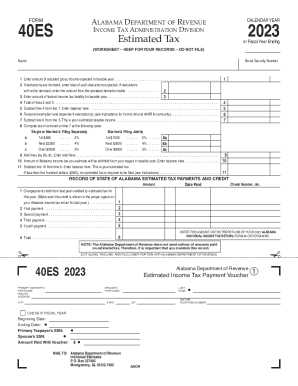

AL Form 40ES 2013 free printable template

Show details

2 First payment. 3 Second payment. 4 Third payment. 5 Fourth payment. 6 Total. ENTER THIS AMOUNT ON THE PROPER LINE OF YOUR 2013 ALABAMA INDIVIDUAL INCOME TAX RETURN FORM 40 OR FORM 40NR. NOTE The Alabama Department of Revenue does not send notices of amounts paid on estimated tax. Therefore it is important that you maintain this record. Form 40ES Instructions Who Must Pay Estimated Tax If you owe additional tax for 2012 you may have to pay estim...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your form 40es 2015 alabama form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 40es 2015 alabama form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 40es 2015 alabama online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form 40es 2015 alabama. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

AL Form 40ES Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form 40es 2015 alabama

How to fill out form 40es 2015 alabama?

01

Begin by gathering all necessary information and documents, such as your Social Security number, income statements, and tax return from the previous year.

02

Make sure to read the instructions provided with the form carefully. These instructions will guide you through the process of filling out the form correctly.

03

Start by carefully entering your personal information, including your name, address, and filing status.

04

Calculate your estimated tax liability for the year. This involves determining your total income, deductions, and credits. Refer to your income statements and tax return from the previous year for accurate figures.

05

Use the provided worksheets to calculate your estimated tax liability. These worksheets will help you determine the correct amount to enter in each section of the form.

06

Transfer the calculated amounts onto form 40es, ensuring accuracy and double-checking all entries.

07

If applicable, include any additional tax payments or credits that should be applied to your estimated tax. This may include any previous overpayment or estimated tax paid throughout the year.

08

Carefully review the completed form for any errors or missing information. Make any necessary corrections before submitting the form.

Who needs form 40es 2015 alabama?

01

Individuals who expect to owe additional taxes to the state of Alabama for the 2015 tax year are required to file form 40es. This form is used to help individuals make estimated tax payments throughout the year.

02

Freelancers, self-employed individuals, and business owners with income that is not subject to withholding tax should also use form 40es to make their estimated tax payments.

03

Individuals who experience significant changes in their income or deductions throughout the year may need to complete form 40es to accurately estimate and pay their taxes.

04

It is important to note that not everyone will need to file form 40es. Individuals who have sufficient tax withholding from their wages or income source may not need to make estimated tax payments using this form.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 40es alabama estimated?

Form 40ES Alabama Estimated is used to pay estimated quarterly taxes in the state of Alabama.

Who is required to file form 40es alabama estimated?

Individuals, corporations, and other entities that anticipate owing taxes to Alabama at the end of the tax year may be required to file Form 40ES.

How to fill out form 40es alabama estimated?

Form 40ES should be filled out with accurate estimates of income, deductions, credits, and other tax-related information for the upcoming tax year.

What is the purpose of form 40es alabama estimated?

The purpose of Form 40ES is to help taxpayers avoid underpayment penalties by making estimated tax payments throughout the year.

What information must be reported on form 40es alabama estimated?

Form 40ES requires information on estimated income, deductions, credits, and tax liability for the upcoming tax year.

When is the deadline to file form 40es alabama estimated in 2023?

The deadline to file Form 40ES for the tax year 2023 is typically January 15, April 15, June 15, and September 15.

What is the penalty for the late filing of form 40es alabama estimated?

The penalty for the late filing of Form 40ES in Alabama is typically a percentage of the underpaid tax amount for each day the payment is late.

How can I send form 40es 2015 alabama to be eSigned by others?

Once your form 40es 2015 alabama is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I make changes in form 40es 2015 alabama?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your form 40es 2015 alabama and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I make edits in form 40es 2015 alabama without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your form 40es 2015 alabama, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Fill out your form 40es 2015 alabama online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.