Get the free Zero Income Statement - Prince George's County - princegeorgescountymd

Show details

Rusher L. Baker, III County Executive Paul E. Rowe, Chair Board of Commissioners Eric C. Brown, Executive Director ZERO INCOME STATEMENT NAME: DATE: SSN Last 4 Digits: This statement is to certify

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your zero income statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your zero income statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit zero income statement online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit zero income statement. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

How to fill out zero income statement

How to fill out zero income statement:

01

Start by gathering all necessary information such as personal details, including your name, address, and contact information.

02

Next, provide details of your financial situation, including any sources of income and expenses. In the case of a zero income statement, you will need to indicate that you have no income.

03

Be thorough and provide accurate information about any assets or property you own, such as vehicles, real estate, or investments.

04

Include any details about your liabilities or debts, such as mortgages, loans, or credit card balances.

05

If applicable, mention any government assistance programs you are enrolled in, such as unemployment benefits or welfare.

06

Double-check all the information provided and make sure it is accurate and up-to-date.

07

Once you have completed the zero income statement, sign and date the document.

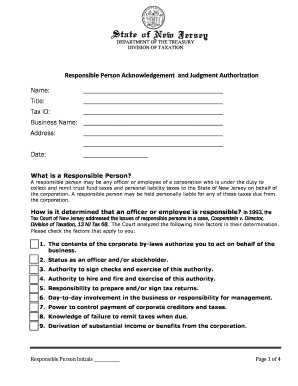

Who needs a zero income statement:

01

Individuals who have no sources of income or are currently unemployed may need a zero income statement.

02

Students who are financially dependent on their parents and do not have any personal income may also require a zero income statement.

03

Those who are retired and solely depend on pension or social security benefits might need a zero income statement to prove their financial situation.

04

Individuals who are temporarily out of work due to illness or injury and are not receiving any income may also require a zero income statement.

05

Some government agencies or financial institutions may request a zero income statement to verify an individual's financial status for certain purposes, such as applying for assistance programs or obtaining loans.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is zero income statement?

A zero income statement is a report that shows zero income earned during a specific period of time.

Who is required to file zero income statement?

Individuals who did not earn any income during a specific period of time are required to file a zero income statement.

How to fill out zero income statement?

To fill out a zero income statement, provide personal information and state that no income was earned during the specific period.

What is the purpose of zero income statement?

The purpose of a zero income statement is to document the lack of income earned by an individual during a specific period of time.

What information must be reported on zero income statement?

The zero income statement must include personal information such as name and address, along with a statement confirming no income was earned.

When is the deadline to file zero income statement in 2023?

The deadline to file a zero income statement in 2023 is typically April 15th, unless an extension is requested.

What is the penalty for the late filing of zero income statement?

The penalty for the late filing of a zero income statement may vary depending on the tax laws of the specific jurisdiction, but typically includes fines or interest charges.

How can I get zero income statement?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific zero income statement and other forms. Find the template you need and change it using powerful tools.

How do I make changes in zero income statement?

The editing procedure is simple with pdfFiller. Open your zero income statement in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I fill out the zero income statement form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign zero income statement and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Fill out your zero income statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.