Get the free it 11ga 2023 excel form

Show details

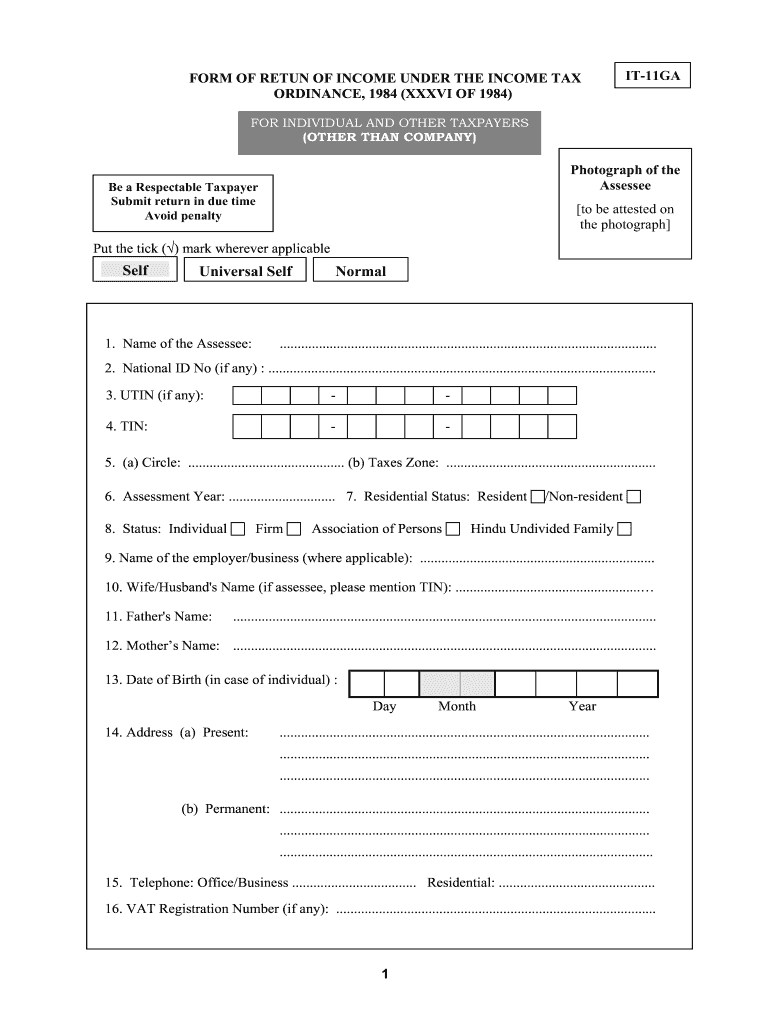

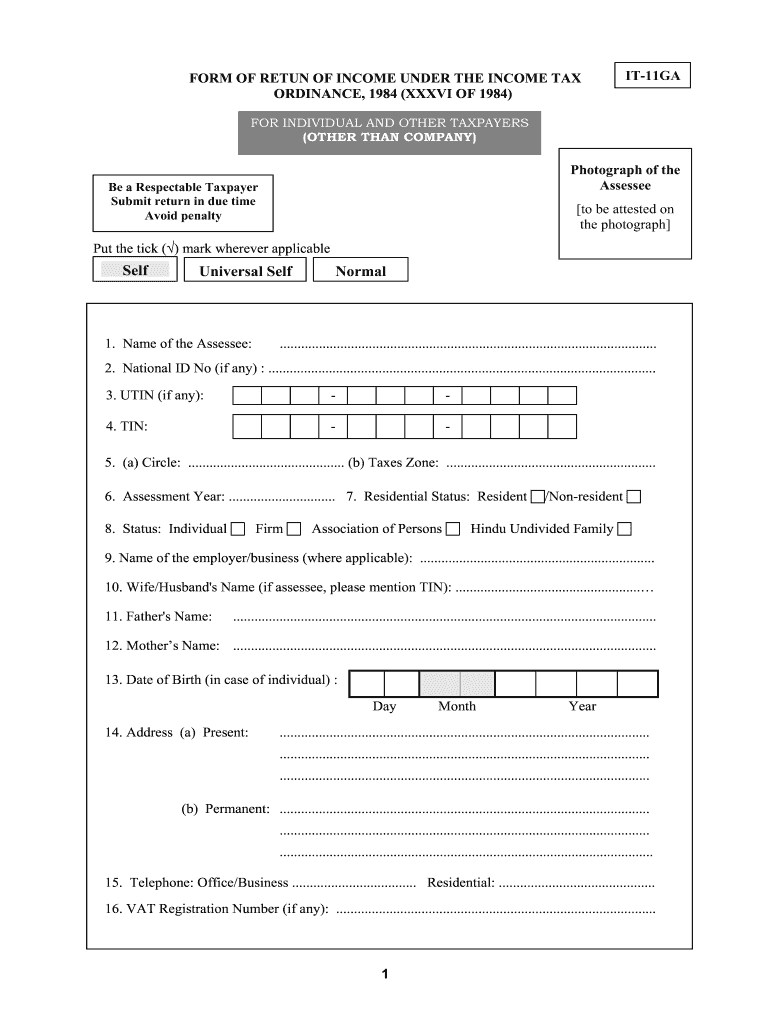

FORM OF RETUN OF INCOME UNDER THE INCOME TAX ORDINANCE 1984 XXXVI OF 1984 IT-11GA FOR INDIVIDUAL AND OTHER TAXPAYERS OTHER THAN COMPANY Photograph of the Assessee Be a Respectable Taxpayer Submit return in due time Avoid penalty to be attested on the photograph Put the tick mark wherever applicable Self Universal Self 1. Form No. IT-10BB FORM Statement under section 75 2 d i and section 80 of the Income Tax Ordinance 1984 XXXVI of 1984 regarding particulars of life style Serial No. Personal...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your it 11ga 2023 excel form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your it 11ga 2023 excel form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing it 11ga 2023 excel online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit income tax return form excel download. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out it 11ga 2023 excel

To fill out the income tax return form, follow these steps:

01

Gather all the necessary documents such as W-2 forms, 1099 forms, and any other relevant income statements.

02

Start by entering your personal information, including your name, social security number, and address, in the designated sections of the form.

03

Proceed to report your income by entering the details from your W-2 forms and any other sources of income, such as self-employment or rental income.

04

Deduct any eligible expenses and adjustments from your income. This may include items such as student loan interest, self-employed business expenses, or contributions to retirement accounts.

05

Determine your filing status, which can affect your tax rates and eligibility for certain deductions or credits. Common filing statuses include single, married filing jointly, and head of household.

