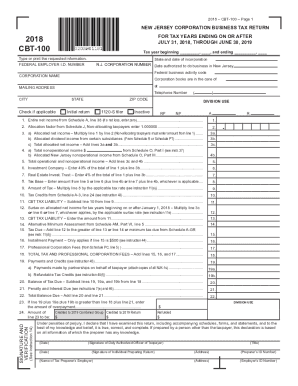

NJ DoT CBT-100 2014 free printable template

Show details

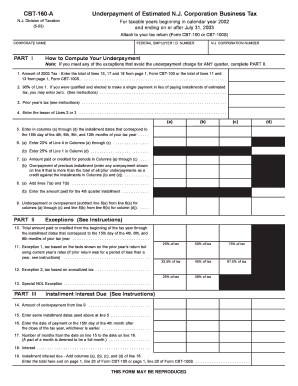

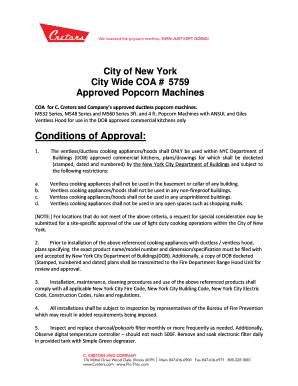

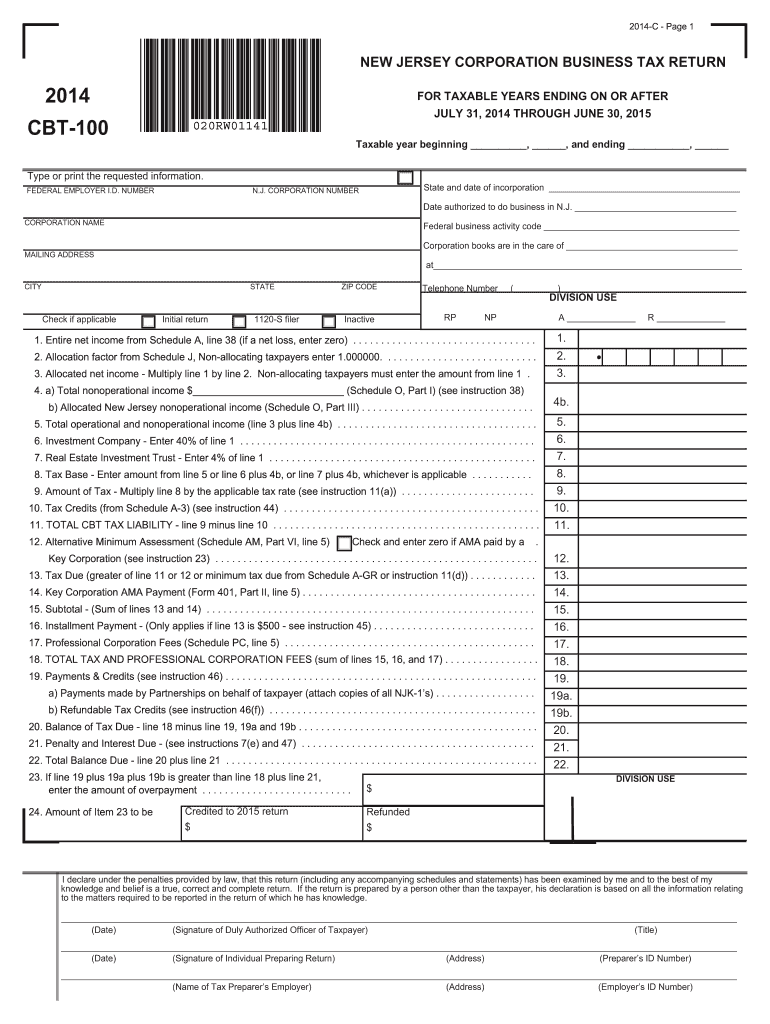

Enter result in Line 1 h and carry to Line 2 Page 1 of the CBT-100. INVESTMENT COMPANIES See Instruction 35 1. The minimum tax liability and installment payment if applicable must be reported on page 1 of the Corporation Business Tax Return. If a balance due exists taxpayers must submit payment with the appropriate Corporation Business Tax Payment Voucher either CBT-100-V or CBT-100S-V. Enter at line 32 Schedule A. 7. State of New Jersey Division of Taxation CERTIFICATION OF INACTIVITY For...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign cbt-100 new jersey corporation

Edit your cbt-100 new jersey corporation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cbt-100 new jersey corporation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cbt-100 new jersey corporation online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit cbt-100 new jersey corporation. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NJ DoT CBT-100 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out cbt-100 new jersey corporation

How to fill out NJ DoT CBT-100

01

Obtain the NJ DoT CBT-100 form from the New Jersey Department of Transportation website or your local office.

