Get the free project 100 insurance form

Get, Create, Make and Sign

Editing project 100 insurance online

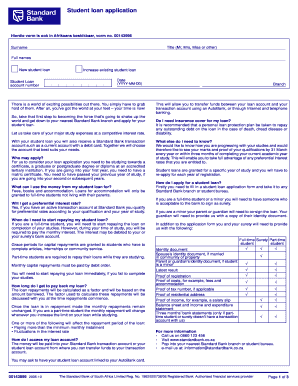

How to fill out project 100 insurance form

How to fill out project 100 insurance:

Who needs project 100 insurance:

Video instructions and help with filling out and completing project 100 insurance

Instructions and Help about project 100 sales form

And good afternoon welcome to the first of our two-part webinar series providing an overview of insurance and insolvency in construction projects we start today with the basics of insurance for construction projects insurance cover is an important aspect of every construction project but insurance policies are complex and insurance companies can often be reluctant to pay out if policies are not followed correctly it's therefore necessary to understand the various features of construction insurance our next webinar in this two-part series will be in a related topic which is insolvency in construction projects now both of the webinars from this series are recorded and are available on our Vimeo site if you'd like to listen again or share with your colleagues so just before we begin the main webinar and topic to minimize background noise, and you've all been placed on mute if you would like to ask questions please do so using the webinar chat function and time permitting we will answer those at the end, so I am Ian Drummond a partner in the projects and infrastructure disputes team in Sheppard a wet burn and I specialize in construction and engineering dispute resolution, and I'm based in Edinburgh, and I'm joined by Kate gillies an associate in my team our team regularly advises on construction contract issues and disputes across a range of projects and clients and throughout the whole life of contracts we therefore have a lot of experience in advising in circumstances involving insurance claims or insolvency and this experience forms the basis of our strategic advice and what we will share with you today, so I will now hand over to Kate who will take us through the agenda for this webinar axiom, so first we'll touch briefly upon some key terms and principles of insurance and that be relevant to other parts of this webinar next we'll add a sum of the different types of insurance for a relevant in the construction industry thirdly will consider some several of the most common standard form contracts and what the default insurance provisions are in each, and finally we'll discuss two recent cases including the Glendale hydroelectric scheme case and what they mean for the construction industry from an insurance perspective so moving on to the key terms and principles start the key insurance terms and principles will no doubt be familiar to some of you, so we'll only spend a couple of minutes running through these firstly insurance is a type of contract commonly referred to as a policy entered into to guard against the loss or liability in specified circumstances the parties to the contract are known as the insured or policyholder and the in shooter or underwriter and exchange the payment of premiums by the insured to the tutor the insurer agreed to compensate the insured if the insured suffers loss or liability arriving from an insured risk this is a crucial component of insurance contracts for example if your house is flooded it's not enough just to...

Fill project 100 limra : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your project 100 insurance form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.