A foreign branch or office of a person that can receive foreign-source income.

A foreign trust.

A trust of a disqualified individual.

A U.S. partnership if the partnership does not meet the requirements for a foreign bank at the time of its qualification for taxation under § 1031.

A U.S. corporation if the corporation is not subject to U.S. income tax and is in a foreign country that will, within one year, have a tax treaty with the U.S.

A foreign corporation that can receive income from the U.S. to avoid or reduce U.S. taxation under § 861.

A foreign estate if the estate is not subject to the U.S. estate tax but is at least 75% owned by foreign persons. If the withholding agent does determine, for purposes of determining whether the foreign trust meets the requirements for foreign branches, that the income being withheld is not from U.S. sources, you should send the applicable amount shown for each branch to the U.S. income tax return administrator for the return year of the tax year (January 1 – December 31) prior to the calendar year in which the foreign trust is established. Complete and send a separate information return. For additional information about U.S. foreign branch withholding, visit the Foreign Bank and Trust reference page. Back to top.

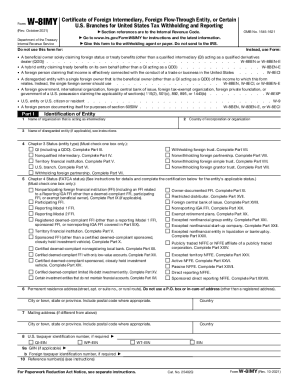

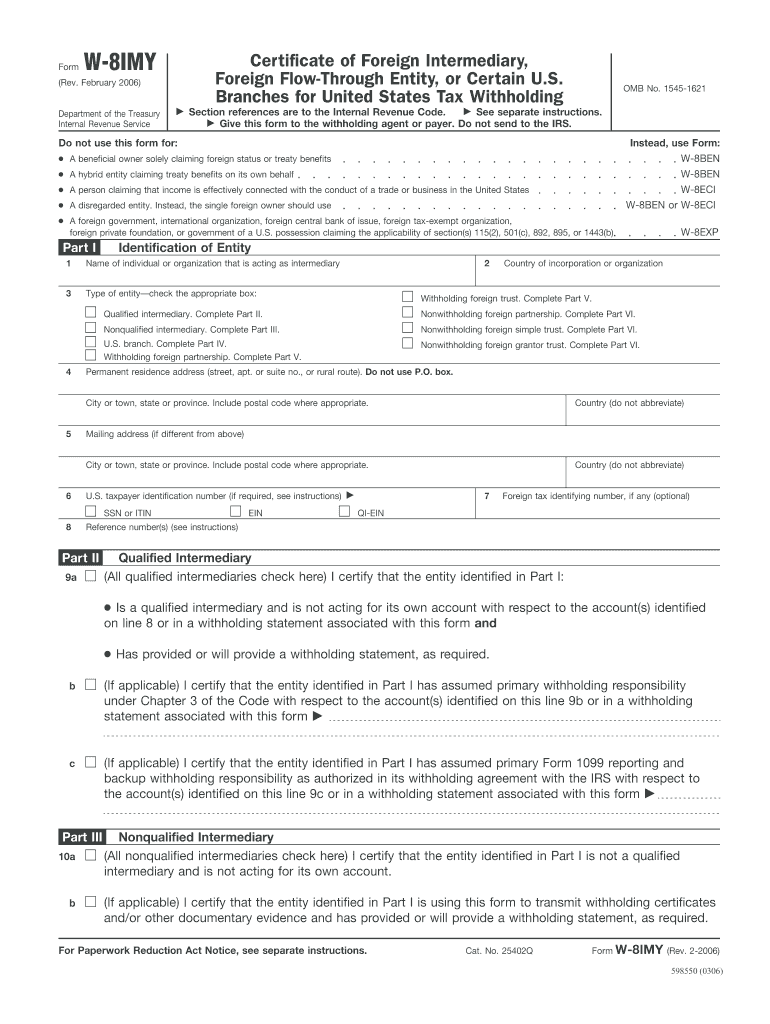

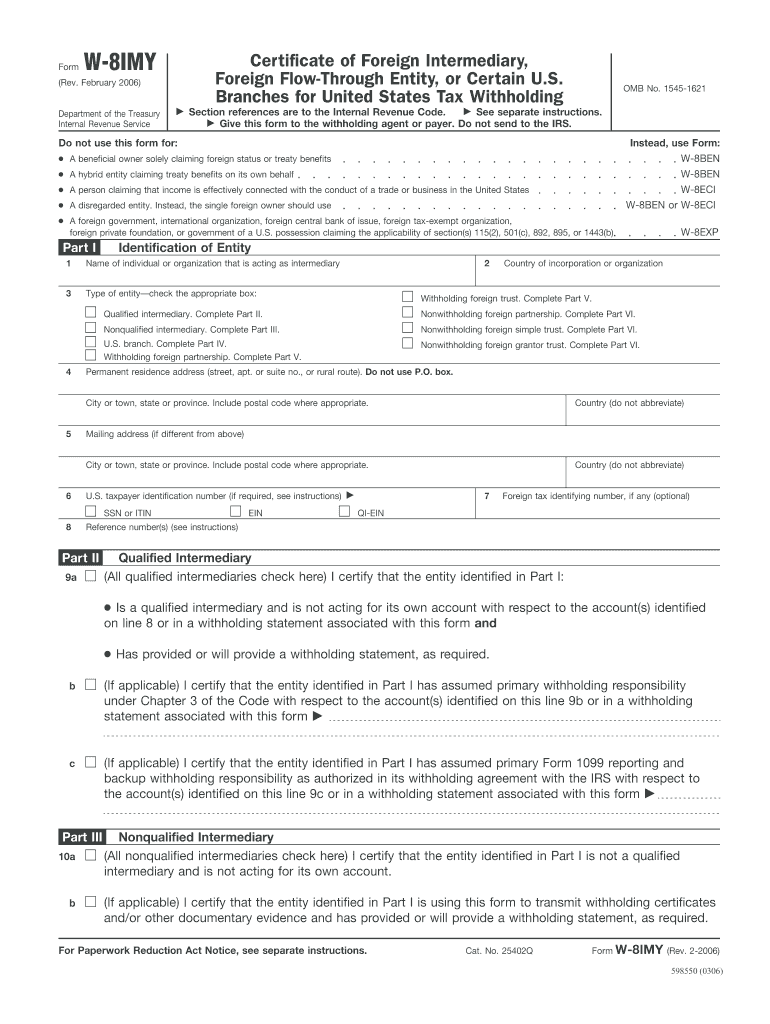

Form W-8K, Interest Statement, Statement of U.S. Income Foreign Mayor, or Certain U.S. Branches for Tax Withholding (Rev. February 2006) Department of the Treasury Internal Revenue Service OMB No. Form W-8K is an information return from the mayor's foreign source income to the IRS under § 1031. The form must be delivered to the United States income tax return administrator for the return year of the tax year (January 1 – December 31) prior to the calendar year in which the foreign mayor is not a U.S. person. You must use this form for income tax withholding under § 1031(b). The form must be either mailed to the United States income tax return administrator or received by the mail. Keep this form in case of a request from the IRS for your records. A person with a U.S. address can use Form W8K-N. Do not use this form for any other purpose.

IRS W-8IMY 2006 free printable template

Show details

Form W-8IMY Certificate of Foreign Intermediary, Foreign Flow-Through Entity, or Certain U.S. Branches for United States Tax Withholding (Rev. February 2006) Department of the Treasury Internal Revenue

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign

Edit your w8imy 2006 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your w8imy 2006 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit w8imy 2006 form online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit w8imy 2006 form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

