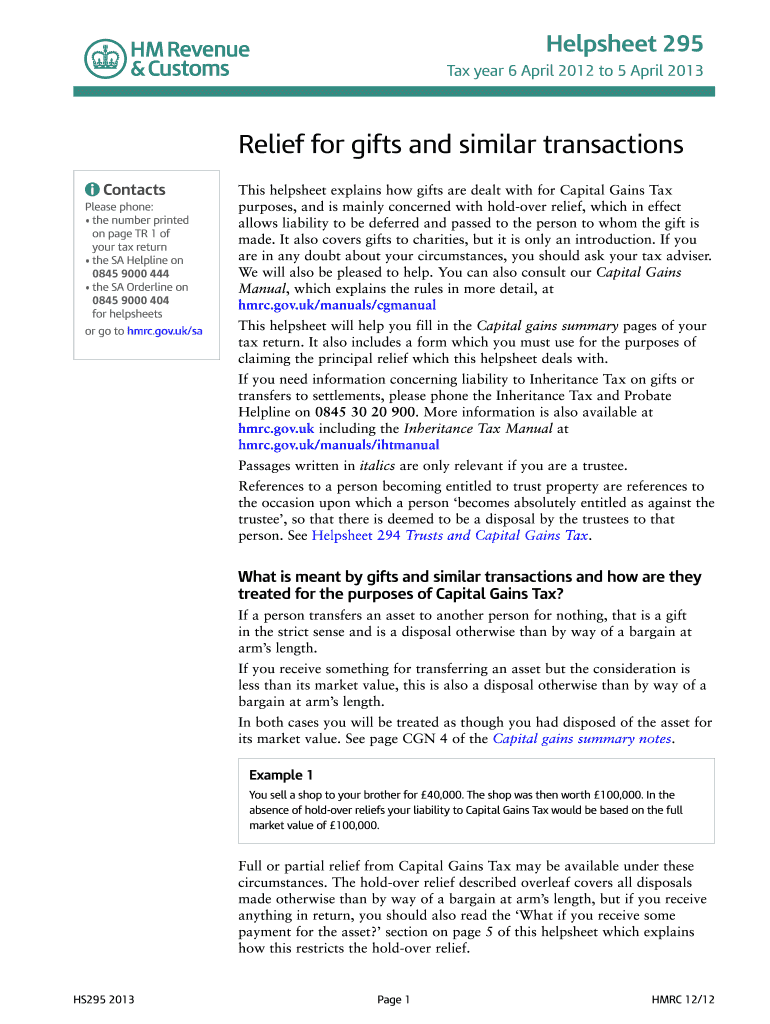

It covers gifts from: a UK resident: £1 million or less

a non-resident with an income, who is ordinarily resident in the UK, but has a permanent home abroad in the UK for less than ££5,0002,000,000 or more £5,000 (or in the case of a gift from a non-resident whose only income for the relevant tax year (including any tax paid in the current tax year not paid the previous tax year) is from the same sources as that for which income tax is payable)

A non-resident whose income, who is ordinarily resident in the UK, but is ordinarily resident in a country outside the UK (a UK international business) for less £500,000 These rules allow for holdover liability to be deferred until the next year of the person receiving the gift. It is important to remember that: the £1 million threshold applies only to gifts worth £1 million.

the £500,000 threshold is the same as that for income tax only

The £1 million threshold and the £500,000 threshold do not apply to donations of more than £2.5 million (this is because they are made at the same time as a gift). The SA Borderline Helpline is run by HM Revenue and Customs (HMRC) and you can call it free (0 444). In the first 30 minutes they will ask: 'Is the person to which the gift is being made a UK resident?

'Is there sufficient evidence to prove that the person to whom the gift is being made is in fact a UK resident?' If the answer is Yes to both of these questions they will give you advice whether the person to whom the gift was made is liable for Capital Gains Tax. However, if the answer to either question is No they will inform you in advance that the person to whom the gift was made is not liable, but they will not give you any further personal advice.

Hold over relief If a person disposes of property within a tax year other than: the tax year they had to pay Capital Gains Tax at the end of that tax year

the period when the last of those gifts of £1 million or more which resulted in a £1 million liability was paid or

the next tax year

The exemption applies.

UK HMRC HS295 2013 free printable template

Show details

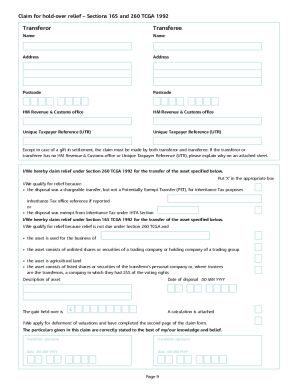

Help sheet 295 Tax year 6 April 2011 to 5 April 2012 Relief for gifts and similar transactions A contact Please phone: the number printed on page TR 1 of your tax return the SA Helpline on 0845 9000

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your where to send helpsheet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your where to send helpsheet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing where to send helpsheet online

To use the professional PDF editor, follow these steps below:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit where to send helpsheet. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

UK HMRC HS295 Form Versions

Version

Form Popularity

Fillable & printabley

Fill form : Try Risk Free

People Also Ask about where to send helpsheet

What is the time limit for HS295?

What is HS295 holdover relief?

What is the gift hold-over relief on death?

How do I claim holdover relief?

How do I make a holdover relief claim?

What is the time limit for hold-over relief claims?

When can holdover relief be claimed?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is where to send helpsheet?

Where to send helpsheet is a form that provides information about where to send certain documents or materials.

Who is required to file where to send helpsheet?

The requirement to file where to send helpsheet can vary depending on the specific situation or context.

How to fill out where to send helpsheet?

To fill out where to send helpsheet, you need to provide the requested information, such as the recipient's name, address, and any other relevant details.

What is the purpose of where to send helpsheet?

The purpose of where to send helpsheet is to ensure that documents or materials are sent to the correct recipient or location.

What information must be reported on where to send helpsheet?

The information required on where to send helpsheet may include the name, address, and contact details of the recipient or destination.

When is the deadline to file where to send helpsheet in 2023?

The deadline to file where to send helpsheet in 2023 may vary depending on the specific requirements or regulations. It is recommended to consult the relevant authorities or guidelines for accurate information.

What is the penalty for the late filing of where to send helpsheet?

The penalty for the late filing of where to send helpsheet may vary depending on the specific circumstances and applicable regulations. Consult the relevant authorities or guidelines for accurate information.

How can I send where to send helpsheet to be eSigned by others?

When you're ready to share your where to send helpsheet, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I create an electronic signature for the where to send helpsheet in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your where to send helpsheet and you'll be done in minutes.

How do I complete where to send helpsheet on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your where to send helpsheet. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your where to send helpsheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.