Who needs an Application for a Social Security Card?

All legal residents working in the United States must have a social security number because it’s necessary for basic things included paying the IRS and getting a job. Social Security numbers are used to report a person’s wages to the government and determine eligibility for benefits.

What is a Social Security Card for?

In the U.S., a social security card is used to document the nine-digit social security number, (SSN) issued to U.S. citizens, permanent residents, and temporary working residents. Its primary purpose is to track individuals for social security purposes, though it is also used for identification and tax purposes. Social security encompasses social welfare and social insurance programs that are supported by taxes from all salaried income.

Is the Application for a Social Security Card accompanied by other forms?

To get your social security card, you need to provide a certain number of documents that serve as evidence of your age, your legal name and identity, your citizenship and immigration status. The documents required vary depending on whether you are a U.S. Born Citizen, a foreign-born U.S. Citizen or a non-citizen. It is also important to note that these documents must be the original documents or copies certified by the issuing agency.

If you are a U.S. born citizen, to prove your citizenship, you can supply:

A U.S. birth certificate or passport

To prove your age, you must present your birth certificate or:

- A religious record showing your date of birth

A U.S. hospital record of your birth

A U.S. passport.

If you are older than twelve years old, then you must appear in person for an interview with evidence to show you do not have a Social Security Number.

To prove your identity you must use a document with date of birth, or age, and a recent photograph such as

- A U.S. driver’s license

A non-driver ID card

A U.S. passport

If you are a non-citizen, you will need documents that prove your immigration status, your work eligibility, your age, and identity.

When is the Application for a Social Security Card due?

There is no set deadline for your application for a social security card. Parent often apply for social security numbers for their children soon after birth, or with the application for a birth certificate. If you are an immigrant, you should apply for a social security number on your immigrant visa application, or 10 days after arriving in the United States so that the Department of Homeland Security documents can be verified online.

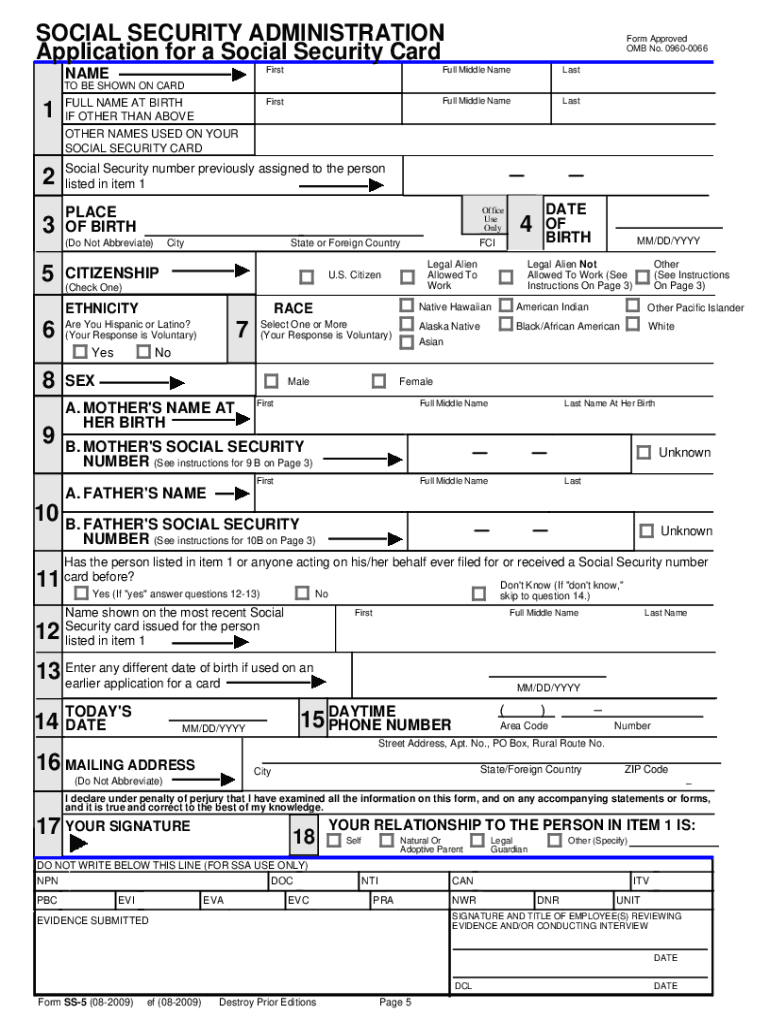

How do I fill out an Application for a Social Security Card?

Filling out an application for a social security card requires you to supply your name, any prior social security number if applicable, place and date of birth, ethnicity, race, gender, and information about your parent’s identities and social security numbers. Make sure you also provide a mailing address, daytime phone number and your signature.

Where do I send the Application for a Social Security Card?

You can send the completed social security card application to your local social security office.