IRS W-8IMY Form Versions

Version

Form Popularity

Fillable & printabley

Fill form : Try Risk Free

People Also Ask about w8imy 2006 form

Who is the beneficial owner of w8imy?

What is the international equivalent of a w9?

Do international companies have a W9?

What are the different types of w8 forms?

What is the difference between a W9 and a w8ben?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is w8imy form?

The W-8IMY form is a tax form used by foreign entities to certify their status for tax withholding purposes in the United States.

Who is required to file w8imy form?

Non-U.S. individuals, entities, or organizations that earn income from a U.S. source and are subject to withholding requirements need to file the W-8IMY form.

How to fill out w8imy form?

To fill out the W-8IMY form, you need to provide your name, address, country of residence, tax identification number, and certify your status. You may need to attach additional documentation depending on your specific situation.

What is the purpose of w8imy form?

The purpose of the W-8IMY form is to establish a foreign entity's tax status and eligibility for reduced withholding or exemption from U.S. tax on certain types of income.

What information must be reported on w8imy form?

The W-8IMY form requires you to report your name, address, country of residence, taxpayer identification number, and provide certification of your status as a non-U.S. entity.

When is the deadline to file w8imy form in 2023?

The deadline to file the W-8IMY form in 2023 may vary depending on the specific requirements and circumstances. It is recommended to consult with a tax professional or refer to the instructions provided with the form or by the tax authority for the most accurate deadline information.

What is the penalty for the late filing of w8imy form?

The penalty for the late filing of the W-8IMY form can vary depending on the specific tax laws and regulations of the jurisdiction. It is advised to consult with a tax professional or refer to the guidelines provided by the relevant tax authority for more information on the penalties associated with late filing.

How do I edit w8imy 2006 form in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your w8imy 2006 form, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I edit w8imy 2006 form straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing w8imy 2006 form.

How can I fill out w8imy 2006 form on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your w8imy 2006 form, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

Fill out your w8imy 2006 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.