Bike MC Donation Receipt 2011-2024 free printable template

Show details

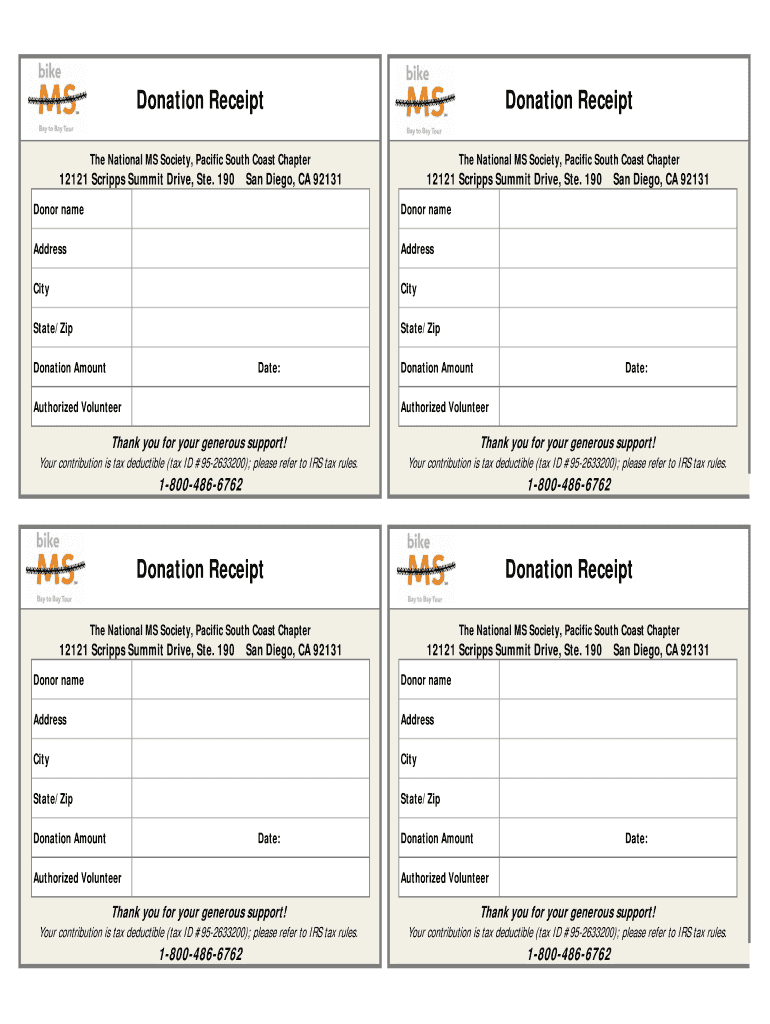

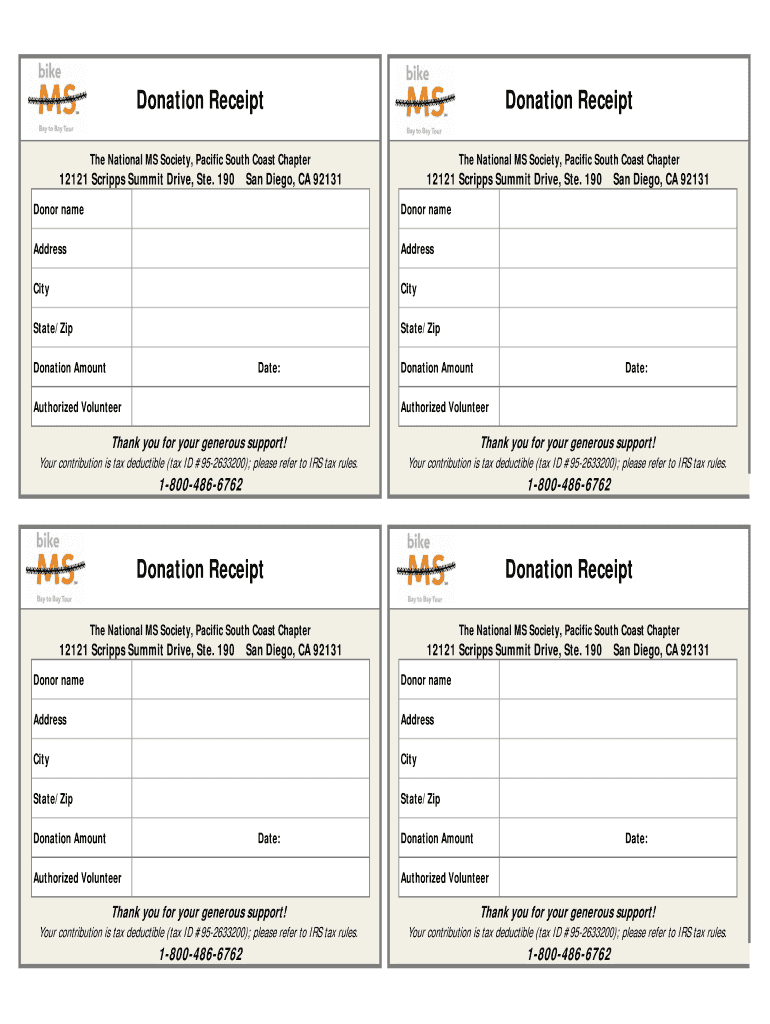

Donation Receipt The National MS Society, Pacific South Coast Chapter 12121 Scripts Summit Drive, Ste. 190 The National MS Society, Pacific South Coast Chapter San Diego, CA 92131 12121 Scripts Summit

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your ms society donation receipt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ms society donation receipt form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ms society donation receipt online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ms society donation receipt. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

How to fill out ms society donation receipt

How to fill out an MS Society donation receipt:

01

Begin by identifying the donor's information. This includes their name, address, and contact details. It is important to ensure that all information is accurate and up-to-date.

02

Next, specify the date of the donation. This should reflect the day the donation was made. It is crucial to record the correct date for accounting and tax purposes.

03

Describe the donated items or the nature of the contribution. Include details about the value, quantity, or any relevant information about the donation. If the donation was monetary, specify the amount and whether it was in cash or a check.

04

Indicate whether the donor received any goods or services in return for their donation. If so, provide a description and the estimated value of these goods or services. This is important for tax purposes and may affect the tax deductibility of the donation.

05

Include any additional information or notes that may be necessary. This could be specific instructions from the donor or any other relevant details.

Who needs an MS Society donation receipt?

01

Individuals who have made a donation to the MS Society and require a tax deduction. A donation receipt serves as proof of the charitable contribution for tax purposes.

02

Businesses or companies that have made a donation to the MS Society for corporate social responsibility or philanthropic reasons. They may need the donation receipt for their financial records or to demonstrate their support for the cause.

03

Non-profit organizations or foundations that receive donations from individuals or businesses and need to issue proper documentation to acknowledge and thank the donors.

In summary, anyone who has made a donation to the MS Society, whether as an individual or a business entity, and requires a receipt for tax purposes or record-keeping should utilize the MS Society donation receipt form. It helps ensure transparency, accountability, and enables donors to claim tax benefits if applicable.

