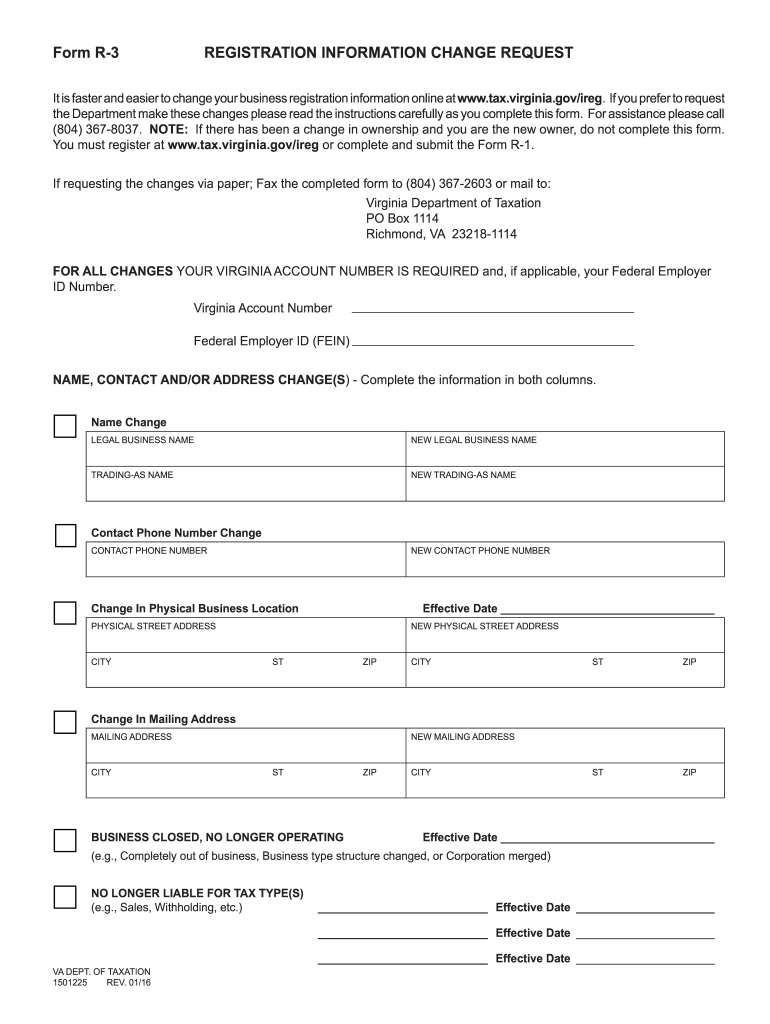

Who needs form R-3?

This is a form for taxpayers registered in the Virginia tax system. If they need to change an item in their registration, they must file this form. It cannot be used to change ownership or register as a new owner of the property.

What is form R-3 for?

The Virginia Department of Taxation gathers information about taxpayers under standardized accounts. If you get married, changed your name, started a new business or closed the previous entity, you must provide the Department with information about these changes.

Is it accompanied by other forms?

For all changes you need to give your account number on this application. If changes concern your business activity, and you possess a Federal Employer ID (VEIN), you should write it too.

When is form R-3 due?

You can use this form whenever you need to update your account.

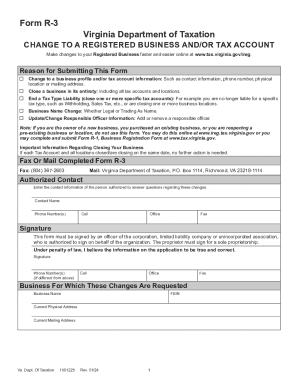

How do I fill out form R-3?

First, write your Virginia account number and VEIN, if applicable. After that you’ll see three tables for making changes in your name, address and contacts. For every change, you must provide the current version and the variant you would like to be registered instead. You can make a name change, contact phone number change, change in physical business location or change a mailing address. Check the box if your business is no longer operating and the effective date at which this change in status occurred. Write down what types of taxes your business is no longer liable for.

Where do I send it?

You can submit this form electronically at www.tax.virginia.gov/ireg. If you prefer to print it out and send it by mail, it should be sent to:

Virginia Department of Taxation

PO Box 1114

Richmond, VA 23218-1114

Or, alternatively, it can be faxed to: (804) 367-2603