02

Read the instructions provided with the form carefully to understand the requirements.

03

Fill out your personal information such as name, address, and contact details at the top of the form.

04

Provide details about the vehicle, including make, model, year, and VIN (Vehicle Identification Number).

05

Indicate the type of work being performed and the purpose of filing the form.

06

Fill any required sections regarding prior permits or inspections, if applicable.

07

Review the completed form for accuracy and completeness.

08

Sign and date the form at the designated space.

09

Submit the form as instructed, either online or in person, along with any necessary documentation or fees.

Who needs NJ DoT CBT-100?

01

Individuals or companies involved in construction, maintenance, or other activities that impact New Jersey roadways may need to complete the NJ DoT CBT-100 form.

02

Contractors who are applying for permits and require a certification for working on state highways also need this form.

03

Any entity looking to obtain or renew a permit for work within New Jersey's transportation infrastructure would require the CBT-100.

Fill

form

: Try Risk Free

People Also Ask about

Can I prepare my own corporate tax return?

There is no legal or IRS requirement that business owners hire a tax professional to prepare their returns. That said, most business owners prefer to get tax pros to do their tax returns. Indeed, a majority of all taxpayers hire tax preparers. But this doesn't mean you have to.

What is NJ CBT form?

Corporation Business Tax (CBT)- Extensions You must include a tentative tax payment with your application for extension. If 90% of the tax liability is not paid by the original due date of the return, your request for an extension will be denied and we will impose penalties and interest for late filing and payment.

What is the final return for CBT-100?

File a final CBT-100 or CBT-100S within 30 days. This return will cover the period from the beginning of the current accounting period to the legal date of dissolution or withdrawal.

Who must file NJ CBT-100S?

Corporations Required to File Every corporation that has elected and qualifies pursuant to Section 1361 of the Internal Revenue Code and has qualified and been accepted as a New Jersey S corporation is required to file a CBT-100S (unless they elect to be part of a combined group).

How do I pay my CBT tax in NJ?

You may make a payment by EFT, e-check, or credit card through our online Corporation Business Tax Online Filing and Payments Service.

How do I file a CBT-100 in NJ?

Visit the Division's website or check with your soft- ware provider to see if they support any or all of these filings. To file and pay the annual report electronically, visit the Division of Revenue and Enterprise Services website. A new, simplified, standardized return is being created that will replace Form CBT-100.

Can you paper file NJ corporate tax return?

Returns must be filed electronically. Note: Form CBT-100 is online for reference purposes only.

Who must file NJ CBT-100?

All taxpayers and tax preparers must file Corporation Business Tax returns and make payments electronically. This mandate includes all returns, estimated payments, extensions, and vouchers. Visit the Division's website or check with your soft- ware provider to see if they support any or all of these filings.

Who is required to file NJ CBT?

Every partnership that has income or loss derived from sources in the State of New Jersey, or has any type of New Jersey resident partner, must file Form NJ-1065. Form NJ- CBT-1065 must be filed when the entity is required to calculate a tax on its nonresident partner(s).

Who files CBT-100S?

CORPORATIONS REQUIRED TO FILE THIS RETURN: (b) Foreign corporations that meet the filing requirements and whose income is immune from tax pursuant to Public Law 86- 272, 15 U.S.C. § 381 et seq., must obtain and complete Schedule N, Nexus - Immune Activity Declaration, and remit the minimum tax with the CBT-100S.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get cbt-100 new jersey corporation?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific cbt-100 new jersey corporation and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I edit cbt-100 new jersey corporation in Chrome?

Install the pdfFiller Google Chrome Extension to edit cbt-100 new jersey corporation and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I edit cbt-100 new jersey corporation on an Android device?

With the pdfFiller Android app, you can edit, sign, and share cbt-100 new jersey corporation on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is NJ DoT CBT-100?

NJ DoT CBT-100 is a tax form used by corporations in New Jersey to report their corporate business tax obligations.

Who is required to file NJ DoT CBT-100?

Any corporation doing business in New Jersey, including foreign corporations that operate within the state, is required to file NJ DoT CBT-100.

How to fill out NJ DoT CBT-100?

To fill out NJ DoT CBT-100, corporations need to provide their identification information, income, deductions, and any applicable tax credits, following the instructions provided for the form.

What is the purpose of NJ DoT CBT-100?

The purpose of NJ DoT CBT-100 is to facilitate the reporting of income and the calculation of the corporate business tax owed to the state of New Jersey.

What information must be reported on NJ DoT CBT-100?

The information that must be reported includes the corporation's gross income, net income, taxable income, applicable deductions, and any tax credits claimed.

Fill out your cbt-100 new jersey corporation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cbt-100 New Jersey Corporation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.