Get the free State Tax Registration Application - The Payroll Center

Show details

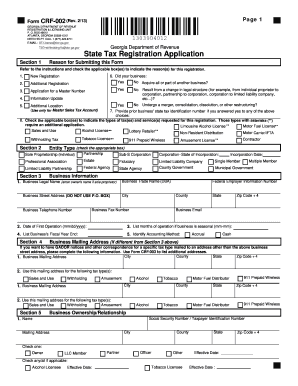

CRF-002 (Rev. 3/08) GEORGIA DEPARTMENT OF REVENUE REGISTRATION & LICENSING UNIT P. O. BOX 49512 ATLANTA, GEORGIA 30359-1512 Fax: 404-417-4317 OR 404-417-4318 NEED HELP? CALL (404) 417-4490 E-MAIL:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your state tax registration application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your state tax registration application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit state tax registration application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit state tax registration application. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

How to fill out state tax registration application

How to fill out state tax registration application:

01

Gather all necessary documents and information, including your Social Security number, business identification number (if applicable), and any relevant tax forms or paperwork.

02

Carefully read through the application instructions and requirements to ensure you understand what is being asked of you.

03

Fill out all required fields accurately, providing complete and up-to-date information. Double-check your entries to avoid any errors.

04

If you have any doubts or questions, seek assistance from a tax professional or contact the relevant tax authority for guidance.

05

Submit the completed application by the designated deadline, either by mail or electronically, depending on the instructions provided.

Who needs state tax registration application:

01

Individuals who are required to file state income taxes.

02

Business owners who operate within a particular state and are obligated to pay state taxes.

03

Any entities or organizations that are mandated by law to register for state tax purposes, such as nonprofit organizations or charities.

Note: The specific requirements for state tax registration may vary depending on your location and individual circumstances. It is always advisable to consult with a tax professional or refer to the guidelines provided by your state's tax authority for accurate and personalized information.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is state tax registration application?

State tax registration application is a form that individuals and businesses must complete in order to register for state taxes.

Who is required to file state tax registration application?

Any individual or business that meets the state's criteria for tax registration must file a state tax registration application.

How to fill out state tax registration application?

To fill out a state tax registration application, you'll need to provide your business information, personal information, and any relevant tax information. The specific steps may vary depending on the state and the type of tax being registered for.

What is the purpose of state tax registration application?

The purpose of a state tax registration application is to inform the state tax authority of your intent to conduct taxable activities within the state and to register for state tax purposes.

What information must be reported on state tax registration application?

The information that must be reported on a state tax registration application typically includes the applicant's name, business name, address, contact information, types of taxes being registered for, and any associated tax identification numbers.

When is the deadline to file state tax registration application in 2023?

The deadline to file a state tax registration application in 2023 may vary depending on the state and the specific tax being registered for. It is recommended to check with the state tax authority or consult a tax professional for the exact deadline.

What is the penalty for the late filing of state tax registration application?

The penalty for the late filing of a state tax registration application may vary depending on the state and the specific tax being registered for. Common penalties include monetary fines or penalties based on a percentage of taxes owed. It is recommended to check with the state tax authority or consult a tax professional for the specific penalty amounts.

How can I send state tax registration application to be eSigned by others?

state tax registration application is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I edit state tax registration application straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing state tax registration application.

Can I edit state tax registration application on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign state tax registration application on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Fill out your state tax registration application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.