Get the free roundpoint mortgage payoff form

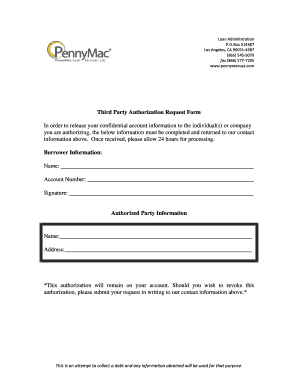

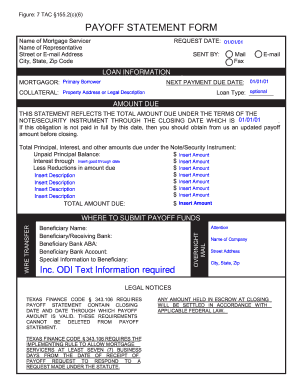

Get, Create, Make and Sign

Editing roundpoint mortgage payoff online

How to fill out roundpoint mortgage payoff form

How to fill out roundpoint payoff?

Who needs roundpoint payoff?

Video instructions and help with filling out and completing roundpoint mortgage payoff

Instructions and Help about roundpoint mortgage request form

Come on man you all know I'm from the shy, and you know how we do it from Chicago we just like to you know keep it real, and so I want to bring to you my song about round point mortgage a company who won't honor taking care of their customers where's Kanye Matt O'Connor was supposed to be here he from the shower right and I Kelly he from the shot to matter of fact he should be here joining me and even Obama man should be hanging out with me doing this on so while we just go ahead and do it like this come on man you know if keys is here man he'd probably do something like this man yeah it kills a break into it like Tuesday, so I'm going to tell you just like it is get a man his money back his money back his money back round point get a man his money back if you're looking for customer service and brown point you can call them up no call them of you can call them up don't call them up because they won't call you back no they won't call you back they won't call you back oh no no no around point and if you ask for the name of the president they'll say no no no no and if you access p to the escrow department they don't say no no no no and if you have to speak to a manager they'll say oh we're going to put your own hold on hold and your way and your weight and your way and your way eat, and then you'll be disconnected ever I'm Paul this is what happened to me oh no no no no round point mortgage round porn give me my money back give me my money back round point mortgage Rand Paul and give me my money back give me my money back doom let me tell you something don't dun this is what I would do if I was handling the customer service MMM you are my customer it round point here's what I would do I would apologize to you instead of telling you why not let me apologize to you boo, boo Hui we didn't mean to do that to you, you should've done that to you, we should have just sent back to check that would have been the right wrist back, but we didn't do what we should've done to you so Oh boohoo this is my point customer service, and we apologize eyes to you because that's what we should do we should think of you who think of you yeah because you are the customer mm, and we should always consider what we do then when we're talking to you boom boom we shouldn't have told you know Jim that we could have given you doing the name of the president of our company doing when you can find that on the internet, and we should have told you know don't dun when you asked to speak to the escrow department in because in the letter that we sent to you doing then it says doing contact the escrow department then if you have any problems or questions ding, so that's why do we want to apologize to you do that's all we can do is apologize to you hmm when we said don't dun that we would call you back ding ding in three days doing we should have followed through with that in doing instead of causing you dun all the problems we did do with our automated service ding ding calling you up...

Fill mortgage online : Try Risk Free

People Also Ask about roundpoint mortgage payoff

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your roundpoint mortgage payoff form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.