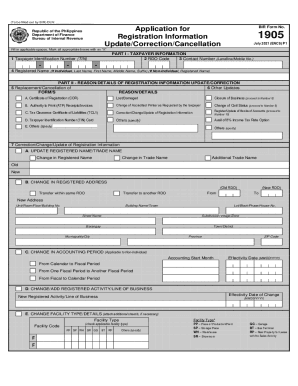

Who Needs BIR Form 1906?

The full name of the BIR Form 1906 is Application to Print Receipts and Invoices. This form is issued by the Philippine Bureau of Internal Revenue. The form is created for individuals who run business with income that is subject to taxation.

What is BIR Form 1906 for?

With BIR Form 1906 business owners can get official receipts and invoices for their company. Individuals who provide services to other people are often asked for receipts and invoices. They also need receipts to document their expenses and claim deductions to their income tax. Additionally, according to the Philippine tax law official receipts and invoices are required for each sales of goods or service. However, getting these documents isn’t an easy process. First, an individual must register their business with the BIR, get permission from the Mayor’s office and then ask for invoices and receipts with BIR Form 1906.

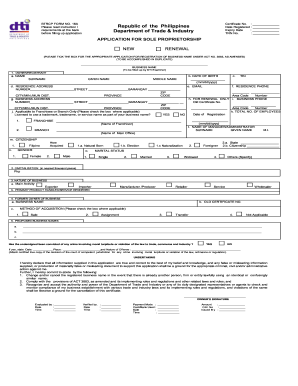

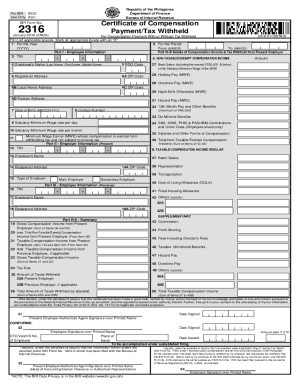

Is BIR Form 1906 Accompanied by Other Forms?

Additional documents that must accompany the application include job order, sample or receipts and invoices, copies of the application for registration, registration fee and certificate of registration with BIR.

When is BIR Form 1906 due?

Fill out BIR Form 1906 on or before commencement of your business.

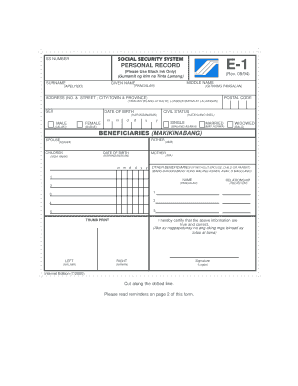

How Do I Fill out BIR Form 1906?

There is only one page to fill out. It contains eleven fillable fields. Provide your TIN, name, trade name, business address, description of receipts and invoices.

Where Do I Send BIR Form 1906?

Once completed and signed, BIR Form 1906 is sent to the Philippine Bureau of Internal Revenue.