Get the free central bank of india atm apply form

Show details

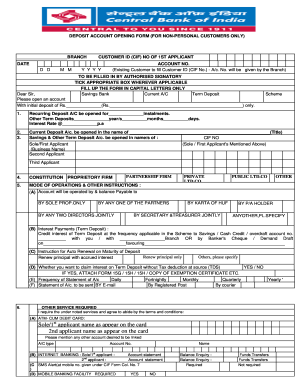

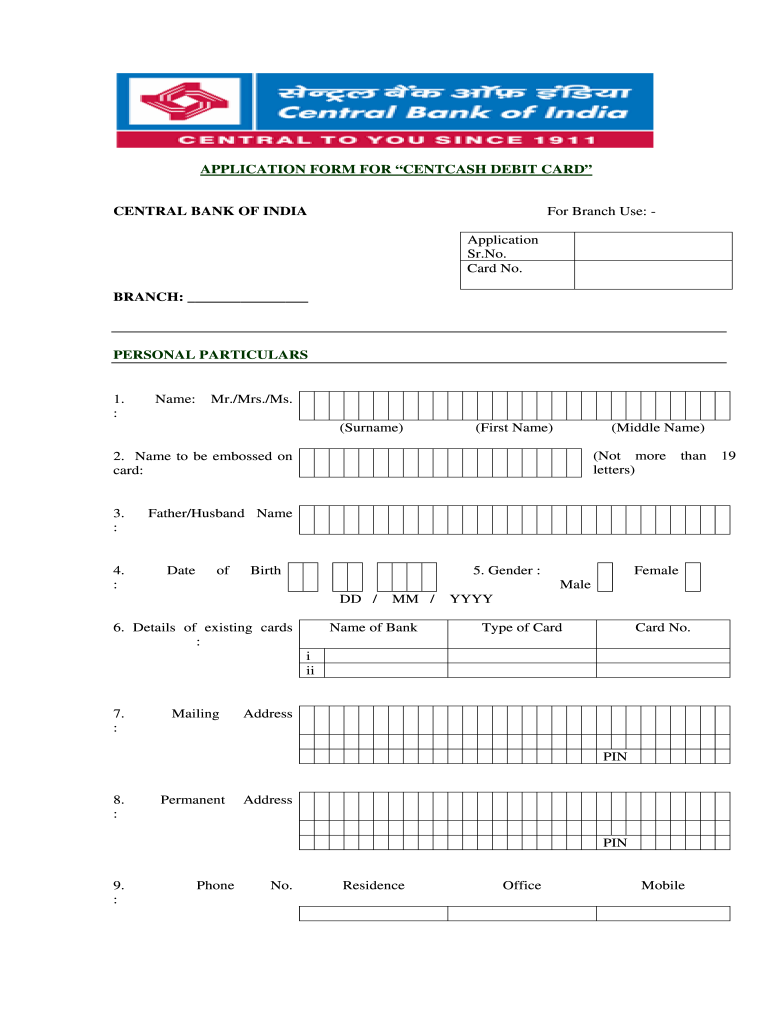

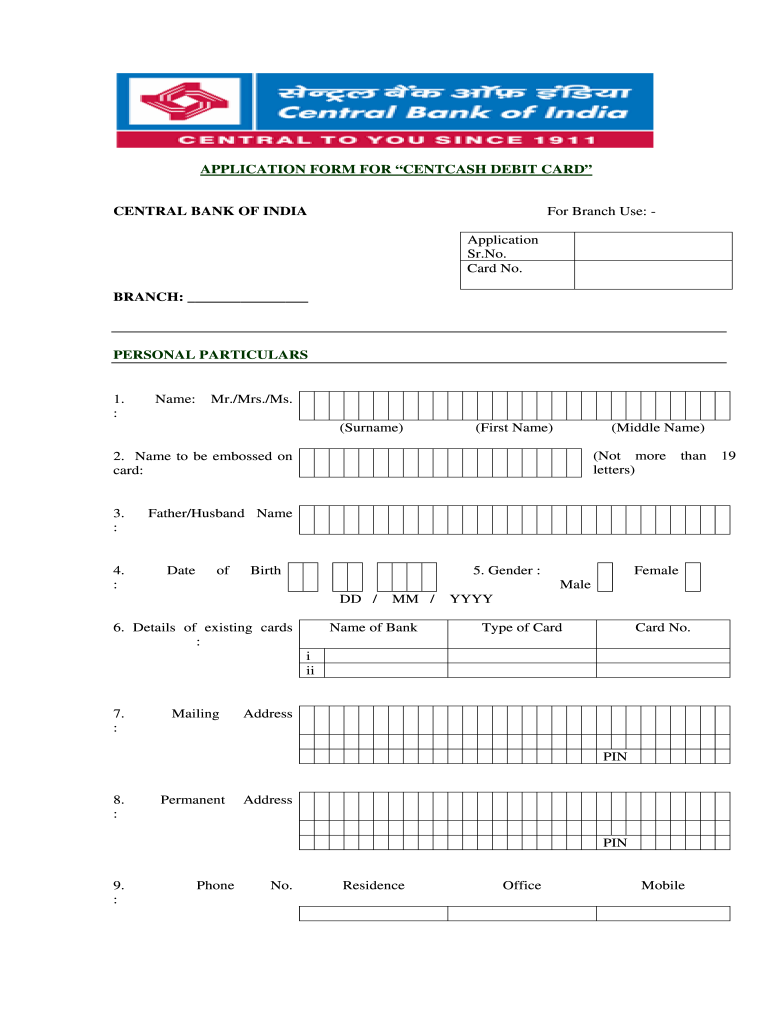

APPLICATION FORM FOR CENTCASH DEBIT CARD CENTRAL BANK OF INDIA For Branch Use Application Sr. No. Card No. BRANCH PERSONAL PARTICULARS Name Mr. I undertake to fulfill and abide by all guidelines issued by Central Bank of India from time to time regarding the International use of Centcash Debit Card and foreign currency transactions. Applicant s Signature I/We irrevocably authorize the Bank to issue a Centc Card to above applicant Signature In case of joint/firm account application form must...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your central bank of india form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your central bank of india form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing central bank of india atm apply online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit central bank of india atm form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

How to fill out central bank of india

How to fill out Central Bank of India:

01

Visit the official website of Central Bank of India.

