Get the free Mortgage Credit Analysis for Mortgage Insurance on One- to ... - HUD - portal hud

Show details

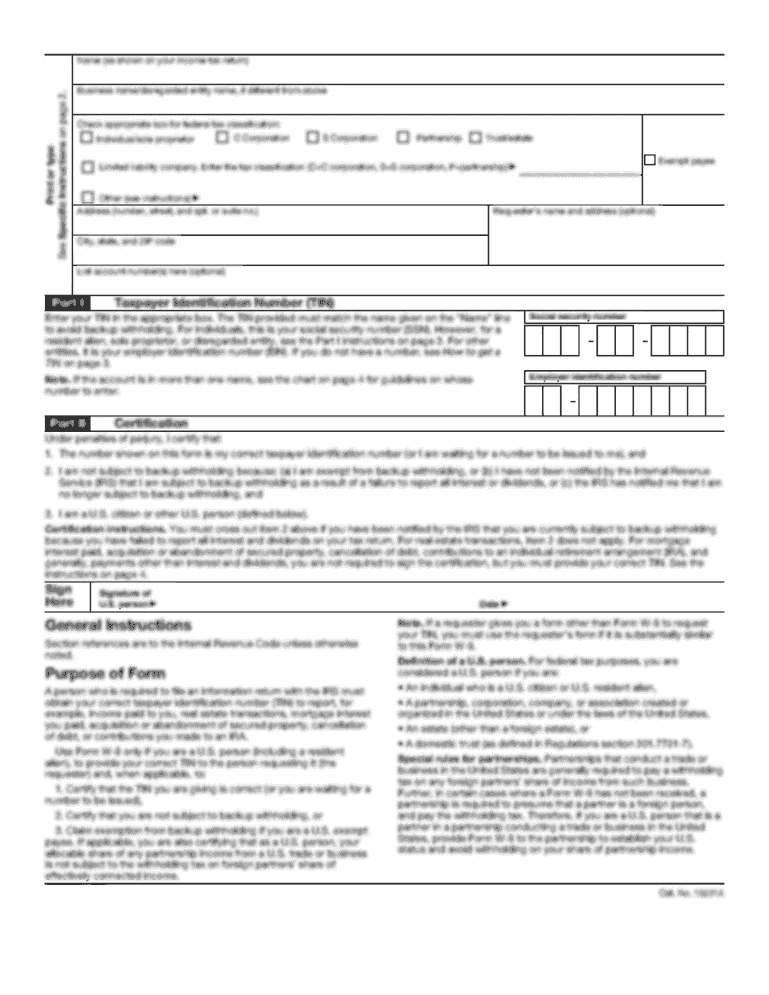

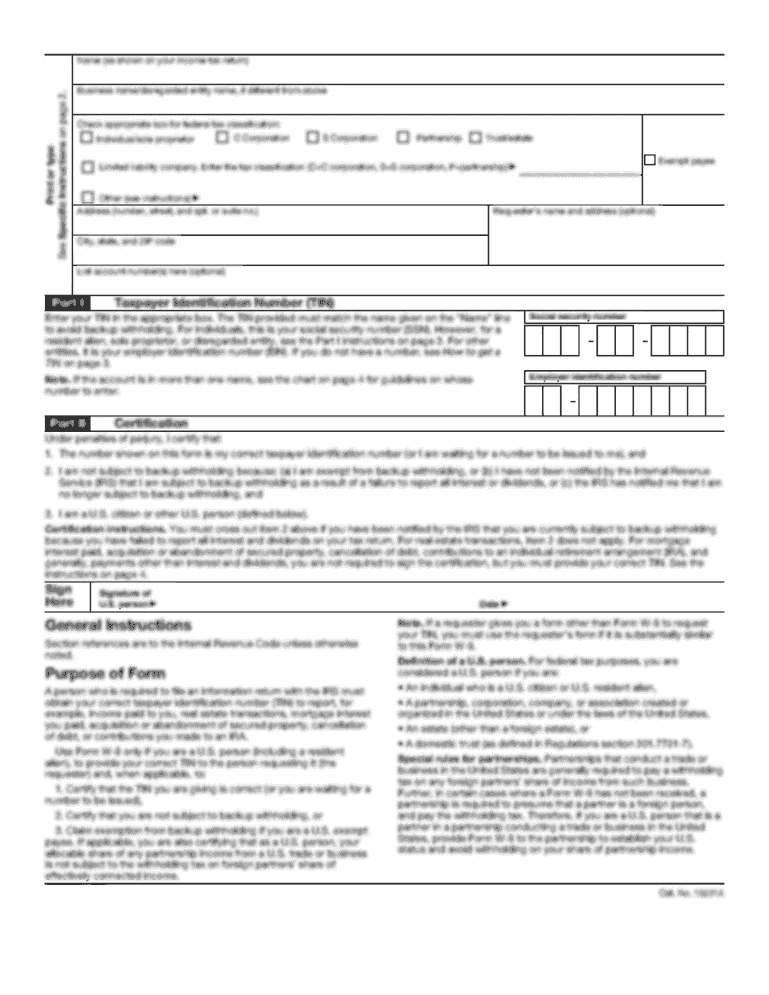

4155.1 REV-5 Mortgage Credit Analysis for Mortgage Insurance on One- to Four-Unit Mortgage Loans Directive Number: 4155.1 MORTGAGE CREDIT ANALYSIS FOR MORTGAGE INSURANCE ON ONE- TO FOUR-UNIT MORTGAGE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your mortgage credit analysis for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage credit analysis for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mortgage credit analysis for online

To use the services of a skilled PDF editor, follow these steps below:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit mortgage credit analysis for. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

How to fill out mortgage credit analysis for

How to Fill out Mortgage Credit Analysis:

01

Start by gathering all the necessary documentation, such as income statements, tax returns, bank statements, and proof of assets.

02

Begin the analysis by filling out personal information, including your name, contact details, and social security number. This information helps lenders verify your identity and track your credit history.

03

Provide details about your employment, including your current job position, employer's name, and length of employment. Lenders want to ensure stability in your income source.

04

In the "Liabilities" section, list all your current debts, such as credit card balances, student loans, and car loans. Include the amount owed, monthly payments, and the remaining term of each loan.

05

Moving on to the "Assets" section, outline all your assets, including bank accounts, investments, real estate holdings, and any other valuable property. Be sure to include the current market value of each asset.

06

Next, analyze your monthly income and expenses. This involves recording your monthly salary, bonuses, and any other sources of income. Detail your monthly expenses, including housing costs, utilities, insurance premiums, transportation expenses, and other regular expenditures.

07

Calculate your debt-to-income ratio by dividing your total monthly debt payments by your gross monthly income. This ratio helps lenders assess your ability to manage additional mortgage payments.

08

Analyze your credit score and history. Provide accurate information about your outstanding loans, late payments, bankruptcies, and any other negative credit events. Be prepared to explain any negative marks on your credit report.

09

Complete the mortgage credit analysis by reviewing all the information provided and ensuring its accuracy. Double-check calculations and verify that all supporting documents are attached.

Who Needs Mortgage Credit Analysis:

01

