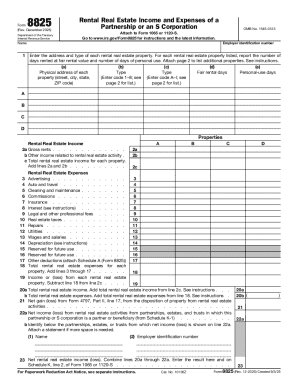

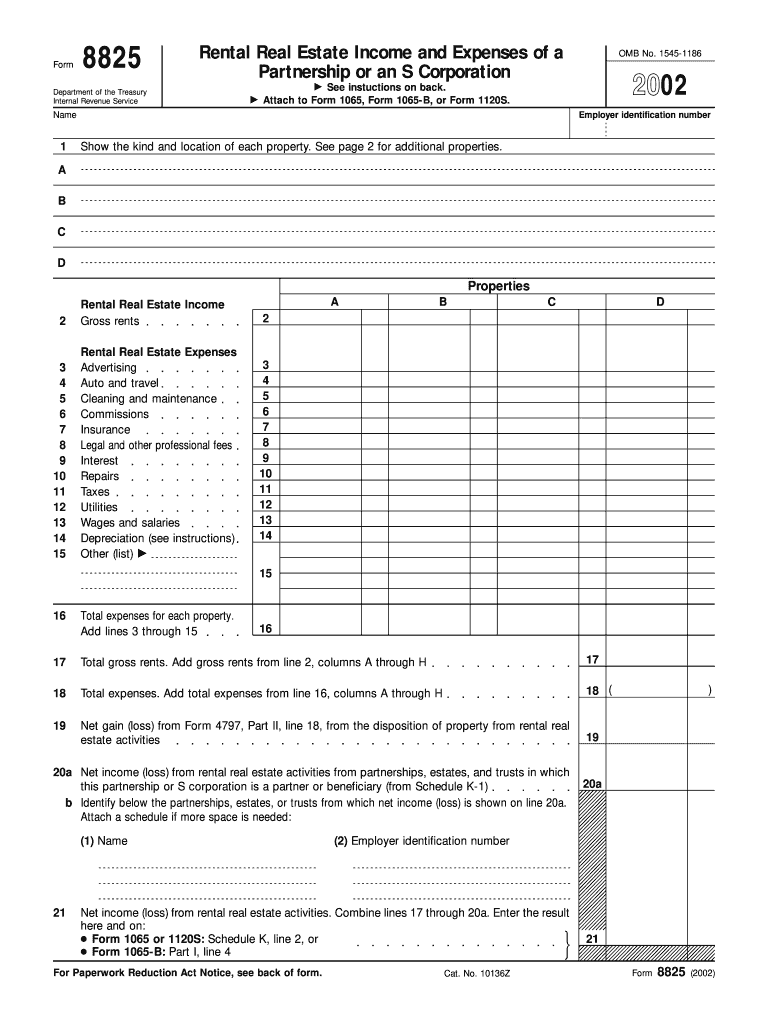

IRS 8825 2002 free printable template

Instructions and Help about IRS 8825

How to edit IRS 8825

How to fill out IRS 8825

About IRS 8825 earlier version of the form

What is IRS 8825?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 8825

What should I do if I need to amend my form 8825 2002 after submitting it?

To correct mistakes on form 8825 2002 after filing, you should prepare an amended return. Clearly indicate any changes made and attach a brief explanation of why the form is being amended. Ensure that you submit the amended version to the same address or method you used initially, and keep records of both the original and amended submissions.

How can I verify the status of my submitted form 8825 2002?

To check the status of your submitted form 8825 2002, you can contact the IRS or use their online tracking tools. You may need to provide identifying information, such as your Social Security number and details of your submission, for verification. It's essential to keep track of any confirmation receipts received upon submission for reference.

Are e-signatures accepted for form 8825 2002, and what should I know about their legality?

E-signatures are accepted for form 8825 2002 as long as they comply with IRS standards and security protocols. It's important to ensure that your e-signature is valid and that the filing software meets the necessary requirements. Retaining should be done in accordance with IRS guidelines for records retention.

What should I do if my form 8825 2002 is rejected after e-filing?

If your form 8825 2002 is rejected after e-filing, you will receive a notification outlining the reasons for rejection. Review the rejection codes and make the necessary corrections before resubmitting the form. You may want to consult with tax professionals if errors persist to ensure compliance.

What are common mistakes to avoid when filing form 8825 2002?

Common mistakes when filing form 8825 2002 include failing to attach supporting documentation, incorrect data entry for income and expenses, and not checking for accuracy prior to submission. Double-check all calculations and ensure that all required information is complete to minimize errors.

See what our users say