refund: Based on the calculated tax liability and any tax payments already made, individuals will determine if they owe additional tax or are eligible for a refund.

It is important to note that this is not an exhaustive list, and taxpayers should refer to the Michigan Department of Treasury's official instructions or consult a tax professional for specific details.

When is the deadline to file state of michigan tax in 2023?

The deadline to file state of Michigan taxes for the year 2023 is typically April 15th. However, it is important to note that tax deadlines can change, so it is advisable to double-check the specific deadline for the year in question closer to the filing date.

What is the penalty for the late filing of state of michigan tax?

The penalty for late filing of state of Michigan taxes is generally 5% of the tax due for each month the return is late, up to a maximum penalty of 25%. Additionally, interest is charged on any unpaid tax balance at a rate of 1% per month until the tax is paid in full.

How can I edit entity michigan on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing michigan representative form right away.

How can I fill out michigan tax forms on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your fillable state of michigan tax forms, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

How do I fill out michigan form 3683 on an Android device?

On Android, use the pdfFiller mobile app to finish your postal michigan form. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

Fill out your entity michigan form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Michigan Tax Forms is not the form you're looking for?Search for another form here.

Keywords relevant to michigan treasury form 3683

Related to entities michigan

If you believe that this page should be taken down, please follow our DMCA take down process

here

.