VT DoT S-3C 2013 free printable template

Show details

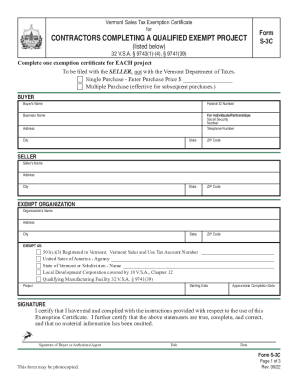

Vermont Sales Tax Exemption Certificate for CONTRACTORS COMPLETING A QUALIFIED EXEMPT PROJECT listed below Form S-3C 32 V. I further certify that the above statements are true complete and correct and that no material information has been omitted. Signature of Buyer or Authorized Agent This form may be photocopied. Title Date Form S-3C Rev. 09/13 Instructions for Use of the Certificate of Exemption for Contractors Form S-3C For use only in completion of qualified projects for exempt...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your vermont sales and use form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your vermont sales and use form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fillable vermont sales and use certificate online

Follow the steps down below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit vermont sales tax exemption certificate s 3c form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

VT DoT S-3C Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out vermont sales and use

How to fill out Vermont Sales and Use:

01

Gather necessary information: Before starting the process, make sure you have all the required information at hand. This includes your business information, such as your business name, address, and Employer Identification Number (EIN), as well as details about the products or services you sell and any applicable exemptions.

02

Understand the form: Familiarize yourself with the Vermont Sales and Use Tax Return form. Read through the instructions and the different sections of the form to understand what information is required in each section.

03

Provide business information: Fill out the top section of the form with your business information, including your legal business name, address, and EIN. This information will identify your business and ensure that the correct sales and use tax account is credited.

04

Report sales and taxable purchases: In the following sections of the form, report your gross sales for the reporting period, as well as any taxable purchases that were not subject to sales tax. Provide accurate figures based on your records and supporting documentation.

05

Claim exemptions: If your business qualifies for any exemptions or deductions, make sure to accurately report these in the appropriate sections of the form. This may include exemptions for certain types of products, sales made to tax-exempt organizations, or other specific conditions.

06

Calculate tax liability: Use the provided formulas and instructions to calculate your tax liability for the reporting period. Be sure to double-check your calculations to ensure accuracy.

07

Make a payment or request a refund: If you owe sales and use tax based on your calculations, enclose a check or money order with the completed form to cover the amount owed. Alternatively, if your calculations show an overpayment, you can request a refund by providing the necessary information.

Who needs Vermont Sales and Use:

01

Businesses operating in Vermont: Any business that sells tangible personal property, certain services, or specified digital products within the state of Vermont is generally required to collect and remit sales and use tax. This includes both brick-and-mortar establishments and online businesses.

02

Out-of-state businesses with nexus in Vermont: Even if your business is not physically located in Vermont, you may still be required to collect and remit sales and use tax if you have nexus in the state. Nexus refers to a significant presence or connection with the state, such as having employees, property, or advertising in Vermont.

03

Certain exemptions may apply: While most businesses are subject to Vermont sales and use tax, there are exemptions available for certain types of products or transactions. For example, sales made to tax-exempt organizations, sales of certain food items, and certain medical supplies may be exempt from taxation. It is important to understand these exemptions and apply them correctly when filling out the tax form.

Fill vermont tax form s 3c : Try Risk Free

People Also Ask about fillable vermont sales and use certificate

What is Vermont Form 112?

Do Vermont sales tax exemption certificates expire?

Who is exempt from paying NC sales tax?

How do I get a US sales tax exemption certificate?

How do I get a resale certificate in Vermont?

What is a E 595E form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is vermont sales and use?

Vermont sales and use tax is a tax on the retail sale, lease, or rental of tangible personal property.

Who is required to file vermont sales and use?

Businesses selling taxable goods or services in Vermont are required to file Vermont sales and use tax.

How to fill out vermont sales and use?

To fill out Vermont sales and use tax, businesses can use the online portal provided by the Vermont Department of Taxes.

What is the purpose of vermont sales and use?

The purpose of Vermont sales and use tax is to generate revenue for the state and to fund essential services.

What information must be reported on vermont sales and use?

Businesses must report their total sales, taxable sales, exemptions, and any credits claimed on their Vermont sales and use tax.

When is the deadline to file vermont sales and use in 2023?

The deadline to file Vermont sales and use tax in 2023 is March 15th.

What is the penalty for the late filing of vermont sales and use?

The penalty for late filing of Vermont sales and use tax is 5% of the tax due per month, up to a maximum of 25%.

How do I modify my fillable vermont sales and use certificate in Gmail?

vermont sales tax exemption certificate s 3c form and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I edit vermont sales tax exemption certificate on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing vermont state tax exempt form, you need to install and log in to the app.

How do I complete vermont sales tax exemption form on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your vermont sales tax exemption form from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

Fill out your vermont sales and use online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Vermont Sales Tax Exemption Certificate is not the form you're looking for?Search for another form here.

Keywords relevant to state of vermont tax exempt form

Related to vermont tax exempt s 3c fillable

If you believe that this page should be taken down, please follow our DMCA take down process

here

.