NJ DoT CBT-100 2011 free printable template

Show details

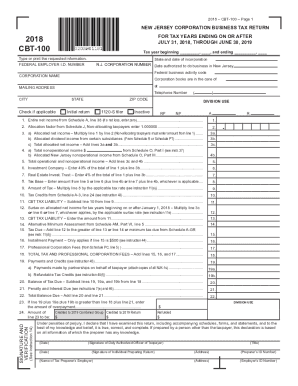

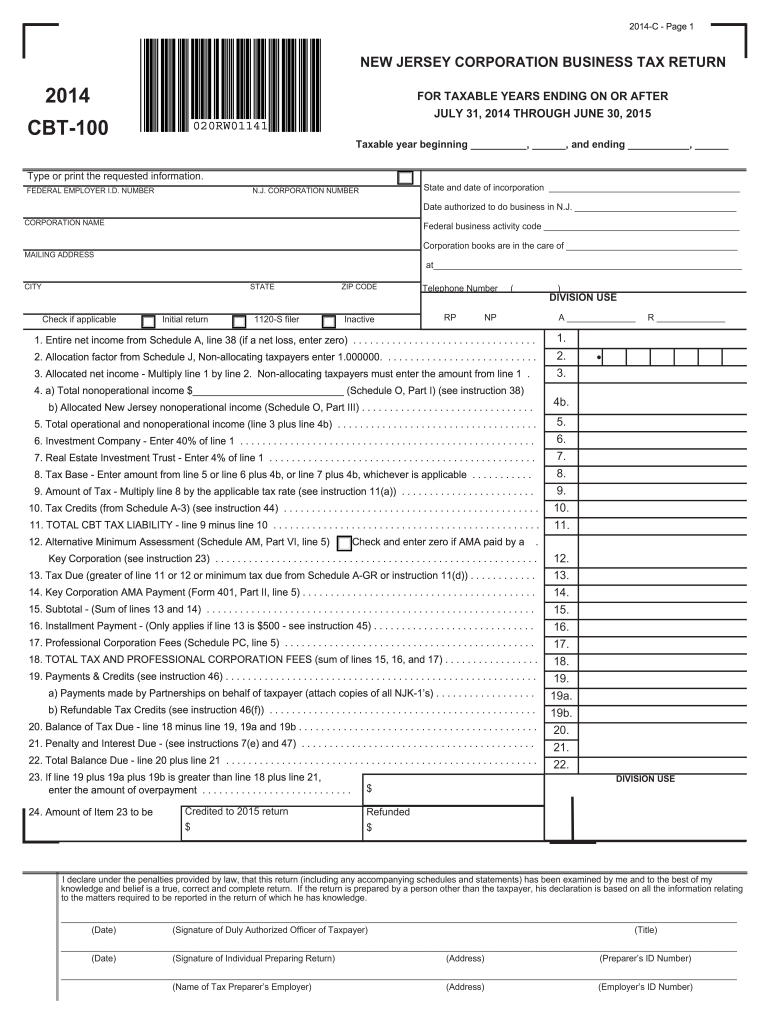

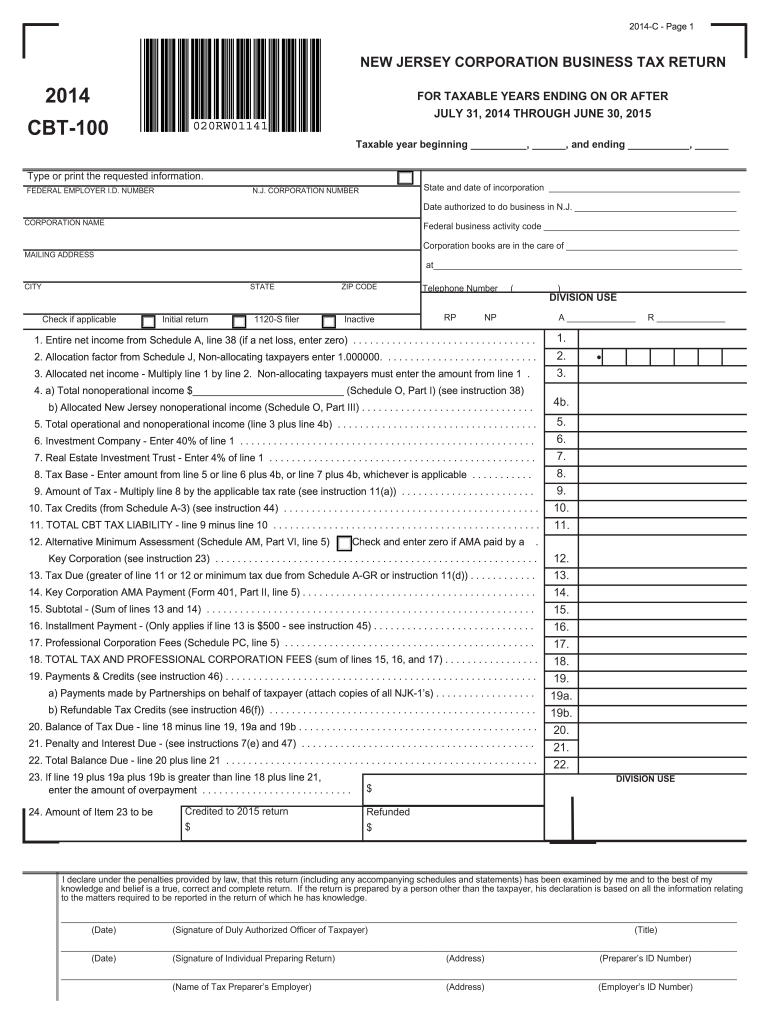

2011-C Page 1 2011 CBT-100 NEW JERSEY CORPORATION BUSINESS TAX RETURN FOR TAXABLE YEARS ENDING ON OR AFTER JULY 31, 2011, THROUGH JUNE 30, 2012, Taxable year beginning, and ending, Type or print the

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NJ DoT CBT-100

Edit your NJ DoT CBT-100 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NJ DoT CBT-100 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NJ DoT CBT-100 online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NJ DoT CBT-100. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NJ DoT CBT-100 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NJ DoT CBT-100

How to fill out NJ DoT CBT-100

01

Obtain a blank CBT-100 form from the NJ DoT website or at a local NJ DoT office.

02

Fill in your business's legal name and address in the designated fields.

03

Provide your federal employer identification number (FEIN) or social security number.

04

Indicate the type of business you operate by selecting the appropriate box.

05

Enter your annual gross receipts as required.

06

Complete any additional sections regarding business activities and vehicle information.

07

Review the form for accuracy, ensuring all fields are filled correctly.

08

Sign and date the form at the bottom where indicated.

09

Submit the completed form via mail or online as instructed.

Who needs NJ DoT CBT-100?

01

Businesses operating commercial vehicles in New Jersey that are subject to a weight-based fee.

02

Any entity that is required to register and report for the NJ DoT for fuel tax or similar purposes.

Fill

form

: Try Risk Free

People Also Ask about