02

Locate the "Forms" or "Downloads" section on the website.

03

Look for the specific form you need to fill out, such as account opening form, loan application form, or any other relevant form.

04

Download the form and open it with a PDF reader or any compatible software.

05

Carefully read the instructions provided on the form and understand the required information.

06

Fill out the necessary details in the form, such as personal information, contact details, and any other specific requirements.

07

Double-check all the provided information to ensure accuracy and completeness.

08

Attach any required documents, such as identity proof, address proof, income proof, or any other supporting documents mentioned in the form.

09

Review the filled-out form and keep a copy for your records.

10

Visit the nearest Central Bank of India branch or the designated office and submit the filled-out form along with the required documents.

11

Follow any further instructions provided by the bank, if necessary.

Who needs Central Bank of India:

01

Individuals: People who require banking services for personal use, such as opening savings accounts, availing loans, or managing their finances, can benefit from Central Bank of India.

02

Businesses: Small, medium, or large businesses looking for banking services like current accounts, trade finance, working capital loans, or other financial products and services can choose Central Bank of India.

03

Investors: Individuals or entities seeking investment opportunities, including fixed deposits or mutual fund schemes, can explore the options provided by Central Bank of India.

04

Borrowers: Individuals or businesses in need of financial assistance, such as home loans, vehicle loans, education loans, or any other types of loans, can approach Central Bank of India.

05

Government: Central Bank of India can serve as a banking partner for the government, providing various financial services and assisting with treasury operations.

06

Non-Resident Indians (NRIs): NRIs wanting to avail banking facilities like NRI accounts, remittance services, or other specialized services can consider Central Bank of India as a viable option.

07

Financial Institutions: Other banks, financial institutions, or intermediaries may require the services of Central Bank of India for interbank transactions, banking partnerships, or liquidity management.

Fill cbi atm form : Try Risk Free

People Also Ask about central bank of india atm apply

How can I generate ATM card in Central Bank of India?

How do I apply for an ATM?

Can I apply for ATM debit card online?

How can I apply for CBI ATM card online?

Can I apply for ATM card online?

How can I start application for ATM card?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is central bank of india?

The Central Bank of India is the central bank of the country and is responsible for formulating and implementing monetary policy. It is also responsible for managing the foreign exchange reserves and issuing currency. In addition, it is responsible for regulating the banking sector, supervising and controlling the activities of banks, and promoting financial inclusion.

Who is required to file central bank of india?

All businesses registered in India are required to file returns with the Central Bank of India. This includes companies, partnerships, unincorporated bodies, trusts and other legal entities.

How to fill out central bank of india?

1. Visit the nearest Central Bank of India branch and fill out a deposit slip.

2. Write your name and account number on the slip.

3. Fill out the amount of money you would like to deposit in the appropriate fields.

4. Sign the slip and hand it to the teller.

5. Provide the teller with your identification and the deposit slip.

6. The teller will then credit your account with the amount you deposited.

What is the purpose of central bank of india?

The Central Bank of India is the central banking institution of India and controls the monetary policy of the Indian rupee. It was established on 1 April 1935 in accordance with the provisions of the Reserve Bank of India Act, 1934. The main objective of the RBI is to maintain price stability while keeping in mind the objective of growth. It also monitors the financial system of the country and regulates the flow of credit to different sectors of the economy. It also oversees the functioning of commercial banks and other financial institutions, and acts as a lender of last resort in times of financial crisis.

What information must be reported on central bank of india?

Central Bank of India must report the following information:

1. Balance sheet

2. Profit and loss statement

3. Financial statements

4. Capital ratios

5. Asset and liability details

6. Interest rate changes

7. Credit ratings

8. Financial performance

9. Non-performing assets

10. Loan portfolio details

11. Regulatory compliance

12. Bank deposits

13. Bank capital requirements

14. Risk management policies

15. Loan policies and procedures

16. Banking regulations

17. Management strategies

18. Liquidity ratios

19. Monetary policy changes

20. Bank fees

21. Cash flow statements

22. Balance sheet ratios

23. Credit risk management

24. Interest rate risk management

25. Payment system operations

When is the deadline to file central bank of india in 2023?

The deadline to file Central Bank of India in 2023 is not yet determined. The Central Bank of India typically sets filing deadlines in the year prior to the filing year, so the deadline for filing in 2023 will likely be announced in 2022.

What is the penalty for the late filing of central bank of india?

The penalty for late filing of central bank of india is a fine of up to Rs. 500 per day. The fine shall be imposed on the file or the person responsible for the late filing of the return.

How can I edit central bank of india atm apply from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including central bank of india atm form, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I send central bank of india atm card apply online for eSignature?

When your central bank atm form is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I create an electronic signature for the central bank of india atm form online apply in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Fill out your central bank of india online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Central Bank Of India Atm Card Apply Online is not the form you're looking for?Search for another form here.

Keywords relevant to central bank of india atm application form

Related to central bank of india atm card online apply

If you believe that this page should be taken down, please follow our DMCA take down process

here

.