Get the free texas department of revenue power of attorney form

Show details

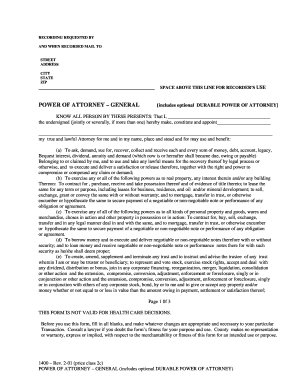

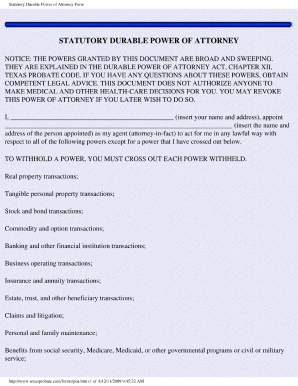

NOTICE The purpose of this power of attorney is to give the person you designate (your Agent) broad powers to handle your property, which may include powers to sell or otherwise dispose of any real

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your texas department of revenue form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your texas department of revenue form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit texas department of revenue online

To use our professional PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit texas department of revenue. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

How to fill out texas department of revenue

How to fill out Texas Department of Revenue:

01

Start by gathering all necessary documents and information. This may include your federal tax return, W-2 forms, 1099 forms, business receipts, and any other relevant financial records.

02

Visit the Texas Department of Revenue website (https://comptroller.texas.gov/) and navigate to the appropriate section for filing your specific tax form. They offer various forms for different types of taxes, such as sales tax, franchise tax, and motor vehicle taxes.

03

Carefully read the instructions provided for the specific tax form you need to complete. Make sure you understand the requirements and any special considerations for your situation.

04

Fill out the form accurately and completely. Provide all requested information, including your personal and business details, income, deductions, and any other relevant data. Double-check your entries to ensure accuracy, as any errors can result in delays or penalties.

05

If required, attach any supporting documents or schedules to the tax form. This might include additional forms, receipts, or statements that substantiate your reported income or deductions.

06

Review your completed form once again to ensure everything is correct. Verify that all calculations are accurate and that you have not missed any important sections or information.

07

Sign and date the form as instructed. If you are filing as a business entity, make sure the appropriate individual signs on behalf of the organization.

08

Depending on the specific tax form, you may need to include payment with your filing. If so, follow the provided instructions for submitting payment, whether it be by check, electronic funds transfer, or another accepted method.

09

Make a copy of all the documents you are submitting for your records. This is important for future reference and to have proof of your filing.

Who needs Texas Department of Revenue:

01

Individuals and businesses operating in Texas and engaging in taxable activities may need to file and pay taxes to the Texas Department of Revenue. This includes sales tax for businesses selling goods or services, franchise tax for corporations and limited liability companies, and motor vehicle taxes for vehicle owners.

02

Self-employed individuals, freelancers, and independent contractors who earn income in Texas are also required to report and pay taxes to the Texas Department of Revenue.

03

Out-of-state businesses that have nexus in Texas, meaning they have a substantial presence or conduct business activities within the state, may also need to file and pay taxes to the Texas Department of Revenue.

04

Additionally, individuals or businesses that owe unpaid taxes or have outstanding tax liabilities in Texas may need to resolve their obligations with the Texas Department of Revenue.

It is important to consult with a tax professional or review the Texas Department of Revenue's guidelines to determine your specific tax obligations and whether you need to file with them.

Fill form : Try Risk Free

People Also Ask about texas department of revenue

How does power of attorney work in Texas?

What is a power of attorney for Texas taxes?

What is Texas Comptroller Form 00 985?

What is a power of attorney 01 137 in Texas?

What is a power of attorney for Texas state taxes?

Where can I get a Texas power of attorney form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is texas department of revenue?

The Texas Department of Revenue is the state agency responsible for collecting and managing state taxes and enforcing tax laws.

Who is required to file texas department of revenue?

Any individual or business that has income or conducts business in the state of Texas may be required to file with the Texas Department of Revenue.

How to fill out texas department of revenue?

You can fill out the Texas Department of Revenue forms either online through their website or by mail. Make sure to provide accurate and complete information.

What is the purpose of texas department of revenue?

The purpose of the Texas Department of Revenue is to collect taxes to fund public services and programs in the state, such as education, healthcare, and infrastructure.

What information must be reported on texas department of revenue?

You must report income, expenses, deductions, credits, and any other relevant financial information on the Texas Department of Revenue forms.

When is the deadline to file texas department of revenue in 2023?

The deadline to file Texas Department of Revenue forms in 2023 is April 15th.

What is the penalty for the late filing of texas department of revenue?

The penalty for late filing of Texas Department of Revenue forms may include fines, interest charges, or other penalties depending on the amount of tax owed and the length of the delay.

How can I send texas department of revenue for eSignature?

Once your texas department of revenue is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I sign the texas department of revenue electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your texas department of revenue in seconds.

How do I fill out the texas department of revenue form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign texas department of revenue and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Fill out your texas department of revenue online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.