Fill form : Try Risk Free

People Also Ask about ms society donation receipt

How much of National MS Society goes to charity?

Are donations to National MS Society tax deductible?

Is a donation receipt tax deductible?

How do you write a receipt for in-kind donations?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ms society donation receipt?

The MS Society donation receipt is a document provided to donors who make a donation to the MS Society. It serves as proof of the donation for tax purposes.

Who is required to file ms society donation receipt?

Donors who make a donation to the MS Society are required to file the donation receipt if they want to claim the donation as a tax deduction.

How to fill out ms society donation receipt?

Donors can fill out the MS Society donation receipt by providing their name, contact information, the amount of the donation, and any other required information. The donation receipt should be signed and dated by both the donor and the MS Society representative.

What is the purpose of ms society donation receipt?

The purpose of the MS Society donation receipt is to provide donors with documentation of their donation for tax purposes. It allows donors to claim the donation as a tax deduction.

What information must be reported on ms society donation receipt?

The MS Society donation receipt must include the donor's name, contact information, the amount of the donation, the date of the donation, and any other relevant details required for tax purposes.

When is the deadline to file ms society donation receipt in 2023?

The deadline to file the MS Society donation receipt in 2023 may vary, but typically it is by the end of the tax year in which the donation was made.

What is the penalty for the late filing of ms society donation receipt?

The penalty for late filing of the MS Society donation receipt may include disallowance of the tax deduction claimed for the donation, as well as potential fines or sanctions from the tax authorities.

Where do I find ms society donation receipt?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the ms society donation receipt in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I edit ms society donation receipt online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your ms society donation receipt and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I edit ms society donation receipt on an iOS device?

You certainly can. You can quickly edit, distribute, and sign ms society donation receipt on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

Fill out your ms society donation receipt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.