What is a 1040 on a tax return?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

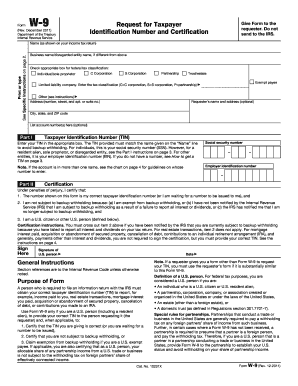

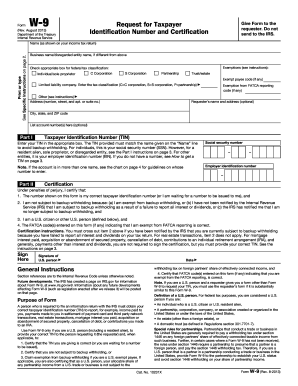

What is form NJ W4?

Employees should complete an Employee's Withholding Allowance Certificate (Form NJ-W4) and give it to their employer to declare withholding information for New Jersey purposes. New Jersey employers must furnish Form NJ-W4 to their employees and withhold New Jersey Income Tax at the rate selected.

Is there a state tax form for New Jersey?

Pay all or some of your New Jersey income taxes online via: New Jersey Division of Taxation. Paying your NJ taxes online on time will be considered a NJ tax extension and you do not have to mail in Form NJ-630. Complete Form NJ-630, include a Check or Money Order, and mail both to the address on Form NJ-630.

What is NJ w 3M?

NJ-W-3M NJ Gross Income Tax Reconciliation of Tax Withheld.

Who is exempt from NJ income tax withholding?

Line 6 Enter 'EXEMPT' to indicate that you are exempt from New Jersey Gross Income Tax Withholdings, IF you meet one of the following conditions: * Your filing status is SINGLE, HEAD OF HOUSEHOLD or QUALIFYING WIDOW(ER) and your wages plus your taxable non-wage income will be $10,000 or less for the current year.

Can you buy tax forms?

You can order the tax forms, instructions and publications you need to complete your 2021 tax return here. We will process your order and ship it by U.S. mail when the products become available. Most products should be available by the end of January 2022.

Where can I get IRS tax forms?

They include: Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676).

What is an NJ-1040?

New Jersey Form NJ-1040 – Personal Income Tax Return for Residents. New Jersey Form NJ-1040NR – Personal Income Tax Return for Nonresidents.

