Get the free Yearly Statement -20 -20 - - oru

Show details

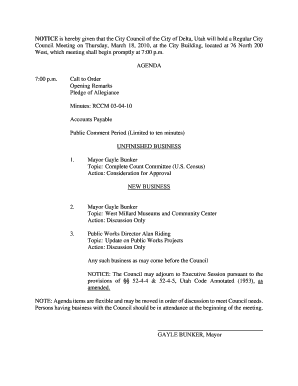

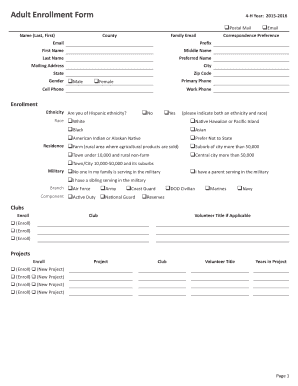

Yearly Statement -20 -20 Date: School Name: Address: City/State/Zip: Local Association Sponsor: ORU EF / CSA Annual Chapter Dues .......................................... ×50.00 Renewing Members

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your yearly statement -20 -20 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your yearly statement -20 -20 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit yearly statement -20 -20 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit yearly statement -20 -20. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out yearly statement -20 -20

How to fill out yearly statement -20 -20:

01

Begin by gathering all relevant financial information for the year, including income, expenses, and investments.

02

Organize this information into categories, such as salary, rental income, interest income, and deductible expenses.

03

Use a software program or a spreadsheet to input the data and calculate totals for each category.

04

Ensure that all necessary forms and documents, such as W-2s, 1099s, and receipts, are properly attached or included.

05

Double-check all calculations and information for accuracy.

06

Sign and date the statement once it is complete.

07

Submit the yearly statement to the appropriate organization or individual, depending on the purpose of the statement.

Who needs yearly statement -20 -20:

01

Individuals who are self-employed and need to report their income and expenses for tax purposes.

02

Small business owners who are required to submit a yearly statement to regulatory bodies or stakeholders.

03

Investors who need to track their investment performance and report their gains or losses.

04

Organizations or individuals who need to provide financial statements as part of a loan application or funding request.

05

Anyone who wants to keep a record of their financial activities and assess their financial health on a yearly basis.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is yearly statement -20 -20?

Yearly statement -20 -20 refers to a financial statement that provides information about the financial activities of an individual or organization for the year 2020 to 2021.

Who is required to file yearly statement -20 -20?

Any individual or organization that had financial activities in the year 2020 to 2021 is required to file the yearly statement -20 -20. This includes businesses, self-employed individuals, and non-profit organizations.

How to fill out yearly statement -20 -20?

To fill out the yearly statement -20 -20, you need to gather all relevant financial information for the year 2020 to 2021, including income, expenses, assets, and liabilities. You can then use accounting software or hire a professional accountant to help you prepare the statement.

What is the purpose of yearly statement -20 -20?

The purpose of the yearly statement -20 -20 is to provide a summary of an individual or organization's financial activities for the year 2020 to 2021. It helps in assessing financial performance, calculating taxes, and making informed financial decisions.

What information must be reported on yearly statement -20 -20?

The yearly statement -20 -20 should include information such as total income, expenses, assets, liabilities, profit or loss, and any other relevant financial data for the year 2020 to 2021.

When is the deadline to file yearly statement -20 -20 in 2023?

The deadline to file the yearly statement -20 -20 in 2023 is usually April 15th. However, it is recommended to check with the relevant tax authorities or consult a professional to confirm the exact deadline.

What is the penalty for the late filing of yearly statement -20 -20?

The penalty for the late filing of the yearly statement -20 -20 may vary depending on the jurisdiction and specific regulations. It is advisable to consult the relevant tax authorities or seek professional advice to determine the exact penalty amount.

How can I manage my yearly statement -20 -20 directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign yearly statement -20 -20 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I send yearly statement -20 -20 to be eSigned by others?

Once your yearly statement -20 -20 is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I edit yearly statement -20 -20 on an Android device?

You can make any changes to PDF files, like yearly statement -20 -20, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

Fill out your yearly statement -20 -20 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.