06

Calculate your total tax liability by using the tax tables provided in the instructions or by using tax software or online tools.

07

Claim any applicable tax credits, such as the Child Tax Credit or the Earned Income Credit, which can lower your tax liability or provide a refund.

08

Double-check all the information you have entered on the form and ensure it is accurate and complete.

09

Sign and date the form before submitting it to the relevant tax authority. Some tax returns may require additional documentation or schedules, so make sure to include any necessary attachments.

Now, as for who needs an income tax return form, it generally applies to individuals and businesses that meet certain income thresholds or have specific tax situations. This can vary from country to country, but generally anyone who had taxable income during the tax year should file a tax return. Additionally, individuals who had taxes withheld from their income throughout the year may want to file a return to claim a refund of any overpaid taxes.

Video instructions and help with filling out and completing it 11ga 2023 excel

Instructions and Help about tax return form 2023 excel

Fill income tax form : Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file income tax return form?

In India, under the Income Tax Act, 1961, all individuals whose taxable income exceeds the basic exemption limit must file an income tax return. This includes salaried individuals, self-employed individuals, and businesses.

How to fill out income tax return form?

1. Gather the necessary documents: To complete your tax return, you'll need a copy of your tax return from the previous year, your W-2 form, 1099 form, and any other income or financial documents you may have received.

