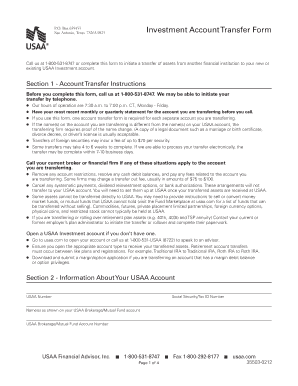

Get the free usaa bank statement template form

Get, Create, Make and Sign

How to edit usaa bank statement template online

How to fill out usaa bank statement template

How to fill out the USAA bank statement template:

Who needs the USAA bank statement template:

Video instructions and help with filling out and completing usaa bank statement template

Instructions and Help about pdf filler form search usaa

Music hi everyone today I'm going to be talking with you about use a bank and more specifically how you can order checks for USA so a little of background on what a check is its a physical piece of paper that's linked to your bank account you can use this to pay someone or a company and the way that it works is you write the check and then the person that you're paying deposits the check once they've done that the money will be taken out of your account and then deposited into theirs so now that we have kind of an understanding of what checks are and how they're used I'm going to show you three ways that you can order checks for you your US a bank account before we get started you will need to have a copy of a voided check or something else that has your bank account number and routing number on it the first thing that you're going to do is open your browser on your phone and type in the bank web address you can use Chrome Firefox Safari whatever browser you normally use will work perfectly fine I'm going to be using Safari in this video as you can see I'm already on the website, and you can see the web address at the top of the screen Mobile USA com you can also use, or you can also check out the description for the link to the USA a so the first way that you can order checks is by logging into your USA a bank account online for this you're going to click on the log on button which is at the top right-hand corner of the screen click on that and then that's going to bring you to this screen right here where you can enter your used your online ID and your password if you don't have an online ID and password you can click right down here where it says already a member and to register for your online access from there just follow the steps on this screen to complete the enrollment process once you're in you're going to want to click on banking options and then order checks online usually banks do charge a fee for checks, and it's normally a set price but be sure to look for any banking promos that include free checks if you have a certain type of count the second way that you can order checks is going to be by calling the customer service number for us a and ordering them over the phone you should be able to find this phone number on the back of your debit card and that will probably be the easiest place that you can find the phone number you can also check out the website for the USA and look for a contact us page but that can sometimes be a little tricky and not so straightforward so if you happen to know another way to find the customer service phone number please be sure to let me know in the comments I do want to let you know that sometimes there will be an additional fee to use this service to order your checks and that's something that the customer service representative will be able to lay out for you when you talk to them the third and final way that you can order checks is going to be through a third-party vendor to do this simply go to...

Fill usaa : Try Risk Free

People Also Ask about usaa bank statement template

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your usaa bank statement template online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.