Fannie Mae 1038 2014-2024 free printable template

Get, Create, Make and Sign

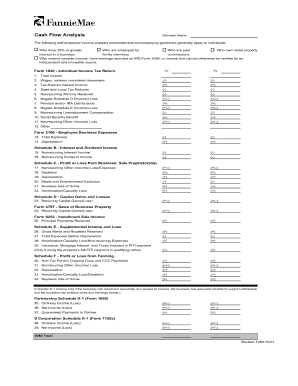

How to edit fannie mae income calculation worksheet excel online

How to fill out fannie mae income calculation

How to fill out Fannie Mae income calculation:

Who needs Fannie Mae income calculation:

Video instructions and help with filling out and completing fannie mae income calculation worksheet excel

Instructions and Help about self employed income worksheet form

Hi and welcome back to the business career college video series we're doing something a little different in this series of videos I do have a couple of videos where I show excel or word or whatever the case is in this video series we're going to build out a multi-year cash flow statement using Excel and this is something that really is most appropriate for somebody who is working through their capstone course others might find it useful, and we will have some continuing ed credits around this series of videos available as well, but it really is at its heart designed for capstone case study students, so we're going to work without a case study though we're going to work through sort of just notional figures, and I'm going to show you how I would build out step by step in fairly long steps unfortunately how I would build out a multi-year cash flow statement, so the first thing is its a very, very long process, and we're going to break it down into as many incremental steps as we can, so I'm going to lay out my sheets it's important to have some degree of organization to work from here and different people will do this differently I'm going to be very very very thorough in describing all my sheets, so I'm going to start off with a sheet where I'm going to have it for nothing but income okay, and you might do one for his in common one for her income will do all sources of income together on the same sheet assuming we're doing financial planning for a couple here which we're going to do because that's going to more closely match most of the scenario certainly not all but most of the scenarios you'll be dealing with at least for the capstone course, and then we're going to obviously have expenses, and then I'm going to have a separate sheet for amounts saved, and then I'm going to list out the liabilities and for now I'm going to stop with a sheet that will refer to as data, or we might call this our assumptions, so the data sheet will start here we'll start populating the data sheet this is the sheet that I'm going to use for all of my variables that might change in a given time or at a given time, so I might start here with let's say inflation that's a good starting point and I might need some assumptions around things like how about a fixed income return and maybe an equity return, and we might have a real estate appreciation that is the extent to which our real estate appreciates in value every year, so that's a good starting point maybe we're going to do retirement age here, so these are some of the assumptions that we're going to work with the top four we'll all be interest rates, so I'm going to change that over to a percentage, and I'm going to give it the appropriate number of decimal places I think right now that'll show up as two decimal places, so we use two percent inflation maybe we'll use as per the financial planning standards council assumptions maybe we'll use two-point-nine percent for our fixed income return and six point three...

Fill fannie mae income worksheet : Try Risk Free

People Also Ask about fannie mae income calculation worksheet excel

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your fannie mae income calculation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.