2. Enter personal information: Start by entering your filing status, name, address, and Social Security number.

3. Calculate your income: Enter all of your sources of income, including wages, salaries, dividends, interest, alimony, unemployment benefits, Social Security benefits, and so on. Make sure to include any income from sources outside the United States.

4. Deduct expenses: Calculate any expenses you are eligible to deduct, including medical expenses, charitable donations, state and local taxes, and other deductible expenses.

5. Calculate your taxes owed: After deducting expenses, you'll need to calculate the amount of taxes you owe. This will depend on your filing status, income level, and other factors.

6. Sign and submit the form: Once you have completed the form, make sure to sign and date it, and then submit it to the IRS. You can usually do this electronically or by mail.

What is the purpose of income tax return form?

The purpose of an income tax return form is to provide the government with an account of a taxpayer's income and other pertinent information, such as deductions and credits, in order to determine how much tax a taxpayer owes or how much of a refund they are due.

What is the penalty for the late filing of income tax return form?

The penalty for the late filing of an income tax return form is 5% of the unpaid taxes for each month the taxes are late, up to a maximum of 25%. There may also be a minimum penalty of $135 or 100% of the unpaid taxes, whichever is less.

What is income tax return form?

An income tax return form is a document that individuals or businesses are required to file with the government to report their income, deductions, and tax liability for a specific year. It provides a detailed summary of a person's or entity's financial information and serves as a basis for calculating the amount of tax owed or the refund due. The form typically requires the taxpayer to disclose income from various sources, including wages, self-employment earnings, investment gains, and other taxable income. Additionally, the form may also ask for information about deductible expenses, credits, and exemptions, which can help reduce the tax liability.

What information must be reported on income tax return form?

The following information must be reported on an income tax return form:

1. Personal Information: This includes the taxpayer's name, address, Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), and filing status (single, married filing jointly, married filing separately, head of household, or qualifying widow(er)).

2. Income: All sources of income must be reported, including wages, salary, tips, self-employment income, rental income, investment income, pension income, and any other income received during the tax year. This information is typically reported on different forms or schedules depending on the type of income.

3. Deductions: Taxpayers can claim certain deductions to reduce their taxable income. These deductions may include expenses related to mortgage interest, state and local taxes, medical expenses, charitable contributions, education expenses, and others. Some deductions require detailed documentation or supporting records.

4. Credits: Tax credits are used to reduce the amount of tax owed. These may include credits for child and dependent care expenses, education expenses, adoption expenses, energy-efficient home improvements, and others. The IRS provides specific forms or schedules to claim these credits.

5. Tax Withholdings and Payments: Taxpayers need to report the total amount of federal income tax withheld from their paychecks, estimated tax payments made throughout the year, and any other federal tax payments made.

6. Health Insurance: Taxpayers must indicate whether they had health insurance coverage during the tax year. If they did not have coverage and did not qualify for an exemption, they may be subject to a penalty, although the penalty has been reduced to zero starting in 2019.

7. Additional Forms and Schedules: Depending on the tax situation, additional forms or schedules may need to be included, such as Schedule C for self-employed individuals, Schedule D for capital gains and losses, Schedule E for rental properties, and others.

It is important to note that tax laws can change, and every taxpayer's situation is unique. Therefore, it is recommended to review the specific IRS instructions and consult with a tax professional for accurate and personalized guidance when filing an income tax return.

How can I edit it 11ga 2023 excel from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your income tax return form excel download into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I edit income tax return excel file download in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your tax return form excel, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I fill out income tax return excel format on an Android device?

Use the pdfFiller Android app to finish your income tax return form 11ga english excel and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

Fill out your it 11ga 2023 excel online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Income Tax Return Excel File Download is not the form you're looking for?Search for another form here.

Keywords relevant to tax return excel file form

Related to return form excel

If you believe that this page should be taken down, please follow our DMCA take down process

here

.