NJ DoT CBT-100 2018-2025 free printable template

Show details

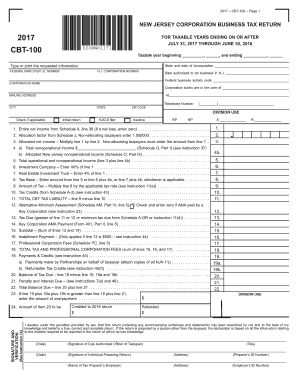

2018 CBT100 Page 1NEW JERSEY CORPORATION BUSINESS TAX RETURN FOR TAX YEARS ENDING ON OR AFTER JULY 31, 2018, THROUGH JUNE 30, 20192018 CBT100Tax year beginning, and ending, Type or print the requested

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign new jersey cbt 100 form

Edit your nj k 1 form cbt 100s form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cbt 100 jersey print form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nj form 100 cbt online

To use our professional PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit nj cbt 100 online form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NJ DoT CBT-100 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out nj in form cbt100

How to fill out NJ DoT CBT-100

01

Obtain the NJ DoT CBT-100 form from the official website or your local Department of Transportation office.

02

Read the instructions carefully before beginning to fill out the form.

03

Start with your personal information: provide your name, address, and contact details in the appropriate fields.

04

Enter your driver's license number or identification number as required.

05

Fill in the details related to the vehicle for which the form is being submitted, including vehicle identification number (VIN) and make/model.

06

Provide information about the insurance policy covering the vehicle, including the policy number and the insurance company's name.

07

Complete any additional sections regarding inspections or emissions testing as applicable.

08

Review all entered information for accuracy before submitting.

09

Sign and date the form as required.

10

Submit the filled-out form either electronically via the provided instructions or by mailing it to the specified address.

Who needs NJ DoT CBT-100?

01

Individuals or businesses looking to register a new vehicle.

02

Those who need to renew their vehicle registration.

03

Anyone who is changing their vehicle's ownership status.

04

People applying for a title for a vehicle in New Jersey.

Video instructions and help with filling out and completing how to cbt 100 tax

Instructions and Help about nj cbt 100

Fill

cbt 100 form nj

: Try Risk Free

People Also Ask about cbt 100 form print

What is a 1040 on a tax return?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

What is form NJ W4?

Employees should complete an Employee's Withholding Allowance Certificate (Form NJ-W4) and give it to their employer to declare withholding information for New Jersey purposes. New Jersey employers must furnish Form NJ-W4 to their employees and withhold New Jersey Income Tax at the rate selected.

Is there a state tax form for New Jersey?

Pay all or some of your New Jersey income taxes online via: New Jersey Division of Taxation. Paying your NJ taxes online on time will be considered a NJ tax extension and you do not have to mail in Form NJ-630. Complete Form NJ-630, include a Check or Money Order, and mail both to the address on Form NJ-630.

What is NJ w 3M?

NJ-W-3M NJ Gross Income Tax Reconciliation of Tax Withheld.

Who is exempt from NJ income tax withholding?

Line 6 Enter 'EXEMPT' to indicate that you are exempt from New Jersey Gross Income Tax Withholdings, IF you meet one of the following conditions: * Your filing status is SINGLE, HEAD OF HOUSEHOLD or QUALIFYING WIDOW(ER) and your wages plus your taxable non-wage income will be $10,000 or less for the current year.

Can you buy tax forms?

You can order the tax forms, instructions and publications you need to complete your 2021 tax return here. We will process your order and ship it by U.S. mail when the products become available. Most products should be available by the end of January 2022.

Where can I get IRS tax forms?

They include: Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676).

What is an NJ-1040?

New Jersey Form NJ-1040 – Personal Income Tax Return for Residents. New Jersey Form NJ-1040NR – Personal Income Tax Return for Nonresidents.

Who files a NJ-1040?

You can file your Form NJ-1040 for 2021 using NJ E-File, whether you are a full-year resident or a part- year resident. Use tax software you purchase, go to an online tax preparation website, or have a tax preparer file your return. (You may file both federal and State Income Tax returns.)

Do I need to fill out NJ-W4?

You must give Form NJ-W4 to your employees to fill out and return to you. This form tells you how to withhold tax from your employee's pay. Do not use the federal W-4 to calculate New Jersey withholdings because employees cannot claim personal exemptions on the federal form.

