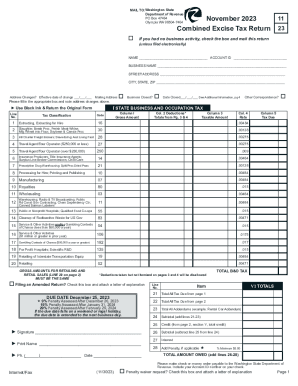

WA DoR Combined Excise Tax Return 2013 free printable template

Show details

If you do not have deductions do not return pages 3 and 4. We cannot approve deductions taken on the Combined Excise Tax Return that are not itemized on pages 3 and 4. MAIL TO Washington State Department of Revenue PO Box 47464 Olympia WA 98504-7464 Jan - Dec 2013 A Combined Excise Tax Return If you had no business activity check the box and mail this return unless filed electronically NAME TAX REG NO. Report deductions under the heading that co...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your combined excise tax 2013 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your combined excise tax 2013 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit combined excise tax 2013 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit combined excise tax 2013. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

WA DoR Combined Excise Tax Return Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out combined excise tax 2013

How to fill out combined excise tax 2013:

01

Collect all necessary information and documents: Before filling out the combined excise tax form for the year 2013, gather all relevant information such as sales data, exemptions, and any other details required for accurate reporting.

02

Obtain the correct form: The combined excise tax form for 2013 can typically be obtained from the tax authority's website or local tax office. Make sure you have the correct form for the specific year.

03

Fill out the personal information: Provide your name, address, social security number or taxpayer identification number, and any other required personal details accurately.

04

Report the sales information: Enter the details of your sales transactions during the 2013 tax year. This may include the taxable amount, exempt amount, and any applicable tax rates for different types of goods or services.

05

Include any applicable exemptions: If you are eligible for any exemptions or deductions, make sure to include them on the form. This may include exemptions for specific industries or products, as well as any credits or deductions allowed by the tax authority.

06

Calculate and report the tax liability: Use the provided instructions or any relevant tax tables to determine your total tax liability for the 2013 tax year. Make sure to accurately calculate the tax owed and report it on the form.

07

Review and double-check: Before submitting the form, review all the information you have entered to ensure accuracy and completeness. Double-check your calculations and make sure you have addressed all the required sections.

08

Submit the form: Once you have completed the combined excise tax form for 2013, follow the instructions provided to submit it to the appropriate tax authority. This may involve mailing the form or filing it electronically, depending on the procedures in place.

Who needs combined excise tax 2013?

01

Businesses engaged in specific activities: The combined excise tax for the year 2013 is typically required for businesses involved in activities subject to this type of tax. These activities may include selling certain goods or services, manufacturing, mining, or operating transportation or communication services.

02

Taxpayers meeting the taxable threshold: Individuals or entities that meet the taxable threshold for combined excise tax in 2013 may be required to file and pay this tax. The specific threshold amount can vary depending on the jurisdiction and the nature of the business or activity.

03

Compliance with local tax rules and regulations: In order to comply with local tax rules and regulations, individuals or entities engaged in activities subject to combined excise tax must file the relevant tax forms, including the 2013 version, to accurately report their tax liability.

Please note that the information provided above is a general overview and may vary depending on the specific jurisdiction or tax authority. It is always recommended to consult with a tax professional or the appropriate tax authority for specific guidance and requirements related to filling out the combined excise tax form for 2013.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is combined excise tax form?

Combined excise tax form is a form used to report and pay excise taxes on various products and services.

Who is required to file combined excise tax form?

Businesses and individuals who engage in activities that are subject to excise taxes are required to file combined excise tax form.

How to fill out combined excise tax form?

Combined excise tax form should be filled out with accurate information regarding the products or services subject to excise taxes and the corresponding tax amounts.

What is the purpose of combined excise tax form?

The purpose of combined excise tax form is to ensure that excise taxes are reported and paid correctly to the relevant tax authorities.

What information must be reported on combined excise tax form?

Information such as the type of products or services subject to excise taxes, the quantity sold or produced, and the corresponding tax amounts must be reported on combined excise tax form.

When is the deadline to file combined excise tax form in 2023?

The deadline to file combined excise tax form in 2023 is typically on the last day of the month following the end of the tax period.

What is the penalty for the late filing of combined excise tax form?

The penalty for the late filing of combined excise tax form may include fines, interest, and legal actions by the tax authorities.

How do I edit combined excise tax 2013 online?

With pdfFiller, it's easy to make changes. Open your combined excise tax 2013 in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I edit combined excise tax 2013 in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your combined excise tax 2013, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I fill out combined excise tax 2013 on an Android device?

Complete combined excise tax 2013 and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

Fill out your combined excise tax 2013 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.