NJ DoT CBT-100 2016 free printable template

Show details

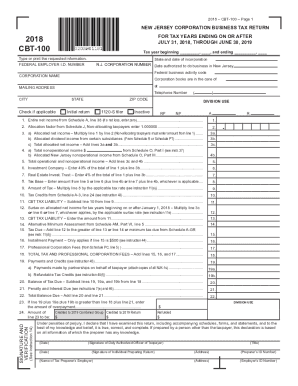

2012-C Page 1 NEW JERSEY CORPORATION BUSINESS TAX RETURN 2012 CBT-100 FEDERAL EMPLOYER I.D. NUMBER FOR TAXABLE YEARS ENDING ON OR AFTER JULY 31, 2012, THROUGH JUNE 30, 2013, Taxable year beginning,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 100 nj form 2016

Edit your 100 nj form 2016 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 100 nj form 2016 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 100 nj form 2016 online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 100 nj form 2016. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NJ DoT CBT-100 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 100 nj form 2016

How to fill out NJ DoT CBT-100

01

Download the NJ DoT CBT-100 form from the official New Jersey Department of Transportation website.

02

Read the instructions carefully before starting to fill out the form.

03

Provide your personal information in the designated fields, including your name, address, and contact details.

04

Fill out the specific sections related to the type of permit or license you are applying for.

05

Include required details such as vehicle information and any relevant identification numbers.

06

Review all the information for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the form along with any required fees or additional documents as specified in the submission guidelines.

Who needs NJ DoT CBT-100?

01

Individuals seeking to obtain a commercial driver’s license in New Jersey.

02

Applicants needing to report certain vehicle-related information as part of the application process.

03

Drivers who need to comply with specific New Jersey Department of Transportation requirements.

Fill

form

: Try Risk Free

People Also Ask about

How does the NJ PTE tax work?

For New Jersey tax purposes, income and losses of a pass-through entity are passed through to its members. However, pass-through entities may elect to pay a Pass-Through Business Alternative Income Tax due on the sum of each of the member's share of distributive proceeds.

What is the NJ PTE tax rate?

How does the pass-through entity determine its tax liability? Sum of Each Member's Share of Distributive ProceedsTax RateFirst $250,0005.675%Amount over $250,000 but not over $1 million ($14,187.50 plus 6.52% of excess over $250,000)6.52%2 more rows

What is NJ PTE 100?

Pass-through entities that filed an election to pay the Pass-Through Business Alternative Income Tax must file Form PTE-100 and pay the tax due. They must also pro- vide Schedule PTE-K-1 to each member reporting the amount of the member's share of distributive proceeds and Pass-Through Business Alternative Income Tax.

What is the final return for CBT-100?

File a final CBT-100 or CBT-100S within 30 days. This return will cover the period from the beginning of the current accounting period to the legal date of dissolution or withdrawal.

Where can I get NJ tax forms?

In Person – Visit the Regional Information Center nearest to you to pick up a copy of the forms and instructions. You must make an appointment as no walk-ins are allowed. Appointment times are 9:00 a.m. to 4:00 p.m. See link above to schedule an appointment.

Who must file NJ CBT-100?

Any officer or director of any corporation who shall distribute or cause to be distributed any assets in dissolution or liquidation to the stockholders without having first paid all corporation franchise taxes, fees, penalties and interest imposed on said corporation, in ance with N.J.S.A.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 100 nj form 2016 from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your 100 nj form 2016 into a dynamic fillable form that you can manage and eSign from anywhere.

How can I send 100 nj form 2016 to be eSigned by others?

Once you are ready to share your 100 nj form 2016, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How can I fill out 100 nj form 2016 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your 100 nj form 2016. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is NJ DoT CBT-100?

NJ DoT CBT-100 is the Business Tax Return form required for corporations operating in New Jersey, specifically designed for the Corporation Business Tax.

Who is required to file NJ DoT CBT-100?

All corporations, including domestic and foreign corporations doing business in New Jersey, are required to file the NJ DoT CBT-100.

How to fill out NJ DoT CBT-100?

To fill out NJ DoT CBT-100, corporations must provide their business information, financial data, and any applicable deductions or credits, following the form's instructions.

What is the purpose of NJ DoT CBT-100?

The purpose of NJ DoT CBT-100 is to assess the Corporation Business Tax owed by corporations, ensuring compliance with New Jersey tax laws.

What information must be reported on NJ DoT CBT-100?

The form requires reporting information such as gross income, business deductions, credits, and the total tax due for the year.

Fill out your 100 nj form 2016 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

100 Nj Form 2016 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.