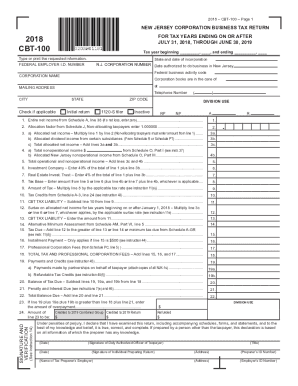

NJ DoT CBT-100 2013 free printable template

Get, Create, Make and Sign NJ DoT CBT-100

How to edit NJ DoT CBT-100 online

Uncompromising security for your PDF editing and eSignature needs

NJ DoT CBT-100 Form Versions

How to fill out NJ DoT CBT-100

How to fill out NJ DoT CBT-100

Who needs NJ DoT CBT-100?

Instructions and Help about NJ DoT CBT-100

This window will pop up and once it loads it'll just be a page that shows you all the divorce papers that are included in this freeze that file that we offer or if you want to have these divorce papers filled in for you, we work with the professional service company you just click on this link, and they charge $2.99, but they guarantee that your divorce papers will be filled in correctly step two the person that has decided to file for divorce must fill out the following forms sign in front of a notary public now if you don't know what that it is just a public notary youth there's one at every branch bank and what they are they're licensed by the state to witness the signing of legal forms such as this, and you'll need to submit these papers after you complete them get them signed in front of a notary you'll need to go to the New Jersey county court clerk's office and file all these forms now after you file all these forms you're going to have to do what's called serving your spouse now all you have to do is get these two forms as well as the waiver process and entry of appearance form, and you're going to have to just put this all in a certified envelope requesting a return receipt and what I'll do is when the receipt comes back that's going to be your official I guess you could say evidence that you've served your spouse, and you're gonna need to have this paper come back to you and file with the clerk's office now moving on to step four I kind of like what we just said you will need to find a way to get a completed and signed affidavit of insurance coverage and waiver of process and big long form from your spouse once you receive this form back you'll have to deliver and file it with the clerk now if you have minor children you must also file at the same time the shared child custody support worksheet that discusses the whole child support situation now this time both spouses should meet to negotiate the separate property settlement agreement now this is the form that you're really going to need because this form is going to tell you exactly the assets and debts that you'll negotiate so who's getting a car who's getting what credit card debt if there is any, and you'll need to me together to sign me and complete the final judgment of course so once you've done all that and again if you have children you're going to have to follow this form, or you're going to have to both do parental education classes that are mandatory for divorce in New Jersey and you have to do it you're gonna need at the end the spouse that filed for divorce to schedule a court hearing, so you got to contact the clerk's office, and they'll tell you how to receive a court date, and you're probably going to have to go in and complete it this request and notice of default hearing, and you've got to send notice to your spouse because you're going to have to obviously notify your spouse of when the court here did is so step 7 just go to your court hearing date and make sure to...

People Also Ask about

What is NJ CBT form?

Who is required to file NJ CBT?

Who files CBT-100S?

How do I file a CBT-100 in NJ?

What is the final return for CBT-100?

What is the due date for NJ CBT-100?

How do I pay my CBT tax in NJ?

Who must file NJ CBT-100?

How do I file as Corp tax return?

Can I prepare my own corporate tax return?

Can you paper file NJ corporate tax return?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit NJ DoT CBT-100 on an iOS device?

How can I fill out NJ DoT CBT-100 on an iOS device?

Can I edit NJ DoT CBT-100 on an Android device?

What is NJ DoT CBT-100?

Who is required to file NJ DoT CBT-100?

How to fill out NJ DoT CBT-100?

What is the purpose of NJ DoT CBT-100?

What information must be reported on NJ DoT CBT-100?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.