Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

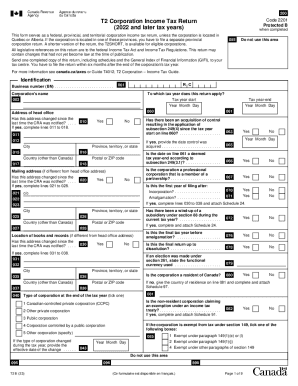

T2 tax forms are a type of tax form used in Canada for reporting the income, deductions, and taxes of corporations. The T2 form is also known as the Corporation Income Tax Return and is filed by all Canadian corporations, regardless of their revenue or whether they made a profit or loss. The form includes various schedules and sections for reporting specific types of income, expenses, deductions, and credits. It is used to determine the corporation's tax liability and to reconcile any taxes owed or overpaid.

Who is required to file t2 tax forms?

The T2 tax form is filed by corporations and non-profit organizations in Canada. It is used to report their income, deductions, and taxes payable to the Canada Revenue Agency (CRA).

How to fill out t2 tax forms?

Filling out T2 tax forms involves multiple steps. Here is a general outline of the process:

1. Gather the necessary information:

- Collect documents such as financial statements, income statements, balance sheets, and general ledgers that provide details of your company's financial activities.

- Review your structure and ownership details, including your business name, address, fiscal year-end, and related information.

2. Complete the Identification area:

- Enter your corporation’s name, business number, fiscal period end, and other relevant identification details in the appropriate sections on the form.

3. Complete the Schedule:

- The T2 tax form is made up of numerous schedules that ask for specific information about your company's income, deductions, credits, and taxes.

- Fill out all the applicable schedules, including Schedule 1, Schedule 100, Schedule 125, Schedule 141, and any others that apply to your situation.

- Ensure you report your business income accurately and claim any eligible deductions.

4. Calculate taxable income and taxes payable:

- Use the amounts from the completed schedules to calculate your taxable income.

- Determine the federal and provincial or territorial taxes payable based on the prescribed tax rates.

5. Complete additional sections:

- There are additional sections in the T2 tax form that require your attention, such as the Capital Cost Allowance (CCA) schedule, which deals with claiming depreciation on assets.

- You may also need to complete sections related to foreign corporations, investment income, and other specific situations.

6. Review and sign the form:

- Double-check all the information you have entered for accuracy to avoid errors on your tax return.

- Once satisfied, sign and date the T2 tax form.

7. Submit the form:

- Send your completed and signed T2 tax form to the appropriate tax authority (i.e., Canada Revenue Agency in Canada) by the deadline specified for your company's tax return.

It's worth noting that the T2 tax form may vary slightly based on your jurisdiction, so it is important to consult the specific instructions and guidelines provided by your tax authority or seek professional assistance for accurate completion.

What is the purpose of t2 tax forms?

The purpose of t2 tax forms is to report the income, expenses, and taxes of a Canadian corporation, typically known as a T2 return. These forms are filed by corporations to fulfill their tax obligations to the Canada Revenue Agency (CRA). T2 forms provide a systematic and standardized way for corporations to report their financial information, calculate their taxable income, and determine the amount of tax they owe. The CRA uses these forms to assess and verify the corporation's tax liability and ensure compliance with tax laws.

What information must be reported on t2 tax forms?

The T2 tax form is the corporate income tax return form used in Canada. It requires reporting various information related to a corporation's income, deductions, and tax liabilities. The key information that usually needs to be reported on the T2 tax form includes:

1. Basic identification details: This includes the corporation's legal name, business number, fiscal period-end, and mailing address.

2. Financial statements: The T2 tax form requires the inclusion of financial statements such as the balance sheet, income statement, and cash flow statement. These statements provide information about the corporation's assets, liabilities, revenues, and expenses.

3. Income details: Corporations need to report their income from various sources, including trading or manufacturing, investments, rentals, royalties, and capital gains.

4. Deductions and credits: Various deductions and credits can be claimed to reduce the taxable income. This includes deductions for business expenses, salaries and wages, bad debts, depreciation, and investment tax credits.

5. Taxes payable: The T2 tax form requires the calculation of the corporation's taxable income, along with federal and provincial taxes payable. This also includes the calculation of any tax installments and the balance due or refund claimed.

6. Capital cost allowance: Corporations need to report the depreciation expense on their capital assets using the Capital Cost Allowance (CCA) system. This information helps determine the amount of deductions for capital assets.

7. Shareholder information: If there have been any changes in the corporation's share structure during the year, it needs to be reported on the tax form. This includes details of shares issued, repurchased, and cancelled.

8. Tax elections and other additional forms: Depending on the specific circumstances of the corporation, there may be additional schedules or forms required to report certain tax elections, allowances, and other information.

It's important to note that the exact information required on the T2 tax form can vary based on the corporation's specific situation and the tax laws of the relevant jurisdiction. Consulting with a tax professional or referring to the official Canada Revenue Agency (CRA) guidelines is advisable for accurate and up-to-date information.

When is the deadline to file t2 tax forms in 2023?

The official deadline for filing T2 tax forms in Canada is generally six months after the end of a corporation's fiscal period. However, the deadline may vary depending on individual circumstances. For example, if the corporation's fiscal year ends on December 31, 2022, the deadline to file the T2 tax forms for that year would be June 30, 2023. It is recommended to consult with a tax professional or the Canada Revenue Agency (CRA) for precise deadlines and any potential extensions or changes that may apply.

What is the penalty for the late filing of t2 tax forms?

The penalty for late filing of T2 tax forms, which are used by corporations to report their income and deductions in Canada, can vary depending on the circumstances. As of March 2022, the penalty for filing T2 tax forms late is generally calculated as follows:

1. A late-filing penalty of 5% of the unpaid tax is imposed if the tax return is filed late. This penalty applies to each full month that the return is late, up to a maximum of 12 months.

2. In addition to the late-filing penalty, there may also be a late-payment penalty of 1% of the unpaid tax for each full month that the tax remains unpaid after the due date. This penalty can also be charged for a maximum of 12 months.

3. If a corporation has filed late in any of the previous three years, the late-filing penalty can be increased to 10% of the unpaid tax, plus 2% for each full month that the return remains late, up to a maximum of 20 months.

It is worth noting that interest charges may also be applicable on any unpaid tax amounts, including both the late-filing penalty and the late-payment penalty. The Canada Revenue Agency (CRA) calculates the penalties based on the total amount due, and penalties can be appealed or reduced in certain circumstances.

It is always advisable to file tax forms on time and pay any taxes owed promptly to avoid these penalties and interest charges.

Where do I find t2 tax forms?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific fillable corp tax for 2012 form and other forms. Find the template you want and tweak it with powerful editing tools.

How do I execute t2 form tribunals ontario online?

Easy online t2 short return 2018 completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit 2012 2020 form canada t2 fill online online?

With pdfFiller, the editing process is straightforward. Open your my account cra tax return form in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.