Who needs form AZ For 5000?

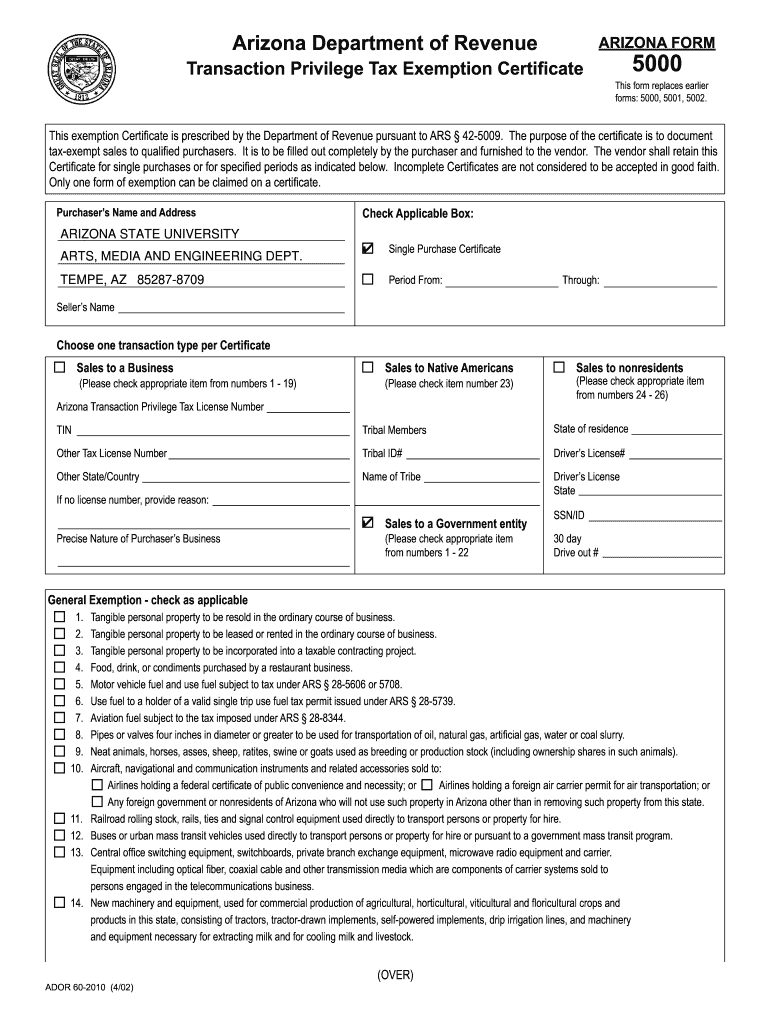

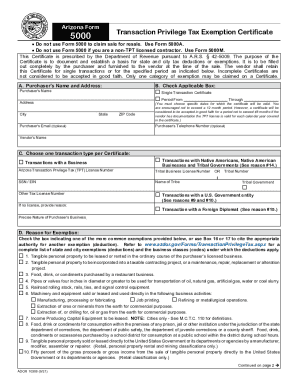

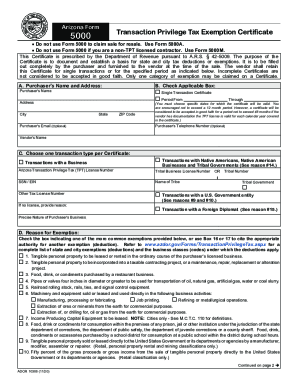

Form AZ 5000 is the Arizona Department of Revenue Transaction Privilege Tax Exemption Certificate that should be completed by a purchaser who is qualified not to pay sales and use tax. This form must not be completed to claim sale for resale.

What is the purpose of the form?

The Arizona Transaction Privilege Tax Exemption Certificate aims to record tax-exempt transactions between vendors and purchasers. Among the common tax-exempt purchases are:

-

Professional or personal services

-

Personal property purchased for release

-

Warranty or service contracts

-

Prescription drugs, some medical equipment, insulin, hearing aids

-

Media materials bought by Arizona libraries and made available for the public

-

Internet access and cable service, custom computer software

-

Conference fees

-

Equipment and chemicals used in research

-

Commercial lease

-

Food for home consumption

-

Professional membership dues

More tax-exempt purchases are listed in Arizona statutes.

Is the Tax Exemption Certificate 5000 accompanied by any other documents?

Typically the form AZ 5000 does not require any attachments. Yet, the transaction itself should be properly recorded to establish the vendor-purchaser relationship.

When is the form due?

The form does have a strict deadline for filing. It should be completed when the relevant circumstances have arisen.

How do I fill out the form?

While completing the Arizona Tax Exemption Certificate, the purchaser has to provide personal information (name, address and vendor’s name), choose the type of transaction (transaction with a business, transaction with Native Americans and their businesses, transactions with nonresidents), check the appropriate reason for exemption, sign, and date the document.

Where do I send Arizona Form 5000?

Once completed and signed by the purchaser, the document is sent to the seller. The seller files it with Arizona Department of Revenue.