Get the free irs form 2119 for 2019

Show details

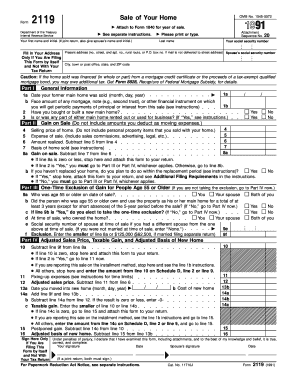

You can write to both the Internal Revenue Service Washington DC 20224 Attention IRS Reports Clearance Officer T FP and the Office of Management and Budget Washington DC 20503. DO NOT send this form to either of these offices. Instead see When and Where To File on this page. General Instructions Purpose of Form Use Form 2119 to report the sale of your main home. Department of the Treasury Internal Revenue Service Instructions for Form 2119 Sale of Your Home Paperwork Reduction Act Notice. We...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your irs form 2119 for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs form 2119 for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing irs form 2119 for 2019 online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit worksheet 2119 form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

How to fill out irs form 2119 for

How to fill out IRS form 2119:

01

Start by entering your personal information in the designated section of the form. This includes your name, social security number, and contact details.

02

Next, provide the necessary information related to the sale or exchange of your principal residence. This includes the date of acquisition and sale, the sales proceeds, and any expenses incurred during the sale.

03

Calculate the gain or loss on the sale by subtracting the adjusted basis of your property from the sales price. The adjusted basis takes into account any improvements, depreciation, or other factors that may affect the value.

04

If you qualify for an exclusion, such as the home sale exclusion or the rollover of gain into another property, indicate it on the form and provide the relevant details.

05

Complete the rest of the form by following the instructions provided. This may involve supplying additional information or attaching supporting documents, depending on your specific circumstances.

Who needs IRS form 2119:

01

Individuals who have sold or exchanged their principal residence during the tax year and need to report the transaction to the IRS.

02

Homeowners who may be eligible for certain exclusions or rollovers based on the sale of their property.

03

Taxpayers who want to ensure compliance with IRS regulations and avoid any potential penalties or audits related to the sale of their home.

Fill irs sale of home form 2119 : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is irs form 2119 for?

IRS Form 2119 is used to calculate and report the sale of a main residence or any other property that was previously used for personal purposes and was later converted to business or rental property. It is used to determine the taxable gain or loss on the sale of such property.

Who is required to file irs form 2119 for?

IRS Form 2119 is used to report the sale of a principal residence and potentially exclude the capital gains from the sale if certain eligibility criteria are met. It must be filed by individuals who have sold their primary residence and want to claim the exclusion on the capital gains from the sale. However, the requirements and eligibility for filing this form may change over time, so it is important to consult the official IRS guidelines or speak with a tax professional for accurate and up-to-date information.

How to fill out irs form 2119 for?

IRS Form 2119 is used to report the sale of your main home when you have a capital gain but qualify for an exclusion of up to $250,000 ($500,000 for married couples filing jointly) on that gain. Here are the steps to fill out Form 2119:

1. Obtain a copy of Form 2119: You can download it from the IRS website or request a copy from the IRS by mail.

2. Provide your personal information: Fill in your name, Social Security number, and address in the appropriate sections at the top of the form.

3. Identify the property: Enter the address and description of the property being sold in the "Description of Property" section.

4. Determine your ownership and use: Indicate the dates you acquired and sold the property, as well as the number of days you used the property as your main home and as a rental property, if applicable.

5. Calculate your gain and exclusion: Subtract your adjusted basis (typically the purchase price plus improvements, minus depreciation) from the net selling price to find your gain. If your gain is less than the exclusion amount, enter the gain in "Part III" and skip the remaining steps. If your gain exceeds the exclusion, continue to the next step.

6. Allocate the gain: If you're married filing jointly, divide the gain between you and your spouse according to your ownership percentages. Enter your allocated gain on line 9 or, if applicable, enter the entire gain on line 10.

7. Calculate the exclusion: Enter the lesser of the exclusion amount ($250,000 or $500,000) or your allocated or full gain from the sale on line 12.

8. Determine the taxable gain: Subtract the exclusion amount from your allocated or full gain, and enter the result on line 13.

9. Sign and date the form: Review your form for accuracy, sign and date it at the bottom.

10. Attach supporting documents: If required, attach a copy of your settlement statement (such as Form HUD-1) to substantiate the information on Form 2119.

11. File the form with your tax return: Keep a copy for your records and submit the completed Form 2119 along with your tax return for the year of the sale.

Note: It's recommended to consult a tax professional for assistance with completing Form 2119, especially if you have complex circumstances or questions about eligibility for the exclusion.

What is the purpose of irs form 2119 for?

IRS Form 2119 is used for calculating the taxable gain or loss on the sale or disposition of a taxpayer's personal residence. It is specifically used for individuals who are claiming an exclusion of gain from the sale of a principal residence under the Internal Revenue Code Section 121. The purpose of this form is to determine if the taxpayer is eligible for the exclusion, and if so, to calculate the amount of gain that is eligible for exclusion.

When is the deadline to file irs form 2119 for in 2023?

According to the Internal Revenue Service (IRS), the deadline to file Form 2119 for the tax year 2023 would be April 15, 2024. However, it's always recommended to refer to the official IRS website or consult with a tax professional for the most accurate and up-to-date information.

What is the penalty for the late filing of irs form 2119 for?

The penalty for the late filing of IRS Form 2119, also known as Sale of Your Home, is dependent on various factors. The form is used to calculate the exclusion of gain from the sale of a primary residence. If the form is filed late without reasonable cause, the penalty can be imposed. As of 2021, the penalty for late filing of Form 2119 is typically 5% of the unpaid tax amount for each month or part of a month that the form is late, up to a maximum of 25% of the unpaid tax. However, the specific penalty amount can vary based on individual circumstances, so it is always recommended to consult the IRS or a tax professional for accurate and up-to-date information.

How can I get irs form 2119 for 2019?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the worksheet 2119 form in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I create an eSignature for the irs form 2119 for 2018 in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your irs form 2119 2020 and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How can I edit form 2119 2019 on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing federal tax form 2119, you need to install and log in to the app.

Fill out your irs form 2119 for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs Form 2119 For 2018 is not the form you're looking for?Search for another form here.

Keywords relevant to form 2119 instructions 2019

Related to form 2119

If you believe that this page should be taken down, please follow our DMCA take down process

here

.