Who needs an M-792 Form?

An M-792 is the Massachusetts Department of Revenue (FOR) form that is a Release of Estate Tax Lien Certificate. In the State of Massachusetts, it is the established practice that the State shall acquire a lien against real estate in Massachusetts that is included in a decedent's gross estate. If the estate taxes do not get paid in full, the lien is in effect for 10 years from the date of the decedent's death. In case the personal representative of the real estate wants to be granted a release of the lien, they must complete Form M-706NR and accompany it by the form M-792.

What is the Certificate for?

Real property in Massachusetts is subject to a lien for estate taxes upon the death of anyone who has a legal interest in the property. In case the decedent’s personal representative needs to be provided with the release of the estate tax lien, the given certificate signed by the Bureau of Desk Audit agent will serve as a proof of such a release.

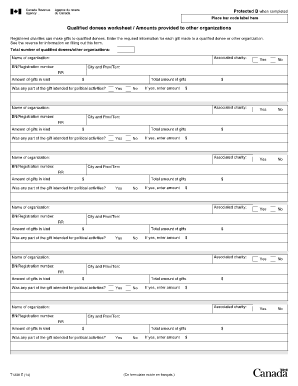

Is the M-792 form accompanied by any other form?

The Release of Estate Tax Lien Certificate must be issued only after the executor of the nonresident decedent’s estate has filled out the Form M-706NR.

How is the form filled out?

The completed M-792 form is to provide the following details:

- Name of the deceased estate owner;

- Death date and domicile;

- Probate court

- Docket number;

- Property description and address,

- Information about the deed on property;

- Details of the certificate of title;

- Certification of the Chief of the Bureau of Desk Audit.

The original copied of the certificate form must be filed with a copy of the recorded deed.