Who files a NJ-1040?

You can file your Form NJ-1040 for 2021 using NJ E-File, whether you are a full-year resident or a part- year resident. Use tax software you purchase, go to an online tax preparation website, or have a tax preparer file your return. (You may file both federal and State Income Tax returns.)

Do I need to fill out NJ-W4?

You must give Form NJ-W4 to your employees to fill out and return to you. This form tells you how to withhold tax from your employee's pay. Do not use the federal W-4 to calculate New Jersey withholdings because employees cannot claim personal exemptions on the federal form.

Who needs to fill out NJ W4?

NJ Taxation New Jersey employers must furnish Form NJ-W4 to their employees and withhold New Jersey Income Tax at the rate selected. When an employee has more than one job, or if spouses/civil union partners are both wage earners, the combined incomes may be taxed at a higher rate.

Where can I get hard copies of tax forms?

Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676). Hours of operation are 7 a.m. to 10 p.m., Monday-Friday, your local time — except Alaska and Hawaii which are Pacific time.

Where to get NJ tax forms?

NJ Taxation Phone – Call our automated phone line at 1-800-323-4400 (within NJ, NY, PA, DE and MD) or 609-826-4400 (from anywhere). In Person – Visit the Regional Information Center nearest to you to pick up a copy of the forms and instructions.

What is a 1040 form and where do I get it?

Form 1040. The IRS 1040 form is one of the official documents that U.S. taxpayers use to file their annual income tax return. The 1040 form is divided into sections where you report your income and deductions to determine the amount of tax you owe or the refund you can expect to receive.

Where can I find my NJ-1040?

Individuals To get a copy or transcript of your tax return, complete Form DCC-1 and send it to: You also can get a copy of your NJ-1040, NJ-1040NR or NJ-1041 at a Division of Taxation Regional Information Center. Otherwise, you can get a copy of a previously filed tax return by completing Form DCC-1 and sending it to:

How do I file my NJ W 3 online?

How to e-file NJ-W3 Go to the Employees menu and select Payroll Tax Forms & W-2's. Choose Tax Form Worksheets in Excel. Click Annual W-2/W3. Pick Last Year in the Dates section. Hit Create Report.

How to fill out NJ-W4 Form 2022?

0:34 2:52 How to fill out a W4 Form 2022 Fast - YouTube YouTube Start of suggested clip End of suggested clip So fill out your first name your last name your social security number your address your city stateMoreSo fill out your first name your last name your social security number your address your city state and zip then in step one section c right here you can go ahead and check off your filing status.

What is the W4 form used for?

Form W-4 tells you, as the employer, the employee's filing status, multiple jobs adjustments, amount of credits, amount of other income, amount of deductions, and any additional amount to withhold from each paycheck to use to compute the amount of federal income tax to deduct and withhold from the employee's pay.

What is form NJ W 3?

NJ Taxation Employers must file a Gross Income Tax Reconciliation of Tax Withheld (Form NJ-W-3) each year to report the total monthly tax remitted, wages paid and withholdings. Registered employers must file Form NJ-W-3 even if no wages were paid and no tax was withheld during the year.

How many allowances should I claim on W4 NJ?

Claiming 1 allowance is typically a good idea if you are single and you only have one job. You should claim 1 allowance if you are married and filing jointly. If you are filing as the head of the household, then you would also claim 1 allowance. You will likely be getting a refund back come tax time.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find NJ DoT CBT-100?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the NJ DoT CBT-100 in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I create an eSignature for the NJ DoT CBT-100 in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your NJ DoT CBT-100 and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I complete NJ DoT CBT-100 on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your NJ DoT CBT-100. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is NJ DoT CBT-100?

NJ DoT CBT-100 is the New Jersey Corporation Business Tax return form that corporations use to report their income and calculate the taxes owed to the state.

Who is required to file NJ DoT CBT-100?

All corporations doing business in New Jersey, including both domestic and foreign corporations, are required to file NJ DoT CBT-100.

How to fill out NJ DoT CBT-100?

To fill out NJ DoT CBT-100, corporations must provide financial information, including revenue, expenses, and deductions, follow the form instructions, and ensure all sections are accurately completed before submission.

What is the purpose of NJ DoT CBT-100?

The purpose of NJ DoT CBT-100 is to determine the amount of corporation business tax a corporation owes to the state of New Jersey based on its income and business activities.

What information must be reported on NJ DoT CBT-100?

Information that must be reported on NJ DoT CBT-100 includes gross income, deductions, credits, and other financial details relevant to the corporation's business operations in New Jersey.

Fill out your NJ DoT CBT-100 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NJ DoT CBT-100 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.