Who needs to fill out NJ W4?

NJ Taxation New Jersey employers must furnish Form NJ-W4 to their employees and withhold New Jersey Income Tax at the rate selected. When an employee has more than one job, or if spouses/civil union partners are both wage earners, the combined incomes may be taxed at a higher rate.

Where can I get hard copies of tax forms?

Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676). Hours of operation are 7 a.m. to 10 p.m., Monday-Friday, your local time — except Alaska and Hawaii which are Pacific time.

Where to get NJ tax forms?

NJ Taxation Phone – Call our automated phone line at 1-800-323-4400 (within NJ, NY, PA, DE and MD) or 609-826-4400 (from anywhere). In Person – Visit the Regional Information Center nearest to you to pick up a copy of the forms and instructions.

What is a 1040 form and where do I get it?

Form 1040. The IRS 1040 form is one of the official documents that U.S. taxpayers use to file their annual income tax return. The 1040 form is divided into sections where you report your income and deductions to determine the amount of tax you owe or the refund you can expect to receive.

Where can I find my NJ-1040?

Individuals To get a copy or transcript of your tax return, complete Form DCC-1 and send it to: You also can get a copy of your NJ-1040, NJ-1040NR or NJ-1041 at a Division of Taxation Regional Information Center. Otherwise, you can get a copy of a previously filed tax return by completing Form DCC-1 and sending it to:

How do I file my NJ W 3 online?

How to e-file NJ-W3 Go to the Employees menu and select Payroll Tax Forms & W-2's. Choose Tax Form Worksheets in Excel. Click Annual W-2/W3. Pick Last Year in the Dates section. Hit Create Report.

How to fill out NJ-W4 Form 2022?

0:34 2:52 How to fill out a W4 Form 2022 Fast - YouTube YouTube Start of suggested clip End of suggested clip So fill out your first name your last name your social security number your address your city stateMoreSo fill out your first name your last name your social security number your address your city state and zip then in step one section c right here you can go ahead and check off your filing status.

What is the W4 form used for?

Form W-4 tells you, as the employer, the employee's filing status, multiple jobs adjustments, amount of credits, amount of other income, amount of deductions, and any additional amount to withhold from each paycheck to use to compute the amount of federal income tax to deduct and withhold from the employee's pay.

What is form NJ W 3?

NJ Taxation Employers must file a Gross Income Tax Reconciliation of Tax Withheld (Form NJ-W-3) each year to report the total monthly tax remitted, wages paid and withholdings. Registered employers must file Form NJ-W-3 even if no wages were paid and no tax was withheld during the year.

How many allowances should I claim on W4 NJ?

Claiming 1 allowance is typically a good idea if you are single and you only have one job. You should claim 1 allowance if you are married and filing jointly. If you are filing as the head of the household, then you would also claim 1 allowance. You will likely be getting a refund back come tax time.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my nj form cbt 100 in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your nj cbt 100 right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I fill out new jersey tax form cbt 100s using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign state of nj cbt 100 form and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I complete cbt 100 2019 on an Android device?

Use the pdfFiller app for Android to finish your cbt 100 form online. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is NJ DoT CBT-100?

The NJ DoT CBT-100 is a tax form used by corporations operating in New Jersey to report their business income and calculate their corporation business tax obligations.

Who is required to file NJ DoT CBT-100?

All corporations that are doing business in New Jersey or deriving income from New Jersey sources are required to file the NJ DoT CBT-100.

How to fill out NJ DoT CBT-100?

To fill out the NJ DoT CBT-100, taxpayers must complete the form by providing corporate information, calculating taxable income, and reporting any deductions and credits applicable to their business activities in New Jersey.

What is the purpose of NJ DoT CBT-100?

The purpose of the NJ DoT CBT-100 is to ensure that corporations report their income accurately and pay the appropriate amount of corporation business tax to the state of New Jersey.

What information must be reported on NJ DoT CBT-100?

Information that must be reported on NJ DoT CBT-100 includes the corporation's gross revenue, cost of goods sold, business deductions, credits, and the calculated tax owed based on net income.

Fill out your how to cbt 100 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nj Cbt 100 is not the form you're looking for?Search for another form here.

Keywords relevant to new jersey form cbt 100

Related to cbt 100

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.