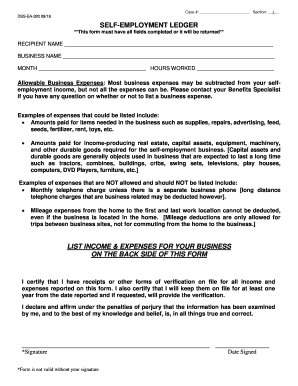

Who Needs Form DSS-EA-320?

Work as a freelancer or independent contractor offers some freedom and flexibility, but it also takes great responsibility. Unlike regular employees, freelancer must keep track of their income independently. And this is what may cause difficulties. Form DSS-EA-320 is Self-Employed Ledger created for self-employed individuals including freelancers, independent contractors and small business owners.

What is Form DSS-EA-320 for?

The main purpose of the Form DSS-EA-320 is to make it easier for self-employed individuals to calculate their income and expenses. With its help a freelancer will be able to create profit/loss statement with all the expenses related to their business.

Is Form DSS-EA-320 Accompanied by Other Forms?

Self-employment ledger is a means to calculate income rather than legal document. Thus, it doesn’t require any supporting documentation. However, it is advisable that a self-employed individual keep all the receipts to prove the income reported is accurate.

When is Form DSS-EA-320 Due?

A freelancer must fill out ledger every time they get paid for the services provided. The ledger is kept for the records within one year from the date it was completed.

How Do I Fill out Form DSS-EA-320?

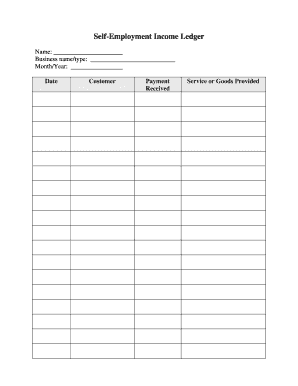

Self-employed ledger is a simple form. Filing process won’t take much time. A freelancer must enter the following information:

- Recipient's name, business name, month and hours worked

- Income that a recipient has got, the date and income type

- Expenses, their type and the date

Where Do I Send Form DSS-EA-320?

Make sure the form is completed correctly and then keep it for the record.