Individuals or families planning to purchase a home require mortgage credit analysis. This process helps them determine their eligibility for a mortgage loan.

02

Those looking to refinance an existing mortgage also need to undergo a mortgage credit analysis. This analysis helps them assess their creditworthiness and determine if refinancing is financially feasible.

03

Mortgage lenders and financial institutions require mortgage credit analysis to evaluate the creditworthiness of borrowers. This analysis assists them in determining the interest rate, loan amount, and down payment requirements for potential borrowers.

In summary, anyone planning to apply for a mortgage or seeking to refinance their current mortgage needs to fill out a mortgage credit analysis. This analysis provides lenders with a comprehensive understanding of an individual's financial situation, including their income, assets, debts, expenses, and credit history.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is mortgage credit analysis for?

Mortgage credit analysis is used to assess the creditworthiness of a borrower applying for a mortgage loan.

Who is required to file mortgage credit analysis for?

Lenders are required to file mortgage credit analysis for borrowers applying for mortgage loans.

How to fill out mortgage credit analysis for?

Mortgage credit analysis can be filled out by providing detailed information about the borrower's credit history, income, and assets.

What is the purpose of mortgage credit analysis for?

The purpose of mortgage credit analysis is to determine the risk associated with lending money to a particular borrower.

What information must be reported on mortgage credit analysis for?

Information such as credit score, income, employment history, debts, and assets must be reported on mortgage credit analysis.

When is the deadline to file mortgage credit analysis for in 2023?

The deadline to file mortgage credit analysis for in 2023 is typically within 45 days of the borrower's loan application.

What is the penalty for the late filing of mortgage credit analysis for?

The penalty for late filing of mortgage credit analysis may vary depending on the lender and the specific circumstances, but it could result in delays in processing the loan application or additional fees for the borrower.

How can I send mortgage credit analysis for for eSignature?

When you're ready to share your mortgage credit analysis for, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I execute mortgage credit analysis for online?

Filling out and eSigning mortgage credit analysis for is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I complete mortgage credit analysis for on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your mortgage credit analysis for. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

Fill out your mortgage credit analysis for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.