AU RTA Form 18a 2009 free printable template

Show details

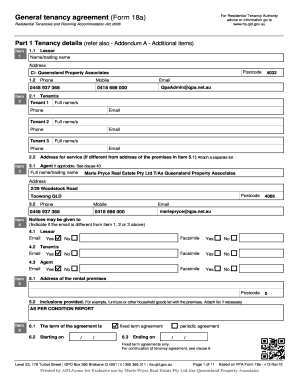

Reset Form Print Form 18a General Tenancy Agreement Internet: www.rta.qld.gov.au Residential Tenancies and Rooming Accommodation Act 2008 Part 1 Tenancy Details Item 1: 1.1 Lessor Address for service

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form 18 a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 18 a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 18 a online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 18 a. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

AU RTA Form 18a Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form 18 a

How to fill out form 18 a:

01

Begin by entering your personal information, such as your name, address, and contact information.

02

Next, provide information about your employment history, including your current employer, job title, and duration of employment.

03

Fill in the details of your income, including salary or wages, bonuses, commissions, and any other sources of income you may have.

04

If you have any deductions or allowances, indicate them in the appropriate section of the form.

05

Specify any exemptions or rebates you may be eligible for, such as tax credits or deductions for dependent children.

06

Review the completed form for accuracy and make any necessary corrections before submitting it.

Who needs form 18 a:

01

Individuals who are employed and earning an income are required to fill out form 18 a.

02

This form is necessary for the calculation and payment of income taxes.

03

Employers may also require their employees to submit the completed form for tax withholding purposes.

Fill form : Try Risk Free

People Also Ask about form 18 a

What is the Workers Compensation Act in NC?

Who is exempt from workers compensation in NC?

What is a NC Form 18?

Which of the following employee groups is not eligible for benefits under the Workers Compensation Act of Manitoba?

How do I get workers comp exemption in NC?

How long does an employer have to file a workers comp claim in North Carolina?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 18 a?

Form 18-A is a notice to creditors and request for marshaling and setting of separate trials in a probate case. It is often used in the context of estate administration to notify creditors that the decedent has passed away and to request that the court schedule separate trials for different issues that may arise during the probate process.

Who is required to file form 18 a?

Form 18-A is required to be filed by certain individuals who receive income from the rental of real property located in Massachusetts but are not Massachusetts residents. This form is used to report and pay the withholding tax on the rental income.

How to fill out form 18 a?

To properly fill out Form 18-A, you will need to follow these steps:

1. Obtain a copy of Form 18-A: This form is typically provided by the organization or institution that requires you to complete it. Ensure you have the most recent version of the form.

2. Read the instructions: Take a moment to carefully read the instructions accompanying the form. This will help you understand the purpose of the form and how to correctly fill it out.

3. Provide personal information: Begin by filling in your personal information in the designated spaces. This information usually includes your full name, address, contact number, date of birth, social security number, and any other relevant details requested.

4. Check the appropriate boxes: Next, go through the form and mark the appropriate boxes or sections that apply to you. Read each option carefully and select the option that accurately represents your situation.

5. Fill in additional details or responses: Some form sections may require you to provide additional details or write brief answers. Ensure you provide accurate and complete information. If there are specific instructions for formatting your responses, follow them accordingly.

6. Double-check for accuracy: Take a moment to carefully review all the information you have provided. Make sure there are no errors or missing details. Pay close attention to spelling, dates, and numbers to ensure accuracy.

7. Sign and date the form: Once you are confident that the form is accurately completed, sign and date it in the designated areas. Your signature usually certifies that the information you provided is true and accurate.

8. Provide any necessary supporting documentation: If the form requires any supporting documentation, make sure to attach them securely. Check the instructions to determine if you need to include copies of identification, proof of address, or any other requested documents.

9. Submit the form: Finally, submit the form as specified by the organization or institution that requires it. Follow any guidelines they provide regarding submission method and deadline.

Remember, it is crucial to carefully read and follow the instructions provided with the form to ensure correct completion. If you have any doubts or questions, seek assistance from the organization or institution responsible for the form.

What is the purpose of form 18 a?

Form 18A is a document used in the Philippines for the registration of corporations. Its purpose is to provide the necessary information about the corporation, its shareholders, directors, officers, and the shares of stock issued. The form is submitted to the Securities and Exchange Commission (SEC) in order to comply with the requirements for the incorporation of a company and to obtain legal recognition as a corporation.

What information must be reported on form 18 a?

Form 18A is used to report financial data for governmental entities and non-governmental not-for-profit organizations. The specific information that must be reported on Form 18A typically includes:

1. Entity Information: Name, address, employer identification number (EIN), fiscal year-end date, and details about the legal status of the organization.

2. Statement of Financial Position: This section includes the organization's assets, liabilities, and net assets or fund balance at the end of the fiscal year.

3. Statement of Activities: This section provides a summary of the organization's revenue, expenses, gains, and losses for the fiscal year. It also includes information about program expenses, administrative expenses, and fundraising expenses.

4. Cash Flow Statement: This statement outlines the cash inflows and outflows during the fiscal year, categorized into operating activities, investing activities, and financing activities.

5. Notes to Financial Statements: These notes provide additional details and explanations regarding specific items included in the financial statements, such as significant accounting policies, contingent liabilities, or related party transactions.

6. Other Supplementary Information: In some cases, additional information may be required, depending on the organization's circumstances. This may include details about significant grants, contributions, or changes in accounting policies.

It's important to note that the specific reporting requirements may vary depending on the organization's size, type, and applicable reporting standards (e.g., Generally Accepted Accounting Principles - GAAP or International Financial Reporting Standards - IFRS).

What is the penalty for the late filing of form 18 a?

The penalty for the late filing of the Form 18 A may vary depending on the jurisdiction and the specific circumstances. It is best to consult with the relevant government agency or jurisdiction's tax regulations to determine the exact penalty and any applicable interest for late filing.

How can I send form 18 a for eSignature?

When your form 18 a is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I make changes in form 18 a?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your form 18 a and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I edit form 18 a on an Android device?

The pdfFiller app for Android allows you to edit PDF files like form 18 a. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

Fill out your form 18 a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.