NJ DoT CBT-100 2012 free printable template

Show details

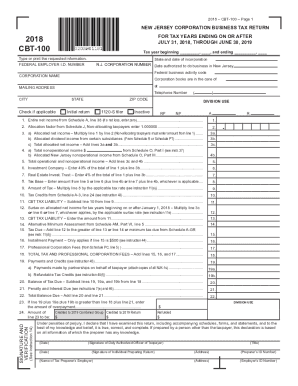

2012-C - Page 1 NEW JERSEY CORPORATION BUSINESS TAX RETURN FOR TAXABLE YEARS ENDING ON OR AFTER JULY 31 2012 THROUGH JUNE 30 2013 CBT-100 Taxable year beginning and ending Type or print the requested information. Check if address change appears below. 9. Federal Taxes 10. Total Combine line 5 and line 9 Include on line 4 taxes paid or accrued to any foreign country state province territory or subdivision thereof. Parts I II and III FOR PERIODS BEGINNING PRIOR TO JANUARY 1 2012. ALL TAXPAYERS...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 2012 cbt 100 form

Edit your 2012 cbt 100 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2012 cbt 100 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2012 cbt 100 form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 2012 cbt 100 form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NJ DoT CBT-100 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 2012 cbt 100 form

How to fill out NJ DoT CBT-100

01

Begin by downloading the NJ DoT CBT-100 form from the official New Jersey Department of Transportation website.

02

Read the instructions carefully to understand the requirements for filling out the form.

03

Fill in your personal information in the designated fields, including your name, address, and contact details.

04

Provide information about your vehicle, including the make, model, and year.

05

Indicate the reason for filing the form, such as changes in ownership or registration.

06

Review the form for accuracy and completeness before submission.

07

Sign and date the form at the bottom where indicated.

08

Submit the completed form to the appropriate NJ DoT office or via the outlined submission method.

Who needs NJ DoT CBT-100?

01

Anyone who needs to report changes related to vehicle ownership, registration, or other relevant updates to the New Jersey Department of Transportation.

02

Individuals or businesses that own, buy, sell, or transfer vehicles in New Jersey may also need to complete the CBT-100 form.

Fill

form

: Try Risk Free

People Also Ask about

Who is required to file NJ CBT?

Every partnership that has income or loss derived from sources in the State of New Jersey, or has any type of New Jersey resident partner, must file Form NJ-1065. Form NJ- CBT-1065 must be filed when the entity is required to calculate a tax on its nonresident partner(s).

Who must file CBT-100?

Federal S corporations that have not elected and been au- thorized to be New Jersey S corporations must complete this return as though no election had been made under I.R.C. § 1362. A copy of Form 1120-S as filed must be submitted. Lines 1 through 28 on Part I, Schedule A of the CBT-100 must be completed.

Who files CBT-100S?

CORPORATIONS REQUIRED TO FILE THIS RETURN: (b) Foreign corporations that meet the filing requirements and whose income is immune from tax pursuant to Public Law 86- 272, 15 U.S.C. § 381 et seq., must obtain and complete Schedule N, Nexus - Immune Activity Declaration, and remit the minimum tax with the CBT-100S.

Who must file NJ corporate tax return?

In general, every corporation existing under the laws of the State of New Jersey is required to file a Corporation Business Tax Return. In addition, a return must be filed by every foreign corporation that: Holds a general certificate of authority to do business in this State issued by the Secretary of State; or.

What is CBT-100S form?

A foreign corporation that owns a New Jersey partnership must file Form CBT-100S to claim the tax paid on their behalf by the part- nership. The foreign corporation cannot transfer the tax paid by the partnership on its behalf to any of its shareholders.

What is the final return for CBT-100?

File a final CBT-100 or CBT-100S within 30 days. This return will cover the period from the beginning of the current accounting period to the legal date of dissolution or withdrawal.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute 2012 cbt 100 form online?

pdfFiller makes it easy to finish and sign 2012 cbt 100 form online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I sign the 2012 cbt 100 form electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your 2012 cbt 100 form in seconds.

Can I edit 2012 cbt 100 form on an iOS device?

Use the pdfFiller mobile app to create, edit, and share 2012 cbt 100 form from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is NJ DoT CBT-100?

NJ DoT CBT-100 is the New Jersey Corporate Business Tax Return form used by corporations doing business in New Jersey to report their income and calculate their tax liability.

Who is required to file NJ DoT CBT-100?

All corporations, including those formed in New Jersey and foreign corporations doing business in New Jersey, are required to file the NJ DoT CBT-100 if they have a gross receipts amount over the threshold established by the state.

How to fill out NJ DoT CBT-100?

To fill out NJ DoT CBT-100, businesses need to gather their financial records, ensure they have reached the correct forms, follow the instructions provided on the form, accurately report their income, deductions, and tax liabilities, and submit the form by the due date.

What is the purpose of NJ DoT CBT-100?

The purpose of NJ DoT CBT-100 is to provide a standardized way for corporations to report their business income and expenses and to calculate the amount of corporate business tax owed to the state of New Jersey.

What information must be reported on NJ DoT CBT-100?

NJ DoT CBT-100 requires corporations to report their total income, deductions, taxable income, and any applicable tax credits, as well as details regarding any apportioned income if the corporation operates in multiple states.

Fill out your 2012 cbt 100 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2012 Cbt 100 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.