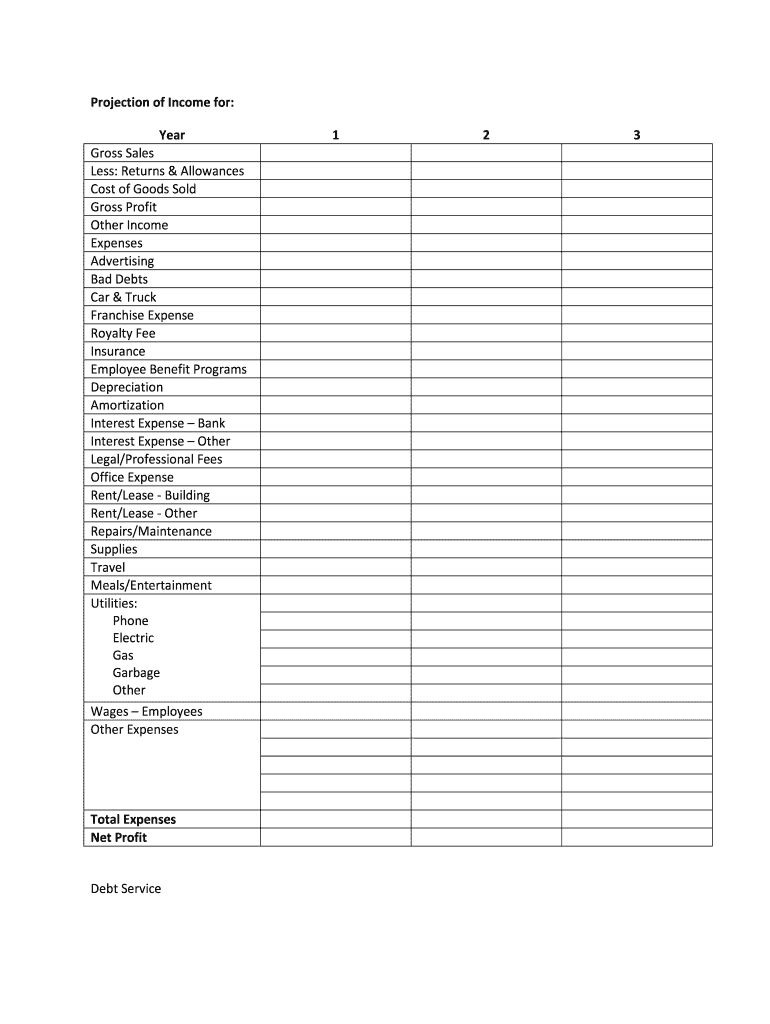

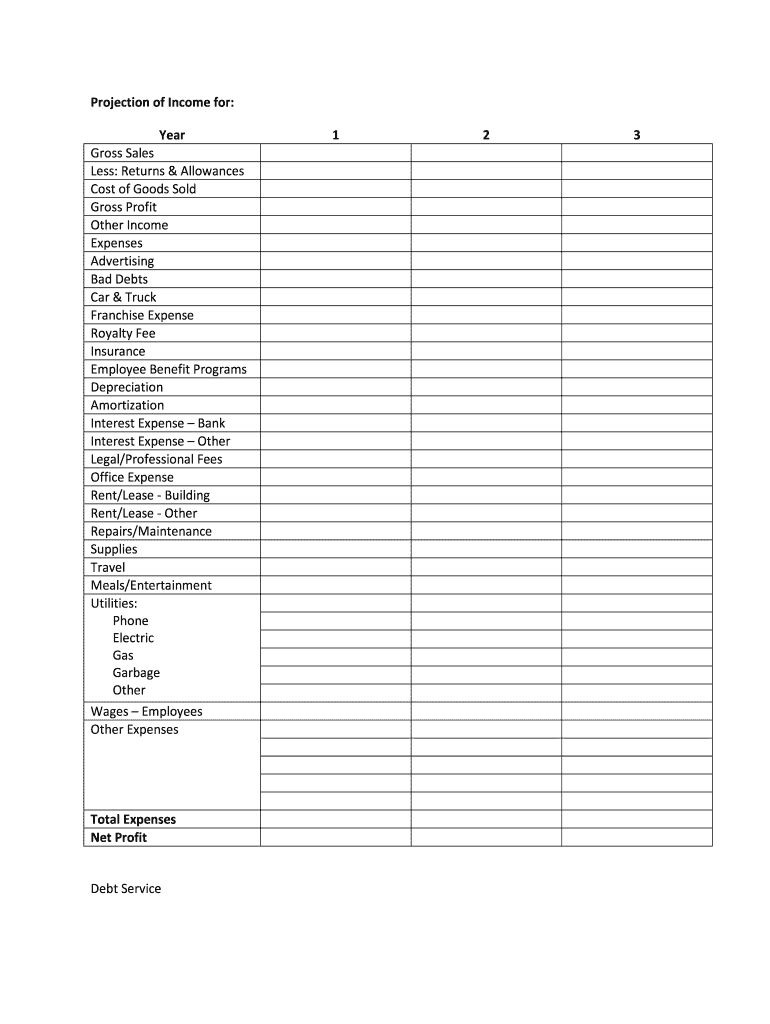

CMCT Projection of Income 2019-2024 free printable template

Get, Create, Make and Sign

How to edit year to date profit and loss statement online

How to fill out year to date profit

Video instructions and help with filling out and completing year to date profit and loss statement

Instructions and Help about interim ytd profit loss form

Hi my name is Justin with Justin Paul management, and I'm going to be talk with you today about understanding a profit loss statement the profit loss statement is actually referred to more commonly as the income statement or possibly a Camp;L and what the profit loss statement actually tells you is how a company's gross profits are transformed into net profits and gross profits are all the money that a company made throughout a year but as you know company has expenses that it takes to run the business so what you look at when you're looking at it at a profit loss is where the company spent how much money and at the bottom line if you will of the statement is the net sales and that shows you actually how much the company made the other common business statements that you would see are the balance sheet or the cash flow statement so for this example I've actually created a fictitious company called Larry's lemonade so let's look at Larry's Camp;L see how his company's doing and see whether he actually made a net profit all right so here we are we're talking about the profit loss statement for Larry's lemonade also referred to more commonly as the income statement and what can be both incredibly informative and confusing about the income statement or profit loss statement is that many of the numbers that you would expect to be negative are expressed in a positive but main thing to understand about an income statement or PL is that from top to bottom you can see kind of the flow of how and where a company spent money and how they made money so let's start at the very top and kind of work our way up down to the bottom and kind of go over some of these terms there at the very top is the total revenue that's how much Larry made he made a thousand dollars and what that that is before any expenses are figured or anything that is just a clear pure statement of how much money Larry's lemonade actually made the cost of revenue is also referred to as the cost of goods sold if you're in a retailing business for example that actually expresses how much money they had to spend on items for example Larry would probably buy lemons sugar plastic cups things like that, so Larry had to spend $200 to make that money and so underneath that you see a gross profit of $800 again those terms are both expressed and positives, so you have to understand what you're looking at under the next section are the operating expenses and these are just more of some more common fields that you would see on an income statement for example underneath the operating expenses we see research let's say Larry spent $75 researching the best recipes and getting some training on how to make lemonade and his general costs basically selling general and admin refer to all the normal expenses that a company would have to do to run a company to run a business you're going to have to pay employees your managers general payroll and taxes things like that all of that are usually underneath the selling...

Fill ytd profit and loss template : Try Risk Free

People Also Ask about year to date profit and loss statement

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your year to date profit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.