Get the free 1099 sa payer name fidelity form

Show details

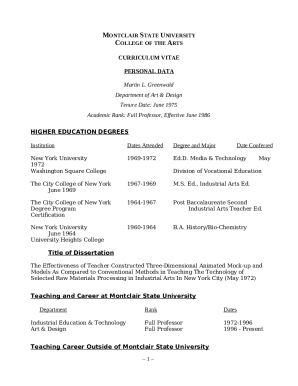

907581 FIDELITY INVESTMENTS Understanding Your 2012 Form 5498-SA for Your Health Savings Account Fidelity is committed to providing concise, detailed information so that you can complete your income

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 1099 sa payer name form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1099 sa payer name form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 1099 sa payer name fidelity online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit fidelity 1099 sa payer name form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

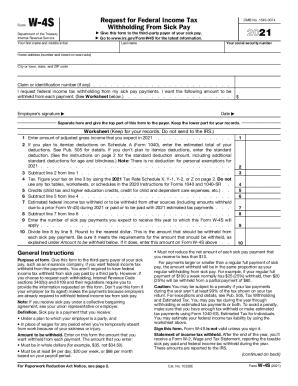

How to fill out 1099 sa payer name

How to fill out 1099 SA payer name:

01

Obtain the 1099 SA form from the Internal Revenue Service (IRS) or other authorized sources.

02

Locate the section on the form where the payer's information is required. This is usually indicated as "Payer's name" or a similar heading.

03

Enter the full legal name of the payer in the designated space. Make sure to accurately spell the name and include any applicable suffixes or prefixes.

04

If the payer is a business entity, use the official business name as registered with the IRS or relevant government agency.

05

If the payer is an individual, enter their full legal name as it appears on their tax records.

06

Double-check the accuracy of the payer's name before proceeding.

07

If there are any changes or corrections to the payer's name after filing the form, promptly notify the IRS and provide the updated information.

Who needs 1099 SA payer name?

01

Individuals or entities who have made payments for the purpose of providing medical services, healthcare reimbursements, or long-term care services.

02

Employers or businesses who have provided health insurance coverage to their employees through a self-insured arrangement.

03

Payers who have distributed funds from Health Savings Accounts (HSAs), Archer Medical Savings Accounts (MSAs), or Medicare Advantage Medical Savings Accounts (MSAs).

04

Organizations or individuals who have made direct payments or reimbursements for qualified medical expenses under a Health Reimbursement Arrangement (HRA).

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 1099 sa payer name?

The payer name for Form 1099-SA is usually the name of the financial institution or administrator that manages the health savings account (HSA) or medical savings account (MSA) from which the distribution was made.

Who is required to file 1099 sa payer name?

The payer (person or entity providing payment) is required to file Form 1099-SA with the Internal Revenue Service (IRS) and the recipient of the payment (individual receiving the distribution from a Health Savings Account - HSA, Archer Medical Savings Account - MSA, or Medicare Advantage MSA) will also receive a copy of the form.

How to fill out 1099 sa payer name?

To fill out Form 1099-SA, you will need to provide the payer's (distributor or administrator) name and contact information. Here are the steps to fill out the payer name:

1. Enter the payer's full legal name in the "Payer's name, street address, city or town, state or province, country, ZIP or foreign postal code" box at the top left corner of the form. Make sure to use the correct legal name that the payer uses for tax purposes.

2. If the payer has a different mailing address, fill it in the "Payer's mailing address (if different from above)" box, which is right below the payer's name box.

3. Include the payer's contact information, such as the phone number and email address, in the spaces provided. This information is optional but can be helpful if the IRS needs to contact the payer for any reason.

Remember to double-check all the information provided to ensure accuracy.

What is the purpose of 1099 sa payer name?

The purpose of the 1099-SA payer name is to identify the individual or entity that made the distribution of funds to the recipient.

What information must be reported on 1099 sa payer name?

On Form 1099-SA, the following information must be reported regarding the payer:

1. Name: The full legal name of the organization or person who made the distribution.

2. Address: The complete mailing address of the payer, including street or P.O. Box, city, state, and ZIP code.

3. Taxpayer Identification Number (TIN): The payer's taxpayer identification number or employer identification number (EIN). This is typically a nine-digit number issued by the IRS.

It is important to note that accurate and complete reporting of payer information is crucial for the recipient to correctly report and reconcile their tax liabilities, as the payer's information verifies the source of the distribution.

What is the penalty for the late filing of 1099 sa payer name?

The penalty for the late filing of Form 1099 with missing payer names varies depending on the circumstances and the length of delay. As of 2021, the general penalties for late filing or incorrect forms are as follows:

- For forms filed within 30 days after the due date: $50 per form

- For forms filed more than 30 days after the due date but before August 1: $110 per form

- For forms filed on or after August 1 or not filed at all: $280 per form

These penalties can increase if the IRS determines that the failure to file was intentional. It is important to note that penalties may change over time, so it is always advisable to consult the IRS instructions or a tax professional for the most accurate and up-to-date information.

How can I edit 1099 sa payer name fidelity from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your fidelity 1099 sa payer name form into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I edit fidelity hsa payer name in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing 1099 sa payer name fidelity and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I create an electronic signature for the fidelity 1099 sa payer name form in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your fidelity hsa payer name in minutes.

Fill out your 1099 sa payer name online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fidelity Hsa Payer Name is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.