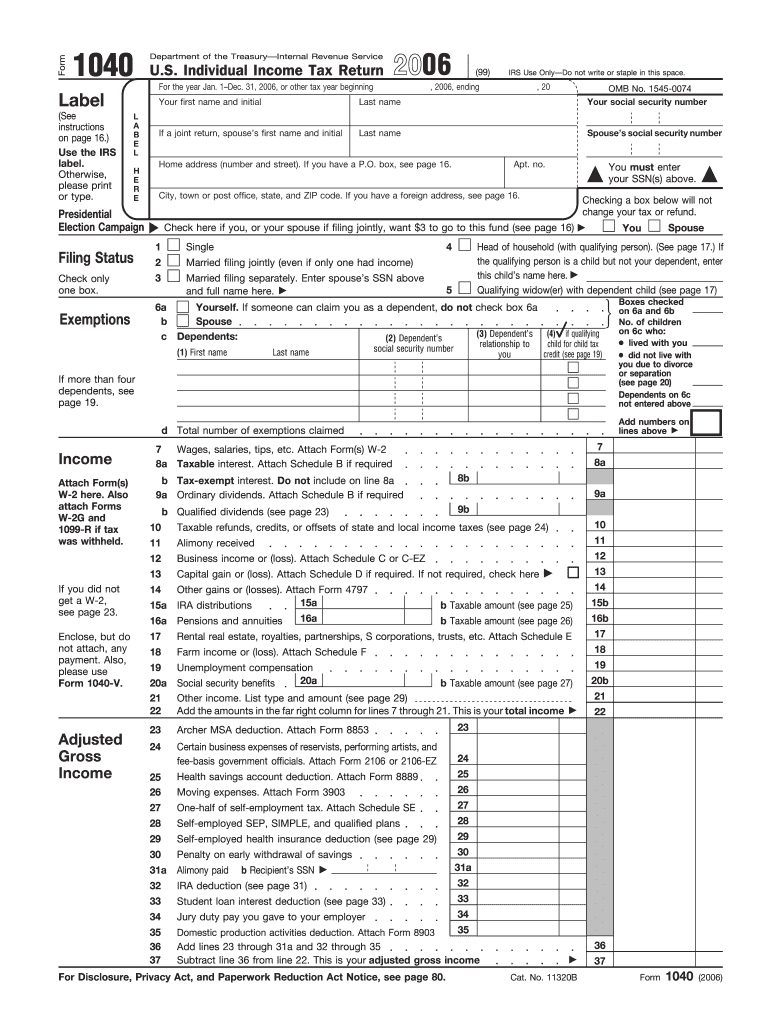

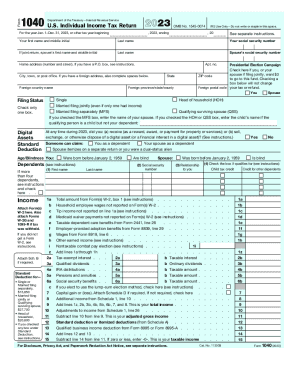

What is the 1040 form for?

The IRS form 1040 is an important document to be filed by all individuals to reveal their earnings for the year. This is done for three main reasons: it is important to determine how much tax should be withheld from the individual's earnings, check whether the person should be given a tax refund, and see whether a taxpayer owes money.

Who needs the IRS 1040 form 2006?

All US residents and citizens must file the IRS form 1040, known as the US Individual Income Tax Return. It is considered a standard document but has many variations, each designed for a particular group of taxpayers.

Is the 1040 form accompanied by other forms?

As a rule, federal tax form 1040 is followed by a W-2 form that an individual may get from the employer. Also, forms W-2G and 1099-R must accompany the 1040 form only if the tax was withheld.

When is the IRS form 1040 due?

Every individual must file form 1040 by April 18, 2007. If you need more time to prepare your tax return, complete and file form 4868 by April 18 2007 to get a 6-month extension. Please note you should make your tax payments by the original due date to avoid penalties.

How do I fill out the IRS form 1040?

In total, the 1040 tax form consists of 79 lines. In 2006, some of these fields have changed. Thus, before filing the document, you should check:

- Delivery service details

- Electronic PIN information

- The amount of educator expenses

- Mileage rate

- Itemized deduction amount in section tax and credits

- Tax exemptions

- Other taxes

- Payments and refunds

Be attentive to making calculations. Use instructions provided for each form.

To draft your tax return, complete the steps below:

- Click on the Get Form button to open your sample in the editor.

- Use the Text and Check/Cross options from the upper toolbar to fill out the blank fields.

- Click the Next button to navigate through the fields of the document.

- Date and sign your sample with the corresponding tools.

- Click Done when finished and proceed to the file-sharing features.

Where do I send the 1040 tax form?

Once your 1040 form is completed and electronically signed, you must send it to the IRS. pdfFiller enables you to file your income declaration to the IRS right from the editor without printing and mailing it. Take advantage of pdfFiller’s Send via USPS option that enables you to ship your paperwork via postal service without printing blanks and filling out envelopes. The up-to-date addresses of the state IRS departments are available on the last page of the official PDF 1040 instruction.